GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

8th Edition

ISBN: 9781260259179

Author: BREWER

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9.A, Problem 5E

Using Fixed

The

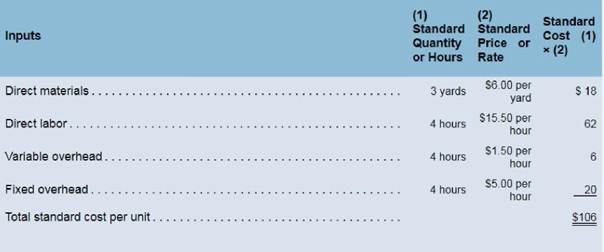

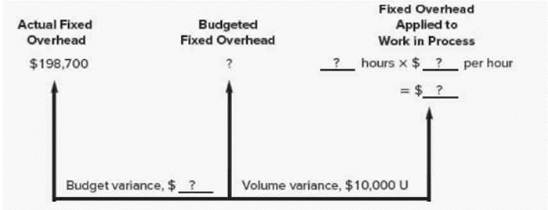

Manufacturing overhead is applied to production on the basis of standard direct labor-hours. During the year, the company worked 37.000 hours and manufactured 9.500 units of product. Selected data relating to the company:s fixed

Required:

- What were the standard hours allowed for the years production?

- What was the amount of budgeted fixed overhead cost for the year?

- What was the fixed overhead

budget variance for the year? - What denominator activity level did the company use in setting the predetermined overhead rate for the year?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What are the implications of the matching principle in accounting?

Expand upon this and add

How do you calculate the net present value (NPV) of a project, and what does it indicate?no ai

Chapter 9 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

Ch. 9.A - Fixed Overhead Variances Primara Corporation has a...Ch. 9.A - Predetermined Overhead Rate: Overhead Variances...Ch. 9.A - Applying Overhead in a Standard Costing System...Ch. 9.A - Prob. 4ECh. 9.A - Using Fixed Overhead Variances The standard cost...Ch. 9.A - Prob. 6ECh. 9.A - Relations Among Fixed Overhead Variances Selected...Ch. 9.A - Applying Overhead; Overhead Variances Lane Company...Ch. 9.A - Applying Overhead; Overhead Variances Chilczuk....Ch. 9.A - Comprehensive Standard Cost Variances "Wonderful!...

Ch. 9.A - Comprehensive Standard Cost Variances Flandro...Ch. 9.A - Selection of a Denominator: Overhead Analysis:...Ch. 9.B - Standard Cost Flows: Income Statement Preparation...Ch. 9.B - Standard Cost Flows: Income Statement Preparation...Ch. 9.B - Standard Cost Flows Bowen Company manufactures one...Ch. 9.B - Standard Cost Flows Hartwell Company manufactures...Ch. 9.B - Transaction Analysis; Income Statement Preparation...Ch. 9.B - Transaction Analysis; Income Statement Preparation...Ch. 9 - What is a static planning budget?Ch. 9 - What is a flexible budget and how does it differ...Ch. 9 - What are some of the possible reasons that actual...Ch. 9 - Why is it difficult to interpret a difference...Ch. 9 - What is a revenue variance and what does it mean?Ch. 9 - What is a spending variance and what does it mean?Ch. 9 - What does a flexible budget enable that a simple...Ch. 9 - How does a flexibe budget based on the cost...Ch. 9 - Prob. 9QCh. 9 - Why are separate price and quantity variances...Ch. 9 - Who is generally responsible for the materials...Ch. 9 - Prob. 12QCh. 9 - Prob. 13QCh. 9 - Our workers are all under labor contracts:...Ch. 9 - Prob. 15QCh. 9 - Prob. 16QCh. 9 - Prob. 17QCh. 9 - The Excel worksheet form that appears below is to...Ch. 9 - Prob. 2AECh. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 2F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 4F15Ch. 9 - Prob. 5F15Ch. 9 - Prob. 6F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 8F15Ch. 9 - Prob. 9F15Ch. 9 - Prob. 10F15Ch. 9 - Prob. 11F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 13F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prepare a Flexible Budget Puget Sound Divers is a...Ch. 9 - Prepare a Report Shong Revenue and Spending...Ch. 9 - Prepare a Flexible Budget with More Than One Cost...Ch. 9 - Direct Materials Variances Bandar Industries...Ch. 9 - Prob. 5ECh. 9 - Prob. 6ECh. 9 - Planning Budget Lavage Rapide is a Canadian...Ch. 9 - EXERCISE 98 Flexible Budget L091 Refer to the data...Ch. 9 - Prepare a Report Showing Revenue and Spending...Ch. 9 - Direct Labor and Variable Manufacturing Overhead...Ch. 9 - Prob. 11ECh. 9 - Working with More Than One Cost Driver The...Ch. 9 - Direct Materials and Direct Labor Variances Huron...Ch. 9 - Direct Materials Variances Refer to the data in...Ch. 9 - Prob. 15ECh. 9 - Prob. 16ECh. 9 - Prob. 17ECh. 9 - Comprehensive Variance Analysis Miller Toy Company...Ch. 9 - More than One Cost Driver Milano Pizza is a small...Ch. 9 - Basic Variance Analysis: the Impact of Vanances on...Ch. 9 - Multiple Products. Materials, and Processes...Ch. 9 - Variance Analysis In a Hospital John Fleming,...Ch. 9 - Flexible Budgets and Spending Variances You have...Ch. 9 - Comprehensive Variance Analysis Marvel Parts....Ch. 9 - Direct Materials and Direct Labor Variances:...Ch. 9 - Comprehensive Variance Analysis Highland Company...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forwardCan you demonstrate the accurate steps for solving this financial accounting problem with valid procedures?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY