Concept explainers

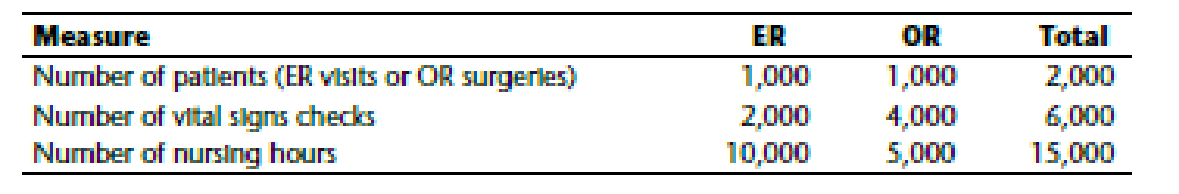

Sacred Heart Hospital (SHH) faces skyrocketing nursing costs, all of which relate to its two biggest nursing service lines—the Emergency Room (ER) and the Operating Room (OR). SHH’s current cost system assigns total nursing costs to the ER and OR based on the number of patients serviced by each line. Total hospital annual nursing costs for these two lines are expected to equal $300,000. The table below shows expected patient volume for both lines.

After discussion with several experienced nurses, Jack Bauer (SHH’s accountant) decided that assigning nursing costs to the two service lines based on the number of times that nurses must check patients’ vital signs might more closely match the underlying use of costly hospital resources. Therefore, for comparative purposes, Jack decided to develop a second cost system that assigns total nursing costs to the ER and OR based on the number of times nurses check patients’ vital signs. This system is referred to as the “vital-signs costing system.” The earlier table also shows data for vital signs checks for lines.

In an effort to better plan for and control OR costs, SHH management asked Jack to calculate the flexible

Actual number of surgeries performed = 950

Standard number of nursing hours allowed for each OR surgery = 5

Actual number of OR nursing hours used = 5,000

Actual OR nursing costs = $190,000

What does each of the calculated variances suggest to Jack regarding actions that he should or should not take with respect to investigating and improving each variance? Also, briefly explain why the variances differ between the two cost systems.

Trending nowThis is a popular solution!

Chapter 10 Solutions

Managerial Accounting

- The Two Cost Systems Sacred Heart Hospital (SHH) faces skyrocketing nursing costs, all of which relate to its two biggest nursing service linesthe Emergency Room (ER) and the Operating Room (OR). SHHs current cost system assigns total nursing costs to the ER and OR based on the number of patients serviced by each line. Total hospital annual nursing costs for these two lines are expected to equal 300,000. The table below shows expected patient volume for both lines. Calculate the amount of nursing costs that the current cost system assigns to the ER and to the OR.arrow_forwardThe Two Cost Systems Sacred Heart Hospital (SHH) faces skyrocketing nursing costs, all of which relate to its two biggest nursing service linesthe Emergency Room (ER) and the Operating Room (OR). SHHs current cost system assigns total nursing costs to the ER and OR based on the number of patients serviced by each line. Total hospital annual nursing costs for these two lines are expected to equal 300,000. The table below shows expected patient volume for both lines. After discussion with several experienced nurses, Jack Bauer (SHHs accountant) decided that assigning nursing costs to the two service lines based on the number of times that nurses must check patients vital signs might more closely match the underlying use of costly hospital resources. Therefore, for comparative purposes, Jack decided to develop a second cost system that assigns total nursing costs to the ER and OR based on the number of times nurses check patients vital signs. This system is referred to as the vital-signs costing system. The earlier table also shows data for vital signs checks for lines. Calculate the amount of nursing costs that the vital-signs costing system assigns to the ER and to the OR.arrow_forwardTo estimate the monthly maintenance cost for the maintenance department in a hospital, the following monthly costs are available: Monthly Expense Supervisor Salary Expense Depreciation Expense-Maintenance Equipment Repairs Expense-Maintenance Equipment Supplies Expense Wages Expense-Maintenance Workers $10,000 The Supervisor Salary Expense and the Depreciation Expense are fixed costs. The remaining expenses are variable costs. There are 1,000 patient days in a month, which is the cost driver for maintenance costs. Estimate the cost function where Y is the monthly maintenance cost and X is the variable cost per patient day. OY-58+$22X OY $30,000 $22.000x OY-$8,000-$22,000x OY-$8,000 $22X $5,000 Costs $3,000 $5,000 $7,000arrow_forward

- What is the value of the cost pool and allocation rate if patient service is used as cost driver and hours of housekeeping used as a cost driver? $100,000 in direct costs, $5 million in patient service revenues, & 5,000 hrs of housekeepingarrow_forwardProvidence Hospital generates monthly performance reports for each of its departments. The hospital must maintain an adequate staff of attending and on-call physicians at all times, so physician costs are not affected by the number of patient visits. But all other costs do vary with patient activity. Nurse- hours are used as the activity measure for nursing costs, and patient visits are used as the activity measure for the cost of supplies and other variable costs. The head physician of the hospital's emergency room, Yolanda Mortensen, is responsible for control of costs. During October, the emergency room unit expected to treat 3,500 patients but actually treated 4,000 patients. The following additional information for October is available: Budget Actual Variance Nurse-hours 2,100 2,320 -220 Nursing costs $46,200 $30,000 $16,200 Supplies & other variable $38,500 $25,500 $13,000 costs Fixed costs $104,200 $109,900 $-5,700 Required Compute the flexible-budget variances for each of the…arrow_forwardZachary Health Care Center Incorporated has three clinics servicing the Seattle metropolitan area. The company's legal services department supports the clinics. Moreover, its computer services department supports all of the clinics and the legal services department. The annual cost of operating the legal services department is $453,200. The annual cost of operating the computer services department is $345,000. The company uses the number of patients served as the cost driver for allocating the cost of legal services and the number of computer workstations as the cost driver for allocating the cost of computer services. Other relevant information follows. I Sewell clinic Alphretta clinic Gwinnett clinic Legal services Computer services Required a. Allocate the cost of computer services to all of the clinics and the legal services department. b. After allocating the cost of computer services, allocate the cost of legal services to the three clinics: c. Compute the total allocated cost of…arrow_forward

- Draw a graph of the cost behavior for each of the following costs incurred by the Mountain Summit Hospital. The hospital measures monthly activity in patient days. Label both axes and the cost line in each graph.1. The cost of food varies in proportion to the number of patient days of activity. In January, the hospital provided 3,000 patient days of care, and food costs amounted to $24,000.2. The cost of salaries and fringe benefits for the administrative staff totals $12,000 per month.3. The hospital’s laboratory costs include two components: (a) $40,000 per month for compensation of personnel and depreciation on equipment and (b) $10 per patient day for chemicals and other materials used in performing the tests.4. The cost of utilities depends on how many wards the hospital needs to use during a particular month. During months with activity under 2,000 patient days of care, two wards are used, resulting in utility costs of $10,000. During months with greater than 2,000 patient days…arrow_forwardThe Housekeeping Services Department of Ruger Clinic, had $100,000 in direct costs during the year. Department Revenue HK Hours Adult Services $3,000,000 1,500 Pediatric Services $1,500,000 3,000 Other Services $ 500,000 500 Total $5,000,000 5,000 What is the value of the cost pool? Which of the two cost drivers is better? Patient service revenue or housekeeping hours? Why?arrow_forwardNovello Medical Center has a single operating room that is used by local physicians to perform surgical procedures. The cost of using the operating room is accumulated by each patient procedure and includes the direct materials costs (drugs and medical devices), physician surgical time, and operating room overhead. On January 1 of the current year, the annual operating room overhead is estimated to be: Disposable supplies $350,100 Depreciation expense 63,100 Utilities 36,700 Nurse salaries 525,800 Technician wages 172,300 Total operating room overhead $1,148,000 The overhead costs will be assigned to procedures based on the number of surgical room hours. Novello Medical Center expects to use the operating room an average of eight hours per day, seven days per week. In addition, the operating room will be shut down two weeks per year for general repairs. a. Compute the estimated number of operating room hours for the year. hours b. Determine the predetermined operating room overhead…arrow_forward

- S Zachary Health Care Center Incorporated has three clinics servicing the Seattle metropolitan area. The company's legal services department supports the clinics. Moreover, its computer services department supports all of the clinics and the legal services department. The annual cost of operating the legal services department is $316,050. The annual cost of operating the computer services department is $451,000. The company uses the number of patients served as the cost driver for allocating the cost of legal services and the number of computer workstations as the cost driver for allocating the cost of computer services. Other relevant information follows. Number of Patients 6,900 5,300 7,100 Number of Workstations Sewell clinic Alphretta clinic Gwinnett clinic Legal services Computer services Required a. Allocate the cost of computer services to all of the clinics and the legal services department. b. After allocating the cost of computer services, allocate the cost of legal services…arrow_forwardStuart Health Care Center Incorporated has three clinics servicing the Seattle metropolitan area. The company's legal services department supports the clinics. Moreover, its computer services department supports all of the clinics and the legal services department. The annual cost of operating the legal services department is $339,550. The annual cost of operating the computer services department is $464,800. The company uses the number of patients served as the cost driver for allocating the cost of legal services and the number of computer workstations as the cost driver for allocating the cost of computer services. Other relevant information follows. Sewell clinic Alphretta clinic Gwinnett clinic. Legal services Computer services Required a. Allocate the cost of computer services to all of the clinics and the legal services department. b. After allocating the cost of computer services, allocate the cost of legal services to the three clinics. c. Compute the total allocated cost of…arrow_forwardThornton Health Care Center Incorporated has three clinics servicing the Seattle metropolitan area. The company's legal services department supports the clinics. Moreover, its computer services department supports all of the clinics and the legal services department. The annual cost of operating the legal services department is $331,000. The annual cost of operating the computer services department is $292,600. The company uses the number of patients served as the cost driver for allocating the cost of legal services and the number of computer workstations as the cost driver for allocating the cost of computer services. Other relevant information follows. Number of Patients:Number of Workstations Sewell clinic 6, 500 : 7 Alphretta clinic 5, 600: 11 Gwinnett clinic 6,300 : 14 Legal services 6 Computer services 18 Required Allocate the cost of computer services to all of the clinics and the legal services department. After allocating the cost of computer services, allocate the cost of…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning