Concept explainers

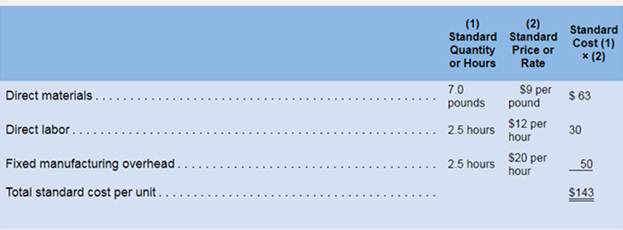

Swain Company manufactures one product. it does not maintain any beginning or ending inventories, and its uses a standard cost system. The company’s beginning balance in

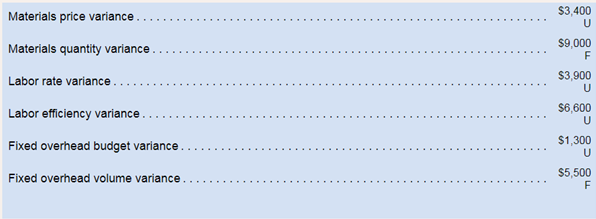

During the period. Swain recorded the following variances:

Required:

1. When Swain closes its standard cost variances, the cost of goods sold will increase (decrease) by how much?

2. Using Exhibit 9B−5 as a guide. prepare an income statement for the year.

3. What is Swain’s ending balance in Retained Earnings?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- Grainger Company produces only one product and sells that product for $110 per unit. Cost information for the product is as follows: Direct Material $16 per Unit Direct Labor $24 per Unit Variable Overhead $5 per Unit Fixed Overhead $40,200 Selling expenses are $4 per unit and are all variable. Administrative expenses of $24,000 are all fixed. Grainger produced 6,000 units; sold 4,800; and had no beginning inventory. A. Compute net income under i. Absorption Costing $ ii. Variable Costing $arrow_forwardSparn Limited incurs the following costs to produce and sell a single product Varinble costs per unit: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative expenses Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses O Absorption costing O Variable costing During the last year, 44,300 units were produced and 28,100 units were sold. The Finished Goods Inventory account at the end of the year shows a balance of $145.800 for the 5,400 unsold units. 1-b. Show computations to support your answer. Required: 1-a. Is the company using absorption costing or variable costing to cost units in the Finished Goods Inventory account? Direct materials Direct labour Variable manufacturing overhead Fixed manufacturing overhead Unit product cost Total cost. 5,400 units $ A 15 7 4 6 Variable Absorption Costing Costing 265,800 421,500arrow_forwardGrainger Company produces only one product and sells that product for $110 per unit. Cost information for the product is as follows: Direct Material $14 per Unit Direct Labor $24 per Unit Variable Overhead $4 per Unit Fixed Overhead $40,200 Selling expenses are $4 per unit and are all variable. Administrative expenses of $24,000 are all fixed. Grainger produced 6,000 units; sold 4,800; and had no beginning inventory. A. Compute net income under 1. Absorption Costing i Variable Costing B. Which costing method provide higher net income? By how much? The absorption costing ✔method provided more net income by Check My Work A. Remember that absorption costing includes all costs necessary for production. Conversely, variable costing only uses the variable costs that relate directly to the production process. Keep this in mind when calculating net income under each assumption. B. Depending on the cost method chosen, there will be differences due to the way fixed costs are treated under each…arrow_forward

- lomework (i) Jax Incorporated reports the following data for its only product. The company had no beginning finished goods inventory and it uses absorption costing. \table[[Sales price,$56.10 per unit], [ Direct materials, $9.10 per unit], [Direct labor, $6.60 per unit], [Variable overhead,$11.10 per unit], [Fixed overhead,$750,300 per year]] Compute gross profit assuming (a) 61,000 units are produced and 61,000 units are sold and (b)82,000 units are produced and 61,000 units are sold. By how much would the company's gross profit increase or decrease from producing 21,000 more units than it sells?arrow_forwardPlease do not give image formatarrow_forwardGrainger Company produces only one product and sells that product for $90 per unit. Cost information for the product is as follows: Direct Material $14 per Unit Direct Labor $26 per Unit Variable Overhead $6 per Unit Fixed Overhead $33,500 Selling expenses are $4 per unit and are all variable. Administrative expenses of $20,000 are all fixed. Grainger produced 5,000 units; sold 4,000; and had no beginning inventory. A. Compute net income under i. Absorption Costing $fill in the blank 1 ii. Variable Costing $fill in the blank 2 B. Which costing method provide higher net income? By how much? The absorption costing method provided more net income by $fill in the blank 4 .arrow_forward

- Grainger Company produces only one product and sells that product for $90 per unit. Cost information for the product is as follows: Direct Material $15 per UnitDirect Labor $24 per UnitVariable Overhead $4 per UnitFixed Overhead $27,200 Selling expenses are $4 per unit and are all variable. Administrative expenses of $16,000 are all fixed. Grainger produced 4,000 units; sold 3,200; and had no beginning inventory. A. Compute net income under i. Absorption Costing $ ii. Variable Costing $ B. Which costing method provide higher net income? By how much? The_____method provided more net income by $_____ .arrow_forwardPlease do not give solution in image formatarrow_forwardAssume that a company maintains no beginning or ending inventories and produces and sells 4,000 units of only one product for a price of $130 per unit. The company’s variable manufacturing costs per unit are $80 and its fixed manufacturing overhead per unit is $24. Its variable selling and administrative expense is $12 per unit and its fixed selling and administrative expense is $46,300. What is the company’s net operating income under absorption costing?arrow_forward

- Jax Incorporated reports the following data for its only product. The company had no beginning finished goods inventory and it uses absorption costing. Sales price$ 58.00per unitDirect materials$ 11.00per unitDirect labor$ 8.50per unitVariable overhead$ 13.00per unitFixed overhead$ 1,440,000per year 1. Compute gross profit assuming (a) 80,000 units are produced and 80,000 units are sold and (b) 120,000 units are produced and 80,000 units are sold. 2. By how much would the company’s gross profit increase or decrease from producing 40,000 more units than it sells?arrow_forwardThe Dorset Corporation produces and sells a single product. The following data refer to the year just completed: Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit Fixed per year 0 31,600 29,600 $ 414 $ 21 $ 621,600 Manufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead per year Assume that direct labor is a variable cost. Required: a. Compute the unit product cost under both the absorption costing and variable costing approaches. b. Prepare an income statement for the year using absorption costing. c. Prepare an income statement for the year using variable costing. d. Reconcile the absorption costing and variable costing net operating income figures in (b) and (c) above. $ 216 $ 50 $37 $ 379,200arrow_forwardNeed help with this accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning