GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

8th Edition

ISBN: 9781260259179

Author: BREWER

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9.A, Problem 3E

Applying

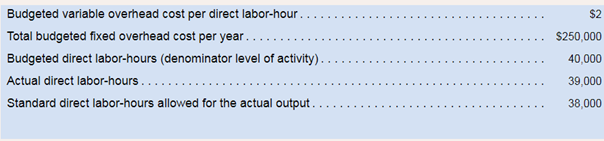

Privack Corporation has a standard cost system in which it applies overhead to products based on the standard direct labor- hours allowed for the actual output of the period. Data concerning the most recent year appear below:  Required:

Required:

I. Compute the predetermined overhead rate for the year. Be sure to include the total budgeted fixed overhead and the total budgeted variable overhead in the numerator of your rate.

2. Compute the amount of overhead that would be applied to the output of the period.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

On May 31, 2026, Oriole Company paid $3,290,000 to acquire all of the common stock of Pharoah Corporation, which became a

division of Oriole. Pharoah reported the following balance sheet at the time of the acquisition:

Current assets

$846,000

Current liabilities

$564,000

Noncurrent assets

2,538,000

Long-term liabilities

470,000

Stockholder's equity

2,350,000

Total assets

$3,384,000

Total liabilities and stockholder's equity

$3,384,000

It was determined at the date of the purchase that the fair value of the identifiable net assets of Pharoah was $2,914,000. At

December 31, 2026, Pharoah reports the following balance sheet information:

Current assets

$752,000

Noncurrent assets (including goodwill recognized in purchase)

2,256,000

Current liabilities

(658,000)

Long-term liabilities

(470,000)

Net assets

$1,880,000

It is determined that the fair value of the Pharoah division is $2,068,000.

On May 31, 2026, Oriole Company paid $3,290,000 to acquire all of the common stock of Pharoah Corporation, which became a

division of Oriole. Pharoah reported the following balance sheet at the time of the acquisition:

Current assets

$846,000

Current liabilities

$564,000

Noncurrent assets

2,538,000

Long-term liabilities

470,000

Stockholder's equity

2,350,000

Total assets

$3,384,000

Total liabilities and stockholder's equity

$3,384,000

It was determined at the date of the purchase that the fair value of the identifiable net assets of Pharoah was $2,914,000. At

December 31, 2026, Pharoah reports the following balance sheet information:

Current assets

$752,000

Noncurrent assets (including goodwill recognized in purchase)

2,256,000

Current liabilities

(658,000)

Long-term liabilities

(470,000)

Net assets

$1,880,000

It is determined that the fair value of the Pharoah division is $2,068,000.

The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025.

1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business.

2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful.

3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years.

4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029.

5.) Oriole incurred $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…

Chapter 9 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

Ch. 9.A - Fixed Overhead Variances Primara Corporation has a...Ch. 9.A - Predetermined Overhead Rate: Overhead Variances...Ch. 9.A - Applying Overhead in a Standard Costing System...Ch. 9.A - Prob. 4ECh. 9.A - Using Fixed Overhead Variances The standard cost...Ch. 9.A - Prob. 6ECh. 9.A - Relations Among Fixed Overhead Variances Selected...Ch. 9.A - Applying Overhead; Overhead Variances Lane Company...Ch. 9.A - Applying Overhead; Overhead Variances Chilczuk....Ch. 9.A - Comprehensive Standard Cost Variances "Wonderful!...

Ch. 9.A - Comprehensive Standard Cost Variances Flandro...Ch. 9.A - Selection of a Denominator: Overhead Analysis:...Ch. 9.B - Standard Cost Flows: Income Statement Preparation...Ch. 9.B - Standard Cost Flows: Income Statement Preparation...Ch. 9.B - Standard Cost Flows Bowen Company manufactures one...Ch. 9.B - Standard Cost Flows Hartwell Company manufactures...Ch. 9.B - Transaction Analysis; Income Statement Preparation...Ch. 9.B - Transaction Analysis; Income Statement Preparation...Ch. 9 - What is a static planning budget?Ch. 9 - What is a flexible budget and how does it differ...Ch. 9 - What are some of the possible reasons that actual...Ch. 9 - Why is it difficult to interpret a difference...Ch. 9 - What is a revenue variance and what does it mean?Ch. 9 - What is a spending variance and what does it mean?Ch. 9 - What does a flexible budget enable that a simple...Ch. 9 - How does a flexibe budget based on the cost...Ch. 9 - Prob. 9QCh. 9 - Why are separate price and quantity variances...Ch. 9 - Who is generally responsible for the materials...Ch. 9 - Prob. 12QCh. 9 - Prob. 13QCh. 9 - Our workers are all under labor contracts:...Ch. 9 - Prob. 15QCh. 9 - Prob. 16QCh. 9 - Prob. 17QCh. 9 - The Excel worksheet form that appears below is to...Ch. 9 - Prob. 2AECh. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 2F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 4F15Ch. 9 - Prob. 5F15Ch. 9 - Prob. 6F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 8F15Ch. 9 - Prob. 9F15Ch. 9 - Prob. 10F15Ch. 9 - Prob. 11F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 13F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prepare a Flexible Budget Puget Sound Divers is a...Ch. 9 - Prepare a Report Shong Revenue and Spending...Ch. 9 - Prepare a Flexible Budget with More Than One Cost...Ch. 9 - Direct Materials Variances Bandar Industries...Ch. 9 - Prob. 5ECh. 9 - Prob. 6ECh. 9 - Planning Budget Lavage Rapide is a Canadian...Ch. 9 - EXERCISE 98 Flexible Budget L091 Refer to the data...Ch. 9 - Prepare a Report Showing Revenue and Spending...Ch. 9 - Direct Labor and Variable Manufacturing Overhead...Ch. 9 - Prob. 11ECh. 9 - Working with More Than One Cost Driver The...Ch. 9 - Direct Materials and Direct Labor Variances Huron...Ch. 9 - Direct Materials Variances Refer to the data in...Ch. 9 - Prob. 15ECh. 9 - Prob. 16ECh. 9 - Prob. 17ECh. 9 - Comprehensive Variance Analysis Miller Toy Company...Ch. 9 - More than One Cost Driver Milano Pizza is a small...Ch. 9 - Basic Variance Analysis: the Impact of Vanances on...Ch. 9 - Multiple Products. Materials, and Processes...Ch. 9 - Variance Analysis In a Hospital John Fleming,...Ch. 9 - Flexible Budgets and Spending Variances You have...Ch. 9 - Comprehensive Variance Analysis Marvel Parts....Ch. 9 - Direct Materials and Direct Labor Variances:...Ch. 9 - Comprehensive Variance Analysis Highland Company...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Reffering to fair value of an asset, division, or organization, What exactly is fair value and how is it assessed?arrow_forwardThe following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. 2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. 4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred 5.) $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…arrow_forwardNonearrow_forward

- I need help solving this general accounting question with the proper methodology.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY