Managerial Accounting

7th Edition

ISBN: 9781337116008

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: South Western Educational Publishing

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 42BEB

Fixed

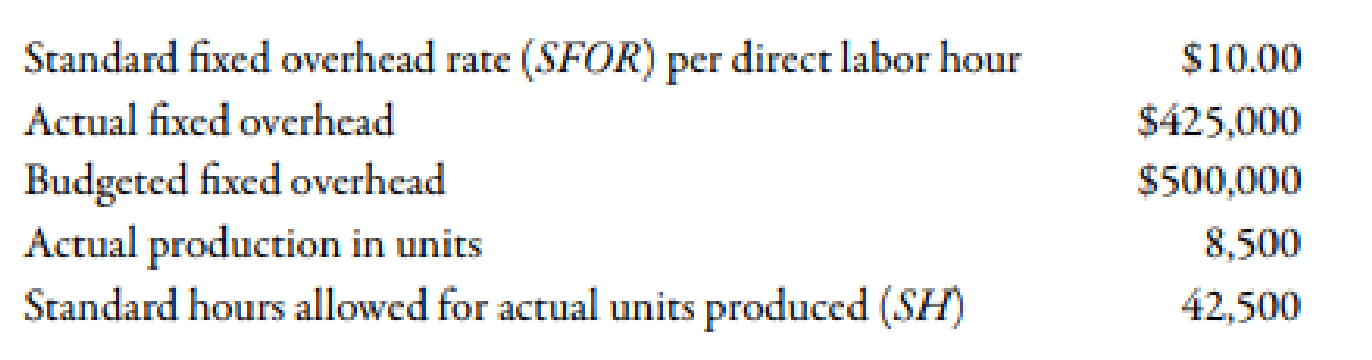

Corey Company provided the following information:

Required:

- 1. Using the columnar approach, calculate the fixed overhead spending and volume variances.

- 2. Using the formula approach, calculate the fixed overhead spending variance.

- 3. Using the formula approach, calculate the fixed overhead volume variance.

- 4. Calculate the total fixed overhead variance.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

M Question 6 - Ch 23: HOME

ation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.

Trini Company set the following standard costs per unit for its single product

Direct materials (30 pounds @ $5.00 per pound)

Direct labor (7 hours @ $14 per hour)

Variable overhead (7 hours @ $7 per hour)

Fixed overhead (7 hours @ $9 per hour)

Standard cost per unit

Production (in units)

Standard direct labor hours (7 DLH per unit)

Budgeted overhead (flexible budget)

Fixed overhead

Variable overhead

Overhead is applied using direct labor hours. The standard overhead rate is based on a predicted activity level of 80%

the company's capacity of 51,000 units per quarter. The following additional information is available.

Direct materials (1,377,000 pounds @ $5.00 per pound)

Direct labor (321,300 hours @ $14 per hour)

Overhead (321,300 hours @ $16 per hour)

Standard (budgeted) cost

Variable overhead

Actual cost

Saved

80

F3

Actual costs incurred during…

Deluxe, Inc. produced 1,000 units of the company's product in 2018. The standard quantity of direct materials was three yards of cloth per unit at a standard cost of $1.05 per yard. The accounting records showed

that 2,600 yards of cloth were used and the company paid $1.10 per yard. Standard time was two direct labor hours per unit at a standard rate of $10.75 per direct labor hour. Employees worked 1,400 hours and

were paid $10.25 per hour.

Read the requirements.

Requirement 1. What are the benefits of setting cost standards?

Standard costing helps managers do the following:

Requirement 2. Calculate the direct materials cost variance and the direct materials efficiency variance as well as the direct labor cost and efficiency variances.

Begin with the cost variances. Select the required formulas, compute the cost variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations

used: AC actual cost; AQ = actual…

Exercise 16-36 (Algo) Variable Cost Variances (LO 16-5)

Paynesville Corporation manufactures and sells a preservative used in food and drug manufacturing. The company carries no

inventories. The master budget calls for the company to manufacture and sell 122,000 liters at a budgeted price of $240 per liter this

year. The standard direct cost sheet for one liter of the preservative follows.

(2 pounds @ $15)

(0.5 hours @ $46)

Direct materials

$30

Direct labor

23

Variable overhead is applied based on direct labor hours. The variable overhead rate is $130 per direct-labor hour. The fixed overhead

rate (at the master budget level of activity) is $65 per unit. All non-manufacturing costs are fixed and are budgeted at $2.3 million for

the coming year.

At the end of the year, the costs analyst reported that the sales activity variance for the year was $732,000 unfavorable.

The following is the actual income statement (in thousands of dollars) for the year.

Sales revenue

$28,138

Less variable…

Chapter 10 Solutions

Managerial Accounting

Ch. 10 - Discuss the dirrerence between budgets and...Ch. 10 - Describe the relationship that unit standards have...Ch. 10 - Why is historical experience often a poor basis...Ch. 10 - Prob. 4DQCh. 10 - Explain why standard costing systems adopted.Ch. 10 - How does standard costing improve the control...Ch. 10 - Discuss the differences among actual costing,...Ch. 10 - Prob. 8DQCh. 10 - The budget variance for variable production costs...Ch. 10 - When should a standard cost variance be...

Ch. 10 - What are control limits, and how are they set?Ch. 10 - Explain why the materials price variance is often...Ch. 10 - The materials usage variance is always the...Ch. 10 - The labor rate variance is never controllable. Do...Ch. 10 - Prob. 15DQCh. 10 - What is kaizen costing? On which part of the value...Ch. 10 - What is target costing? Describe how costs are...Ch. 10 - Prob. 18DQCh. 10 - The variable overhead efficiency variance has...Ch. 10 - Describe the difference between the variable...Ch. 10 - What is the cause of an unfavorable volume...Ch. 10 - Does the volume variance convey any meaningful...Ch. 10 - Which do you think is more important for control...Ch. 10 - Prob. 1MCQCh. 10 - A currently attainable standard is one that a....Ch. 10 - An ideal standard is one that a. uses only...Ch. 10 - The underlying details for the standard cost per...Ch. 10 - The standard quantity of materials allowed is...Ch. 10 - The standard direct labor hours allowed is...Ch. 10 - Investigating variances from standard is a. always...Ch. 10 - Prob. 8MCQCh. 10 - The materials price variance is usually computed...Ch. 10 - Responsibility for the materials usage variance is...Ch. 10 - Responsibility for the labor rate variance...Ch. 10 - Responsibility for the labor efficiency variance...Ch. 10 - (Appendix 10A) Which of the following items...Ch. 10 - (Appendix 10A) Which of the following is true...Ch. 10 - The total variable overhead variance is the...Ch. 10 - A variable overhead spending variance can occur...Ch. 10 - The total variable overhead variance can be...Ch. 10 - The total fixed overhead variance is a. the...Ch. 10 - The total fixed overhead variance can be expressed...Ch. 10 - An unfavorable volume variance can occur because...Ch. 10 - Prob. 21BEACh. 10 - Control Limits During the last 6 weeks, the actual...Ch. 10 - Use the following information to complete Brief...Ch. 10 - Use the following information to complete Brief...Ch. 10 - Use the following information to complete Brief...Ch. 10 - Use the following information to complete Brief...Ch. 10 - Rath Company showed the following information for...Ch. 10 - Variable Overhead Spending and Efficiency...Ch. 10 - Performance Report for Variable Variances Humo...Ch. 10 - Total Fixed Overhead Variance Bradshaw Company...Ch. 10 - Fixed Overhead Spending and Volume Variances,...Ch. 10 - Prob. 32BEBCh. 10 - Control Limits During the last 6 weeks, the actual...Ch. 10 - Prob. 34BEBCh. 10 - Use the following information to complete Brief...Ch. 10 - Use the following information to complete Brief...Ch. 10 - Use the following information to complete Brief...Ch. 10 - Mulliner Company showed the following information...Ch. 10 - Variable Overhead Spending and Efficiency...Ch. 10 - Performance Report for Variable Variances Potter...Ch. 10 - Bulger Company provided the following data:...Ch. 10 - Fixed Overhead Spending and Volume Variances,...Ch. 10 - Standard Quantities of Labor and Materials...Ch. 10 - Sommers Company uses the following rule to...Ch. 10 - Use the following information for Exercises 10-45...Ch. 10 - Refer to the information for Cinturon Corporation...Ch. 10 - Refer to the information for Cinturon Corporation...Ch. 10 - Materials Variances Manzana Company produces apple...Ch. 10 - Labor Variances Verde Company produces wheels for...Ch. 10 - At the beginning of the year, Craig Company had...Ch. 10 - Jackie Iverson was furious. She was about ready to...Ch. 10 - 10-52 Materials and Labor Variances Refer to the...Ch. 10 - Refer to the information for Deporte Company...Ch. 10 - Esteban Products produces instructional aids,...Ch. 10 - Escuchar Products, a producer of DVD players, has...Ch. 10 - Use the following information for Exercises 10-56...Ch. 10 - Refer to the information for Rostand Inc. above....Ch. 10 - At the beginning of the year, Lopez Company had...Ch. 10 - Zepol Company is planning to produce 600,000 power...Ch. 10 - Last year, Gladner Company had planned to produce...Ch. 10 - Anker Company had the data below for its most...Ch. 10 - Cabanarama Inc. designs and manufactures...Ch. 10 - Basuras Waste Disposal Company has a long-term...Ch. 10 - Tom Belford and Tony Sorrentino own a small...Ch. 10 - Mantenga Company provides routine maintenance...Ch. 10 - Buenolorl Company produces a well-known cologne....Ch. 10 - The management of Golding Company has determined...Ch. 10 - Phono Company manufactures a plastic toy cell...Ch. 10 - Botella Company produces plastic bottles. The unit...Ch. 10 - The Lubbock plant of Morrils Small Motor Division...Ch. 10 - Moleno Company produces a single product and uses...Ch. 10 - The Lubbock plant of Morrils Small Motor Division...Ch. 10 - Extrim Company produces monitors. Extrims plant in...Ch. 10 - Lynwood Company produces surge protectors. To help...Ch. 10 - Shumaker Company manufactures a line of high-top...Ch. 10 - Paul Golding and his wife, Nancy, established...Ch. 10 - Prob. 79CCh. 10 - Prob. 1MTCCh. 10 - The Two Cost Systems Sacred Heart Hospital (SHH)...Ch. 10 - Prob. 3MTCCh. 10 - Prob. 4MTCCh. 10 - The Two Cost Systems Sacred Heart Hospital (SHH)...Ch. 10 - Prob. 6MTCCh. 10 - Prob. 7MTCCh. 10 - Prob. 8MTCCh. 10 - Prob. 9MTCCh. 10 - Sacred Heart Hospital (SHH) faces skyrocketing...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fixed Overhead Spending and Volume Variances, Columnar and Formula Approaches Branch Company provided the following information: Required: 1. Using the columnar approach, calculate the fixed overhead spending and volume variances. 2. Using the formula approach, calculate the fixed overhead spending variance. 3. Using the formula approach, calculate the fixed overhead volume variance. 4. Calculate the total fixed overhead variance.arrow_forwardVariable Overhead Spending and Efficiency Variances, Columnar and Formula Approaches Rath Company provided the following information: Required: 1. Using the columnar approach, calculate the variable overhead spending and efficiency variances. 2. Using the formula approach, calculate the variable overhead spending variance. 3. Using the formula approach, calculate the variable overhead efficiency variance. 4. Calculate the total variable overhead variance.arrow_forwardVariable Overhead Spending and Efficiency Variances, Columnar and Formula Approaches Aretha Company provided the following information: Required: 1. Using the columnar approach, calculate the variable overhead spending and efficiency variances. 2. Using the formula approach, calculate the variable overhead spending variance. 3. Using the formula approach, calculate the variable overhead efficiency variance. 4. Calculate the total variable overhead variance.arrow_forward

- Performance Report for Variable Variances Humo Company provided the following information: Required: Prepare a performance report that shows the variances for each variable overhead item (inspection and power).arrow_forwardThe variable overhead rate variance is caused by the sum between which of the following? A. actual and standard allocation base B. actual and standard overhead rates C. actual and budgeted units D. actual units and actual overhead ratesarrow_forwardExplain how the two-, three-, and four-variance overhead analyses are related.arrow_forward

- Acme Inc. has the following information available: A. Compute the material price and quantity, and the labor rate and efficiency variances. B. Describe the possible causes for this combination of favorable and unfavorable variances.arrow_forwardPerformance Report for Variable Variances Potter Company provided the following information: Required: Prepare a performance report that shows the variances for each variable overhead item (inspection and power).arrow_forwardThe variable overhead efficiency variance is caused by the difference between which of the following? A. actual and budgeted units B. actual and standard allocation base C. actual and standard overhead rates D. actual units and actual overhead ratesarrow_forward

- In 2 way variance analysis, materials, labor and variable overhead variances maybe broken down to ________ variances. A. Price and spending B. Quantity and time C. spending and efficiency D. spending and capacityarrow_forwardAnswer only d, e, and farrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY