Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 7.43P

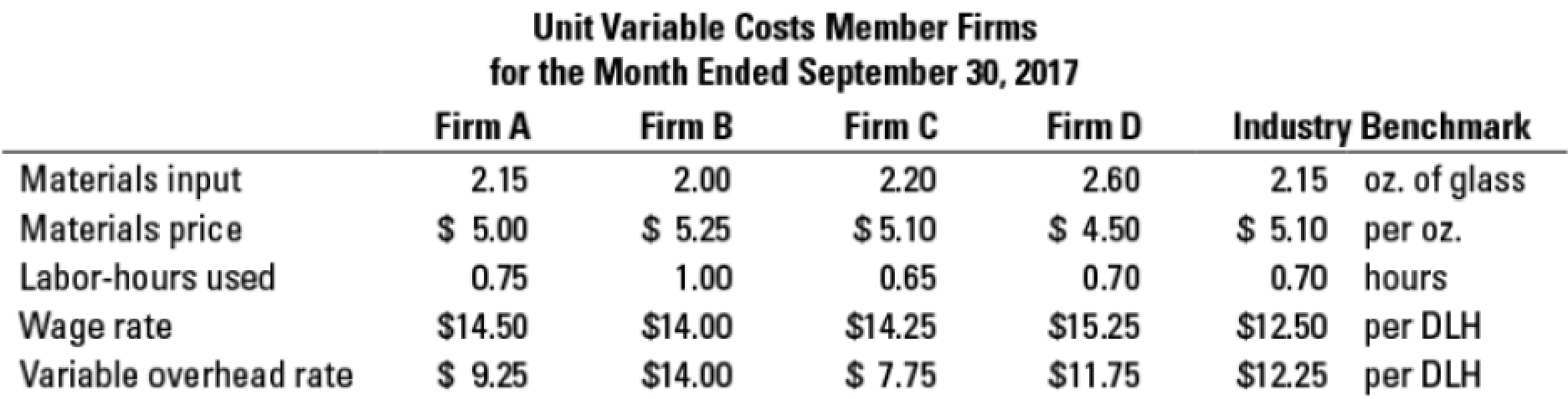

Use of materials and manufacturing labor variances for benchmarking. You are a new junior accountant at In Focus Corporation, maker of lenses for eyeglasses. Your company sells generic-quality lenses for a moderate price. Your boss, the controller, has given you the latest month’s report for the lens trade association. This report includes information related to operations for your firm and three of your competitors within the trade association. The report also includes information related to the industry benchmark for each line item in the report. You do not know which firm is which, except that you know you are Firm A.

- 1. Calculate the total variable cost per unit for each firm in the trade association. Compute the percent of total for the material, labor, and variable

overhead components. - 2. Using the trade association’s industry benchmark, calculate direct materials and direct manufacturing labor price and efficiency variances for the four firms. Calculate the percent over standard for each firm and each variance.

- 3. Write a brief memo to your boss outlining the advantages and disadvantages of belonging to this trade association for benchmarking purposes. Include a few ideas to improve productivity that you want your boss to take to the department heads’ meeting.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

hi expert please give me answer general accounting

Given the solution for accounting

General accounting question

Chapter 7 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 7 - What is the relationship between management by...Ch. 7 - What are two possible sources of information a...Ch. 7 - Distinguish between a favorable variance and an...Ch. 7 - What is the key difference between a static budget...Ch. 7 - Why might managers find a flexible-budget analysis...Ch. 7 - Describe the steps in developing a flexible...Ch. 7 - List four reasons for using standard costs.Ch. 7 - How might a manager gain insight into the causes...Ch. 7 - List three causes of a favorable direct materials...Ch. 7 - Describe three reasons for an unfavorable direct...

Ch. 7 - How does variance analysis help in continuous...Ch. 7 - Why might an analyst examining variances in the...Ch. 7 - Prob. 7.13QCh. 7 - When inputs are substitutable, how can the direct...Ch. 7 - Benchmarking against other companies enables a...Ch. 7 - Metal Shelf Companys standard cost for raw...Ch. 7 - All of the following statements regarding...Ch. 7 - Amalgamated Manipulation Manufacturings (AMM)...Ch. 7 - Atlantic Company has a manufacturing facility in...Ch. 7 - Basix Inc. calculates direct manufacturing labor...Ch. 7 - Flexible budget. Sweeney Enterprises manufactures...Ch. 7 - Flexible budget. Bryant Companys budgeted prices...Ch. 7 - Flexible-budget preparation and analysis. Bank...Ch. 7 - Flexible budget, working backward. The Clarkson...Ch. 7 - Flexible-budget and sales volume variances....Ch. 7 - Price and efficiency variances. Sunshine Foods...Ch. 7 - Materials and manufacturing labor variances....Ch. 7 - Direct materials and direct manufacturing labor...Ch. 7 - Price and efficiency variances, journal entries....Ch. 7 - Materials and manufacturing labor variances,...Ch. 7 - Journal entries and T-accounts (continuation of...Ch. 7 - Price and efficiency variances, benchmarking....Ch. 7 - Static and flexible budgets, service sector....Ch. 7 - Flexible budget, direct materials, and direct...Ch. 7 - Variance analysis, nonmanufacturing setting. Joyce...Ch. 7 - Comprehensive variance analysis review. Ellis...Ch. 7 - Possible causes for price and efficiency...Ch. 7 - Material-cost variances, use of variances for...Ch. 7 - Direct manufacturing labor and direct materials...Ch. 7 - Direct materials efficiency, mix, and yield...Ch. 7 - Direct materials and manufacturing labor...Ch. 7 - Direct materials and manufacturing labor...Ch. 7 - Use of materials and manufacturing labor variances...Ch. 7 - Direct manufacturing labor variances: price,...Ch. 7 - Direct-cost and selling price variances. MicroDisk...Ch. 7 - Variances in the service sector. Derek Wilson...Ch. 7 - Prob. 7.47P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with this problem and accountingarrow_forwardUsing the Hofstede Country Comparison ToolLinks to an external site., compare your nation to two other nations on Hofstede’s dimensions. Based on what you know about these national cultures and the cultural dimensions discussed in class, how do you interpret the accuracy of this information?arrow_forwardI need help with this solution for accountingarrow_forward

- Provide correct solution and accountingarrow_forwardYou want to buy a $259,000 home. You plan to pay 10% as a down payment and take out a 30- year loan for the rest. a) How much is the loan amount going to be? b) What will your monthly payments be if the interest rate is 5%? c) What will your monthly payments be if the interest rate is 6%?arrow_forwardI need help with solution accountingarrow_forward

- Please provide correct solution and accountingarrow_forwardMega Company believes the price of oil will increase in the coming months. Therefore, it decides to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X1, Mega purchases call options for 14,000 barrels of oil at $30 per barrel at a premium of $2 per barrel with a March 1, 20X2, call date. The following is the pricing information for the term of the call: Date Spot Price Futures Price (for March 1, 20X2, delivery) November 30, 20X1 $ 30 $ 31 December 31, 20X1 31 32 March 1, 20X2 33 The information for the change in the fair value of the options follows: Date Time Value Intrinsic Value Total Value November 30, 20X1 $ 28,000 $ –0– $ 28,000 December 31, 20X1 6,000 14,000 20,000 March 1, 20X2 42,000 42,000 On March 1, 20X2, Mega sells the options at their value on that date and acquires 14,000 barrels of oil at the spot price. On June 1, 20X2, Mega sells the…arrow_forwardTex Hardware sells many of its products overseas. The following are some selected transactions. Tex sold electronic subassemblies to a firm in Denmark for 120,000 Danish kroner (Dkr) on June 6, when the exchange rate was Dkr 1 = $0.1750. Collection was made on July 3 when the rate was Dkr 1 = $0.1753. On July 22, Tex sold copper fittings to a company in London for £35,000 with payment due on September 20. Also, on July 22, Tex entered into a 60-day forward contract to sell £35,000 at a forward rate of £1 = $1.630. The forward contract is not designated as a hedge. The spot rates follow: July 22 £1 = $1.580 September 20 £1 = $1.612 Tex sold storage devices to a Canadian firm for C$71,000 (Canadian dollars) on October 11, with payment due on November 10. On October 11, Tex entered into a 30-day forward contract to sell Canadian dollars at a forward rate of C$1 = $0.730. The forward contract is not designated as a hedge. The spot rates were as follows: October 11 C$1 =…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY