Concept explainers

Direct materials efficiency, mix, and yield variances. Sandy’s Snacks produces snack mixes for the gourmet and natural foods market. Its most popular product is Tempting Trail Mix, a mixture of peanuts, dried cranberries, and chocolate pieces. For each batch, the budgeted quantities and budgeted prices are as follows:

| Quantity per Batch | Price per Cup | |

| Peanuts | 60 cups | $1 |

| Dried cranberries | 30 cups | $2 |

| Chocolate pieces | 10 cups | $3 |

Small changes to the standard mix of direct materials reflected in the above quantities do not significantly affect the overall end product. In addition, not all ingredients added to production end up in the finished product, as some are rejected during inspection.

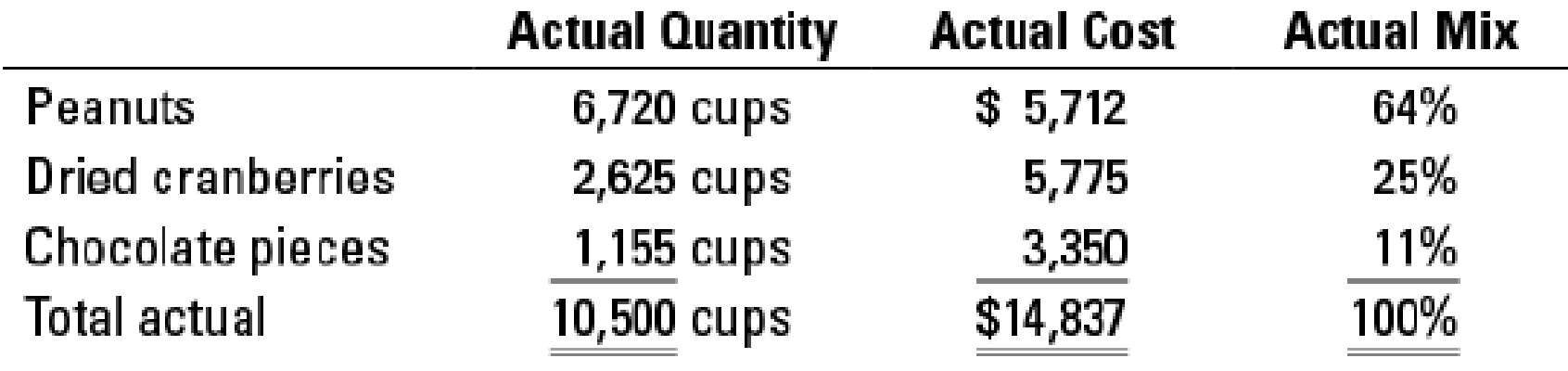

In the current period, Sandy’s Snacks made 100 batches of Tempting Trail Mix with the following actual quantity, cost, and mix of inputs:

- 1. What is the budgeted cost of direct materials for the 100 batches?

Required

- 2. Calculate the total direct materials efficiency variance.

- 3. Calculate the total direct materials mix and yield variances.

- 4. How do the variances calculated in requirement 3 relate to those calculated in requirement 2? What do the variances calculated in requirement 3 tell you about the 100 batches produced this period? Are the variances large enough to investigate?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- What is the cost of the delivery van ?arrow_forwardWhat is the volume of sales in units required to achieve the target profit? General accountingarrow_forwardSubject: Financial Accounting-The Banner Income Fund's average daily total assets were $100 million for the year just completed. Its stock purchases for the year were $20 million, while its sales were $12.5 million. What was its turnover?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning