Concept explainers

Transaction Analysis; Income Statement Preparation

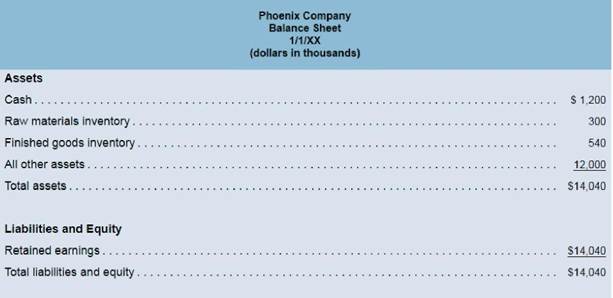

The company's

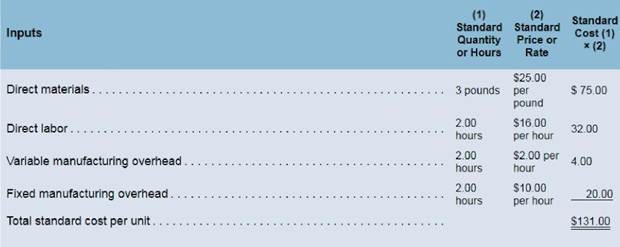

Phoenix Company manufactures only one product and uses a standard cost system. The company uses a plantwide predetermined

During the year Phoenix completed the following transactions:

a. Purchased (with cash) 460.000 pounds of raw material at a price of $26.50 per pound.

b. Added 430.000 pounds of raw material to work in process to produce 125.000 units.

c. Assigned direct labor costs to work in process. The direct laborers (who were paid in cash) worked 265.000

hours at an average cost of $1 5.00 per hour to manufacture 125.000 units.

d. e portion of the

predetermined overhead rate multiplied by the number of direct labor-hours allowed to manufacture 125.000

units. Actual variable

e. Applied fixed manufacturing overhead to work in process inventory using the fixed portion of the predetermined

overhead rate multiplied by the number of direct labor-hours allowed to manufacture 125,000 units. Actual fixed

manufacturing overhead costs for the year were $2,450,000. Of this total, $1,300,000 related to items such as

insurance, utilities, and salaried indirect laborers that were all paid in cash and $1, 150,000 related to

of equipment.

f Transferred 125.000 units from work in process to finished goods.

g. Sold (for cash) 123,000 units to customers at a price of $1 75 per unit.

h. Transferred the standard cost associated with the 123.000 units sold from finished goods to cost of goods sold.

i. Paid $3,300,000 of selling and administrative expenses.

j. Closed all standard cost variances to cost of goods sold.

Required:

- Compute all direct materials, direct labor, variable overhead, and fixed overhead variances for the year.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- Classify the following account: Prepaid Insurance – Asset, Liability, Equity, Revenue, or Expense? Need helparrow_forwardClassify the following account: Prepaid Insurance – Asset, Liability, Equity, Revenue, or Expense?arrow_forwardJournalize the following transaction: Purchased equipment worth $10,000, paying $4,000 in cash and the balance on credit.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,