Concept explainers

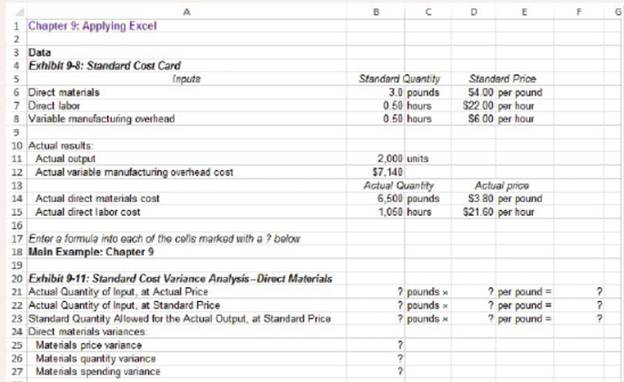

The Excel worksheet form that appears below is to be used to recreate the main example in the text related to the Colonial Pewter Company. Download the workbook containing this form from Connect, where you will also receive instructions about how to use this worksheet form.

You should proceed to the requirements below only after completing your worksheet.

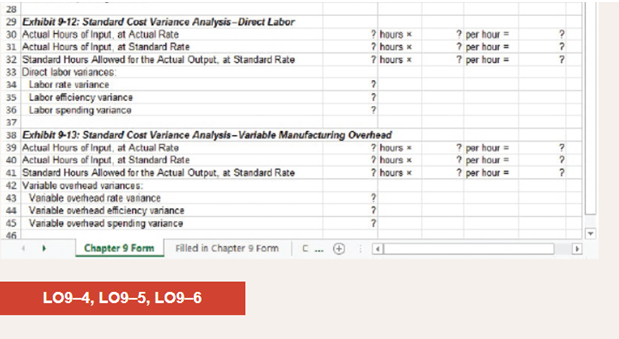

Check your worksheet by changing the direct materials standard quantity in cell B6 to 2.9 pounds, the direct labor quantity standard quantity in cell B7 to 0.6 hours. and the variable manufacturing

a. What is the materials quantity variance? Explain this variance.

b. What is the labor rate variance? Explain this variance.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- G Company budgets sales of $2,250,000, fixed costs of $62,900, and variable costs of $280,600. What is the contribution margin ratio for G Company?arrow_forwardCost account tutor solve thisarrow_forwardOwnership and profit distribution in a sole proprietorship are generally seen on its balance sheet, respectively, as: a. A personal capital account and dividends b. Common stock and dividends c. Common stock and withdrawals d. A personal capital account and withdrawalsarrow_forward

- If the contribution margin ratio for Vera Company is 28%, sales were $1,135,000, and fixed costs were $297,420, what was the income from operations? Right Answerarrow_forwardabc general accountingarrow_forwardIf the contribution margin ratio for Vera Company is 28%, sales were $1,135,000, and fixed costs were $297,420, what was the income from operations?arrow_forward

- Direct material 5000,direct labour 25000arrow_forwardCalculate the plantwide factory overhead ratearrow_forwardDuring FY 2020, Dorchester Company plans to sell Widgets for $14 a unit. Current variable costs are $6 a unit and fixed costs are expected to total $146,000. Use this information to determine the dollar value of sales for Dorchester to break even. (Round to the nearest whole dollar.)arrow_forward

- What is the pension expense for 2023?arrow_forwardNimbus Financial Services expects its accountants to work 30,000 direct labor hours per year. The company's estimated total indirect costs are $275,000. The direct labor rate is $80 per hour. The company uses direct labor hours as the allocation base for indirect costs. If Nimbus performs a job requiring 25 hours of direct labor, what is the total job cost? Answerarrow_forwardACCOUNTarrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning