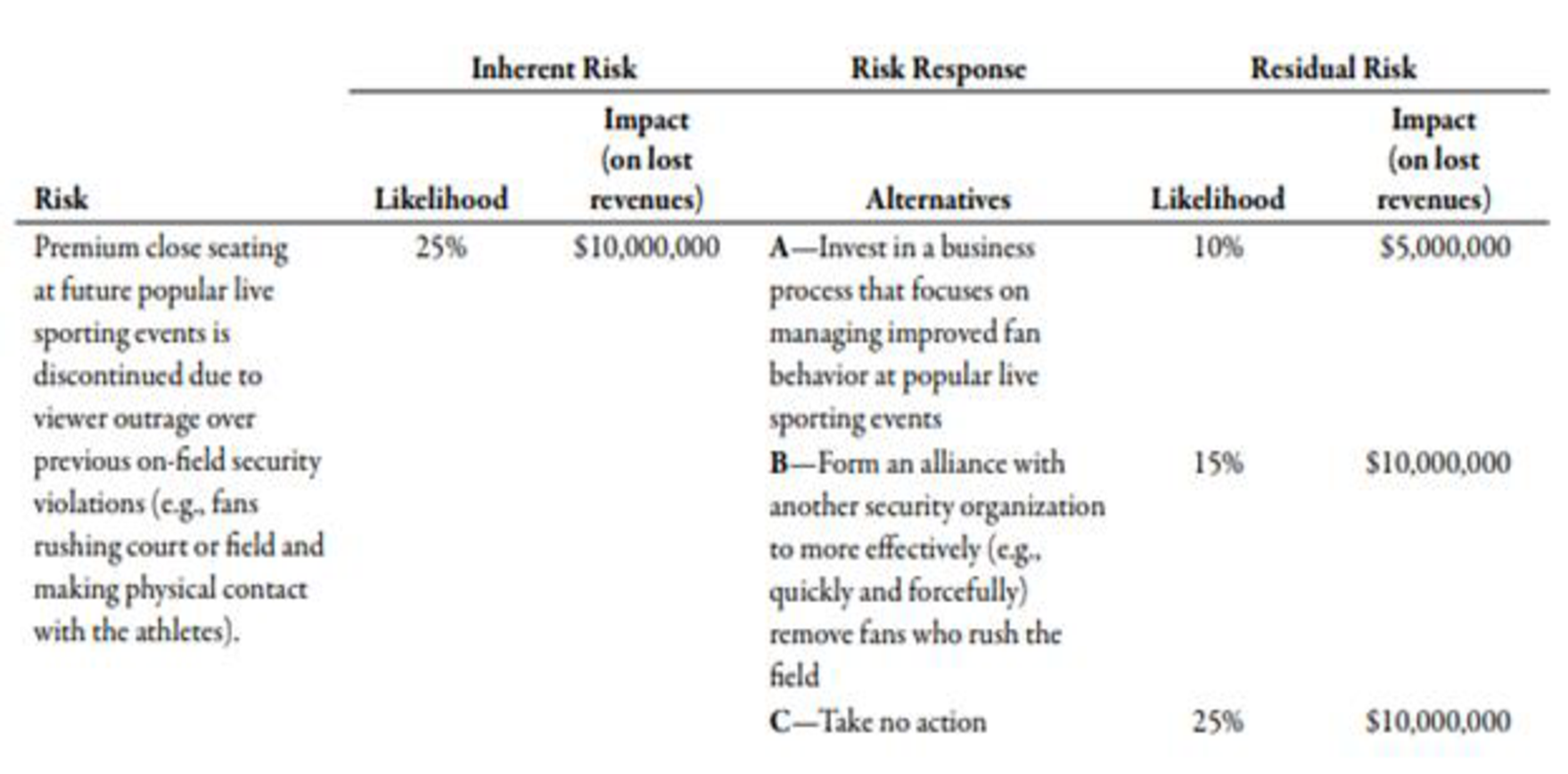

Crazy Fan Guard Company provides security services to popular live sporting event venues. Crazy Fan management has identified one of its top risks as the possibility that restrictions on premium close seating options will severely decrease its sales revenue by lessening the demand for its security services. The table below displays a description of this top risk, an inherent risk assessment, three risk response alternatives, and finally, a residual risk assessment.

Crazy Fan Guard’s

Required:

- 1. Calculate the benefit of each risk response alternative A through C.

- 2. Calculate the net benefit of each risk alternative A through C.

- 3. CONCEPTUAL CONNECTION Using net benefit as the criterion, explain the best risk response alternative that Crazy Fan Guard Company management should implement.

Trending nowThis is a popular solution!

Chapter 13 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Please don't use AI And give correct answer .arrow_forwardLouisa Pharmaceutical Company is a maker of drugs for high blood pressure and uses a process costing system. The following information pertains to the final department of Goodheart's blockbuster drug called Mintia. Beginning work-in-process (40% completed) 1,025 units Transferred-in 4,900 units Normal spoilage 445 units Abnormal spoilage 245 units Good units transferred out 4,500 units Ending work-in-process (1/3 completed) 735 units Conversion costs in beginning inventory $ 3,250 Current conversion costs $ 7,800 Louisa calculates separate costs of spoilage by computing both normal and abnormal spoiled units. Normal spoilage costs are reallocated to good units and abnormal spoilage costs are charged as a loss. The units of Mintia that are spoiled are the result of defects not discovered before inspection of finished units. Materials are added at the beginning of the process. Using the weighted-average method, answer the following question: What are the…arrow_forwardQuick answerarrow_forward

- Financial accounting questionarrow_forwardOn November 30, Sullivan Enterprises had Accounts Receivable of $145,600. During the month of December, the company received total payments of $175,000 from credit customers. The Accounts Receivable on December 31 was $98,200. What was the number of credit sales during December?arrow_forwardPaterson Manufacturing uses both standards and budgets. For the year, estimated production of Product Z is 620,000 units. The total estimated cost for materials and labor are $1,512,000 and $1,984,000, respectively. Compute the estimates for: (a) a standard cost per unit (b) a budgeted cost for total production (Round standard costs to 2 decimal places, e.g., $1.25.)arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT