The Two Cost Systems

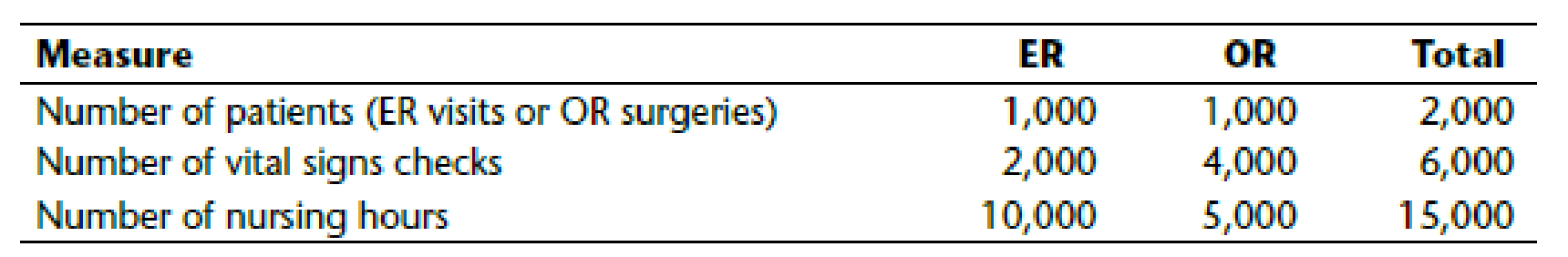

Sacred Heart Hospital (SHH) faces skyrocketing nursing costs, all of which relate to its two biggest nursing service lines—the Emergency Room (ER) and the Operating Room (OR). SHH’s current cost system assigns total nursing costs to the ER and OR based on the number of patients serviced by each line. Total hospital annual nursing costs for these two lines are expected to equal $300,000. The table below shows expected patient volume for both lines.

After discussion with several experienced nurses, Jack Bauer (SHH’s accountant) decided that assigning nursing costs to the two service lines based on the number of times that nurses must check patients’ vital signs might more closely match the underlying use of costly hospital resources. Therefore, for comparative purposes, Jack decided to develop a second cost system that assigns total nursing costs to the ER and OR based on the number of times nurses check patients’ vital signs. This system is referred to as the “vital-signs costing system.” The earlier table also shows data for vital signs checks for lines.

Calculate the amount of nursing costs that the vital-signs costing system assigns to the ER and to the OR.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting

- Sacred Heart Hospital (SHH) faces skyrocketing nursing costs, all of which relate to its two biggest nursing service linesthe Emergency Room (ER) and the Operating Room (OR). SHHs current cost system assigns total nursing costs to the ER and OR based on the number of patients serviced by each line. Total hospital annual nursing costs for these two lines are expected to equal 300,000. The table below shows expected patient volume for both lines. After discussion with several experienced nurses, Jack Bauer (SHHs accountant) decided that assigning nursing costs to the two service lines based on the number of times that nurses must check patients vital signs might more closely match the underlying use of costly hospital resources. Therefore, for comparative purposes, Jack decided to develop a second cost system that assigns total nursing costs to the ER and OR based on the number of times nurses check patients vital signs. This system is referred to as the vital-signs costing system. The earlier table also shows data for vital signs checks for lines. In an effort to better plan for and control OR costs, SHH management asked Jack to calculate the flexible budget variance (i.e., flexible budget costs - actual costs) for OR nursing costs, including the price variance and efficiency variance. Given that Jack is interested in comparing the reported costs of both systems, he decided to prepare the requested OR variance analysis for both the current cost system and the vital-signs costing system. In addition, Jack chose to use each cost systems estimate of the cost per OR nursing hour as the standard cost per OR nursing hour. Jack collected the following additional information for use in preparing the flexible budget variance for both systems: Actual number of surgeries performed = 950 Standard number of nursing hours allowed for each OR surgery = 5 Actual number of OR nursing hours used = 5,000 Actual OR nursing costs = 190,000 What does each of the calculated variances suggest to Jack regarding actions that he should or should not take with respect to investigating and improving each variance? Also, briefly explain why the variances differ between the two cost systems.arrow_forwardThe Housekeeping Department of Micanopy Hospital has direct costs of $500,000. The hospital's four patient service departments utilize the following amounts of space:Department A = 1,000 square feetDepartment B = 2,000 square feetDepartment C = 3,000 square feetDepartment D = 4,000 square feet Assuming that the cost driver for housekeeping costs is the amount of occupied space, what is the allocation of housekeeping costs to each department? Show all work. ....typing onlyarrow_forwardHealth-Temp Company is a placement agency for temporary nurses. It serves hospitals and clinics throughout the metropolitan area. Health-Temp Company believes it will place temporary nurses for a total of 23,500 hours next year. Health-Temp charges the hospitals and clinics 90 per hour and has variable costs of 75.60 per hour (this includes the payment to the nurse). Total fixed costs equal 321,000. Required: 1. Calculate the contribution margin per unit and the contribution margin ratio. 2. Calculate the sales revenue needed to break even. 3. Calculate the sales revenue needed to achieve a target profit of 100,000. 4. What if Health-Temp had target operating income (profit) of 110,000? Would sales revenue be larger or smaller than the one calculated in Requirement 3? Why? By how much?arrow_forward

- Health-Temp Company is a placement agency for temporary nurses. It serves hospitals and clinics throughout the metropolitan area. Health-Temp Company believes it will place temporary nurses for a total of 28,000 hours next year. Health-Temp charges the hospitals and clinics $80 per hour and has variable costs of $67.20 per hour (this includes the payment to the nurse). Total fixed costs equal $345,984. Required: 1. Calculate the contribution margin per unit and the contribution margin ratio (express the ratio as a decimal rather than a percentage). If required, round your answers to two decimal places. Contribution margin per unit $_____ Contribution margin ratio ______ 2. Calculate the sales revenue needed to break even.$______ 3. Calculate the sales revenue needed to achieve a target profit of $79,360.$______ 4. What if Health-Temp had target operating income (profit) of $97,280? Would sales revenue be larger or smaller than the one calculated in Requirement 3? LARGER By how…arrow_forwardProvidence Hospital generates monthly performance reports for each of its departments. The hospital must maintain an adequate staff of attending and on-call physicians at all times, so physician costs are not affected by the number of patient visits. But all other costs do vary with patient activity. Nurse- hours are used as the activity measure for nursing costs, and patient visits are used as the activity measure for the cost of supplies and other variable costs. The head physician of the hospital's emergency room, Yolanda Mortensen, is responsible for control of costs. During October, the emergency room unit expected to treat 3,500 patients but actually treated 4,000 patients. The following additional information for October is available: Budget Actual Variance Nurse-hours 2,100 2,320 -220 Nursing costs $46,200 $30,000 $16,200 Supplies & other variable $38,500 $25,500 $13,000 costs Fixed costs $104,200 $109,900 $-5,700 Required Compute the flexible-budget variances for each of the…arrow_forwardShady Rest Nursing Home has 100 private pay residents. The administrator is concerned about balancing the ratio its private pay to non-private pay patients. Non-private pay sources reimburse an average of $100 per day whereas private pay residents pay average 100 percent of full daily charges. The administrator estimates that variable cost per resident per day is $25 for supplies, food, and contracted services and annual fixed costs are $4,562,500. What is the daily contribution margin of each non-private pay resident? If 25 percent of the residents are non-private pay, what will shady Rest charge the private pay patients in order to break even? What if non-private pay payors cover 50 percent of the residents?arrow_forward

- The housekeeping services department of Ruger Clinic, a multispecialty practice had $100,000 in direct costs this year. The patient services department generated $5,000,000 in patient revenue and the departments used a total of 5,000 total hours of housekeeping.The adult services department generated $3 million in patient revenue and used 1,500 housekeeping hours what is dollar allocation if patient services is used as the cost driverarrow_forwardCampbell Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,200 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $ 6,900 6,400 4,100 9,600 26,600 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Campbell for $2.80 each. Required a. Calculate the total relevant cost. Should Campbell continue to make the containers? b. Campbell could lease the space it currently uses in the manufacturing process. If leasing would produce $12,800 per month, calculate the total avoidable costs. Should Campbell continue to make the containers? a. Total relevant cost Should Campbell continue to make the containers? b. Total avoidable cost Should Campbell continue to make the containers?arrow_forwardFinch Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,200 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $ 6,400 6,000 4,000 11,400 27,300 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Finch for $2.70 each. Required a. Calculate the total relevant cost. Should Finch continue to make the containers? b. Finch could lease the space it currently uses in the manufacturing process. If leasing would produce $11,000 per month, calculate the total avoidable costs. Should Finch continue to make the containers? a. Total relevant cost Should Finch continue to make the containers? b. Total avoidable cost Should Finch continue to make the containers?arrow_forward

- Vernon Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,100 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $5,700 6,500 3,200 8,400 27,100 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Vernon for $2.60 each. Required a. Calculate the total relevant cost. Should Vernon continue to make the containers? b. Vernon could lease the space it currently uses in the manufacturing process. If leasing would produce $12,700 per month, calculate the total avoidable costs. Should Vernon continue to make the containers? a. Total relevant cost a. Should Vernon continue to make the containers? b. Total avoidable cost b. Should Vernon continue to make the containers?arrow_forwardDiscuss two different criteria Mr. Smith can use to determine the sequence for allocating support department costs using the step-down method.arrow_forwardMesa Telcom has three divisions, commercial, retail, and consumer, that share the common costs of the company's computer server network. The annual common costs are $2,860,000. You have been provided with the following information for the upcoming year: Connections Time on Network (hours) Commercial 51,000 121,000 Retail 61,000 151,000 Consumer 108,000 378,000 What is the allocation rate for the upcoming year, assuming Mesa Telcom uses the single-rate method and allocates common costs based on the time on the network? Multiple Choice $4.40. $3.29. $23.64. $19.36.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning