Concept explainers

Comprehensive

"Wonderful! Not only did our salespeople do a good job in meeting the sales budget this year, but our production people did a good job in controlling costs as well." said Kim Clark, president of Martell Company. "Our $ 18.300 overall

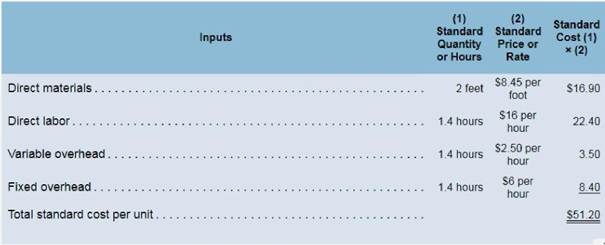

The following additional information is available for the year just completed:

a. The company manufactured 30.000 units of product during the year.

b. A total of 64.000 feet of material was purchased during the year at a cost of $8.55 per foot. All of this material was used to manufacture the 30,000 units produced. There were no beginning or ending inventories for the year.

c. The company worked 43,500 direct labor-hours during the year at a direct labor cost of $15.80 per hour.

d.

Required:

1. Compute the materials price and quantity variances for the year.

2. Compute the labor rate and efficiency variances for the year.

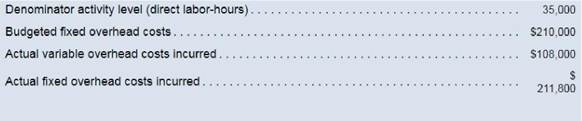

3. For manufacturing overhead compute:

a. The variable overhead rate and efficiency variances for the year.

b. The fixed overhead budget and volume variances for the year.

4. Total the variances you have computed and compare the net amount with the $18.300 mentioned by the president. Do you agree that bonuses should be given to everyone for good cost control during the year? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivableno aiarrow_forwardWhich of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forwardWhat does a ledger account represent? A) A detailed record of all business transactionsB) A summary of trial balancesC) An individual record for each accountD) The final balance of a financial statement Need help!arrow_forward

- What is the primary purpose of accounting? A) To generate tax revenueB) To record, summarize, and report financial transactionsC) To determine the market value of assetsD) To manage payrollarrow_forwardWhat are the three main financial statements in accounting?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning