Concept explainers

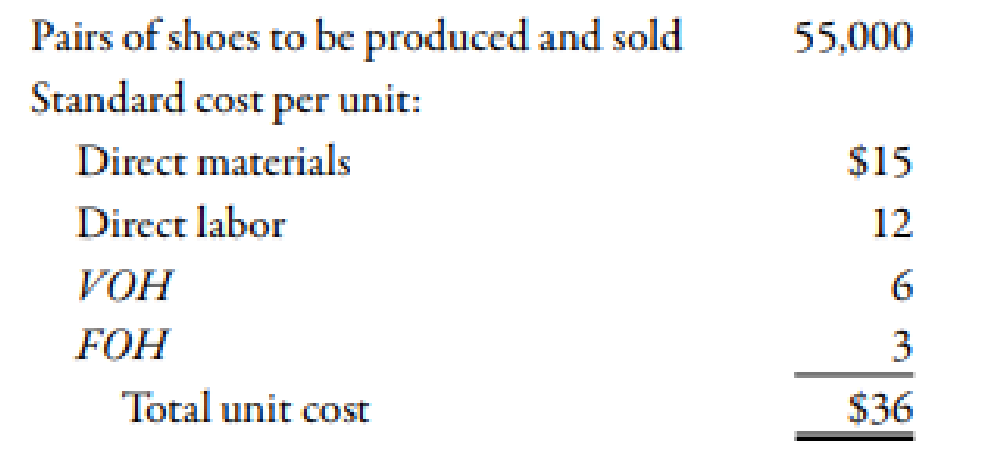

Shumaker Company manufactures a line of high-top basketball shoes. At the beginning of the year, the following plans for production and costs were revealed:

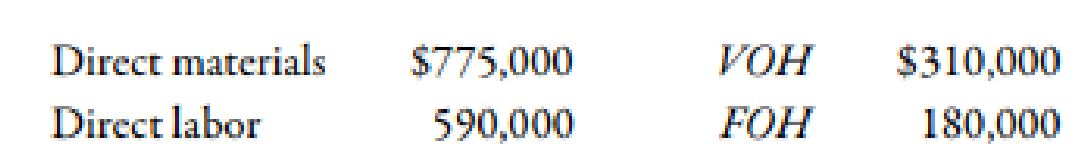

During the year, a total of 50,000 units were produced and sold. The following actual costs were incurred:

There were no beginning or ending inventories of raw materials. In producing the 50,000 units 63,000 hours were worked, 5% more hours than the standard allowed for the actual output.

Required:

- 1. Using a flexible budget, prepare a performance report comparing expected costs for the actual production with actual costs.

- 2. Determine the following: (a) Fixed overhead spending and volume variances and (b) Variable overhead spending and efficiency variances.

1.

Construct the performance report by comparing the expected costs for the actual production with actual costs with the help of flexible budget.

Explanation of Solution

Flexible Budgets:

Flexible budgets are prepared for various levels of activities or outputs. This enables the entity to know the result for the selected level of activity.

Performance report of the variances:

| Budgeted variance | |||

| Overhead cost item |

Actual cost (A) ($) |

Actual Costs (B) ($) |

Spending variance ($) |

| Direct material | 775,000 | 750,0001 | 25,000 (U) |

| Direct labor | 590,000 | 600,0002 | 10,000 (F) |

| Variable overhead | 310,000 | 300,0003 | 10,000 (U) |

| Fixed overhead | 180,000 | 165,0004 | 15,000 (U) |

| Total | 1,855,000 | 1,815,000 | 40,000 (U) |

Table (1)

Working Note:

1. Calculation of actual cost of direct material:

2. Calculation of actual cost of direct labor:

3. Calculation of actual cost of variable overhead:

4. Calculation of actual cost of fixed overhead:

2.

Calculate the value of fixed overhead spending and volume variance. Also, calculate the value of variable overhead spending and efficiency variance.

Explanation of Solution

(a).

Use the following formula to calculate fixed overhead spending variance:

Substitute $180,000 for actual fixed overhead and $165,000 for budgeted fixed overhead in the above formula.

Therefore, the fixed overhead spending variance is $15,000 (U).

Use the following formula to calculate volume variance:

Substitute $165,000 for budgeted fixed overhead, $2.50 for fixed overhead rate and $60,000 for standard hours in the above formula.

Therefore, the volume variance is $15,000 (U).

(b).

Use the following formula to calculate variable overhead spending variance:

Substitute $310,000 for actual overhead, $5.00 for standard variable overhead and 63,000 hours for actual hours in the above formula.

Therefore, the variable overhead spending variance is $5,000 (F).

Use the following formula to calculate variable efficiency variance:

Substitute 63,000 hours for actual hours, 60,000 hours for standard hours and $5.00 for applied variable overhead in the above formula.

Therefore, the efficiency variance is $15,000 (U).

Working Note:

1. Calculation of standard hours:

2. Calculation of fixed overhead rate:

First, hours allowed computed so as calculating the fixed overhead rate:

3. Calculation of variable overhead rate

Want to see more full solutions like this?

Chapter 10 Solutions

Managerial Accounting

- Wyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardDuring the week of June 12, Harrison Manufacturing produced and shipped 15,000 units of its aluminum wheels: 3,000 units of Model A and 12,000 units of Model B. The following costs were incurred: Required: 1. Assume initially that the value-stream costs and total units shipped apply only to one model (a single-product value stream). Calculate the unit cost, and comment on its accuracy. 2. Calculate the unit cost for Models A and B, and comment on its accuracy. Explain the rationale for using units shipped instead of units produced in the calculation. 3. What if Model A is responsible for 40 percent of the materials cost? Show how the unit cost would be adjusted for this condition.arrow_forward

- Ingles Company manufactures external hard drives. At the beginning of the period, the following plans for production and costs were revealed: During the year, 24,800 units were produced and sold. The following actual costs were incurred: There were no beginning or ending inventories of direct materials. The direct materials price variance was 10,168 unfavorable. In producing the 24,800 units, a total of 12,772 hours were worked, 3 percent more hours than the standard allowed for the actual output. Overhead costs are applied to production using direct labor hours. Required: 1. Prepare a performance report comparing expected costs to actual costs. 2. Determine the following: a. Direct materials usage variance b. Direct labor rate variance c. Direct labor usage variance d. Fixed overhead spending and volume variances e. Variable overhead spending and efficiency variances 3. Use T-accounts to show the flow of costs through the system. In showing the flow, you do not need to show detailed overhead variances. Show only the over- and underapplied variances for fixed and variable overhead.arrow_forwardDuring the week of May 10, Hyrum Manufacturing produced and shipped 16,000 units of its aluminum wheels: 4,000 units of Model A and 12,000 units of Model B. The cycle time for Model A is 1.09 hours and for Model B is 0.47 hour. The following costs and production hours were incurred: Required: 1. Assume that the value-stream costs and total units shipped apply only to one model (a single-product value stream). Calculate the unit cost, and comment on its accuracy. 2. Assume that Model A is responsible for 40% of the materials cost. Calculate the unit cost for Models A and B, and comment on its accuracy. Explain the rationale for using units shipped instead of units produced in the calculation. 3. Calculate the unit cost for the two models, using DBC. Explain when and why this cost is more accurate than the unit cost calculated in Requirement 2.arrow_forwardDuring the week of August 21, Parley Manufacturing produced and shipped 4,000 units of its machine tools: 1,500 units of Tool SK1 and 2,500 units of Tool SK3. The cycle time for SK1 is 0.73 hour, and the cycle time for SK3 is 0.56 hour. The following costs were incurred: Required: 1. Assume that the value-stream costs and total units shipped apply only to one model (a single-product value stream). Calculate the unit cost, and comment on its accuracy. 2. Assume that Tool SK1 is responsible for 60% of the materials cost. Calculate the unit cost for Tool SK 1 and Tool SK3, and comment on its accuracy. Explain the rationale for using units shipped instead of units produced in the calculation. 3. Calculate the unit cost for the two models, using DBC. Explain when and why this cost is more accurate than the unit cost calculated in Requirement 2.arrow_forward

- Rulers Company is a neon sign company that estimated overhead will be $60,000, consisting of 1,500 machine hours. The cost to make Job 416 is $95 in neon, 15 hours of labor at $13 per hour, and five machine hours. During the month, it incurs $95 in indirect material cost, $130 in administrative labor, $320 in utilities, and $350 in depreciation expense. What is the predetermined overhead rate if machine hours are considered the cost driver? What is the cost of Job 416? What is the overhead incurred during the month?arrow_forwardSmokeCity, Inc., manufactures barbeque smokers. Based on past experience, SmokeCity has found that its total annual overhead costs can be represented by the following formula: Overhead cost = 543,000 + 1.34X, where X equals number of smokers. Last year, SmokeCity produced 20,000 smokers. Actual overhead costs for the year were as expected. Required: 1. What is the driver for the overhead activity? 2. What is the total overhead cost incurred by SmokeCity last year? 3. What is the total fixed overhead cost incurred by SmokeCity last year? 4. What is the total variable overhead cost incurred by SmokeCity last year? 5. What is the overhead cost per unit produced? 6. What is the fixed overhead cost per unit? 7. What is the variable overhead cost per unit? 8. Recalculate Requirements 5, 6, and 7 for the following levels of production: (a) 19,500 units and (b) 21,600 units. (Round your answers to the nearest cent.) Explain this outcome.arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forward

- The Lubbock plant of Morrils Small Motor Division produces a major subassembly for a 6.0 horsepower motor for lawn mowers. The plant uses a standard costing system for production costing and control. The standard cost sheet for the subassembly follows: During the year, the Lubbock plant had the following actual production activity: (a) Production of motors totaled 50,000 units, (b) The company used 82,000 direct labor hours at a total cost of 1,066,000. (c) Actual fixed overhead totaled 556,000. (d) Actual variable overhead totaled 860,000. The Lubbock plants practical activity is 60,000 units per year. Standard overhead rates are computed based on practical activity measured in standard direct labor hours. Required: 1. Compute the variable overhead spending and efficiency variances. 2. CONCEPTUAL CONNECTION Compute the fixed overhead spending and volume variances. Interpret the volume variance. What can be done to reduce this variance?arrow_forwardBrees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for 66 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Prior to making a decision, the companys CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 3 setups1,160 each (The setups would be avoided, and total spending could be reduced by 1,160 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is 12,300 and could be totally avoided if the part were purchased. Engineering work: 470 hours, 45/hour. (Although the work decreases by 470 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.) 75 fewer material moves at 30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. 2. Now, using the special study data, repeat the analysis. 3. Discuss the qualitative factors that would affect the decision, including strategic implications. 4. After reviewing the special study, the controller made the following remark: This study ignores the additional activity demands that purchasing would cause. For example, although the demand for inspecting the part on the production floor decreases, we may need to inspect the incoming parts in the receiving area. Will we actually save any inspection costs? Is the controller right?arrow_forwardDuring March, the following costs were charged to the manufacturing department: $22,500 for materials; $45,625 for labor; and $50,000 for manufacturing overhead. The records show that 40,000 units were completed and transferred, while 10,000 remained in ending inventory. There were 45,000 equivalent units of material and 42,500 units of conversion costs. Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub