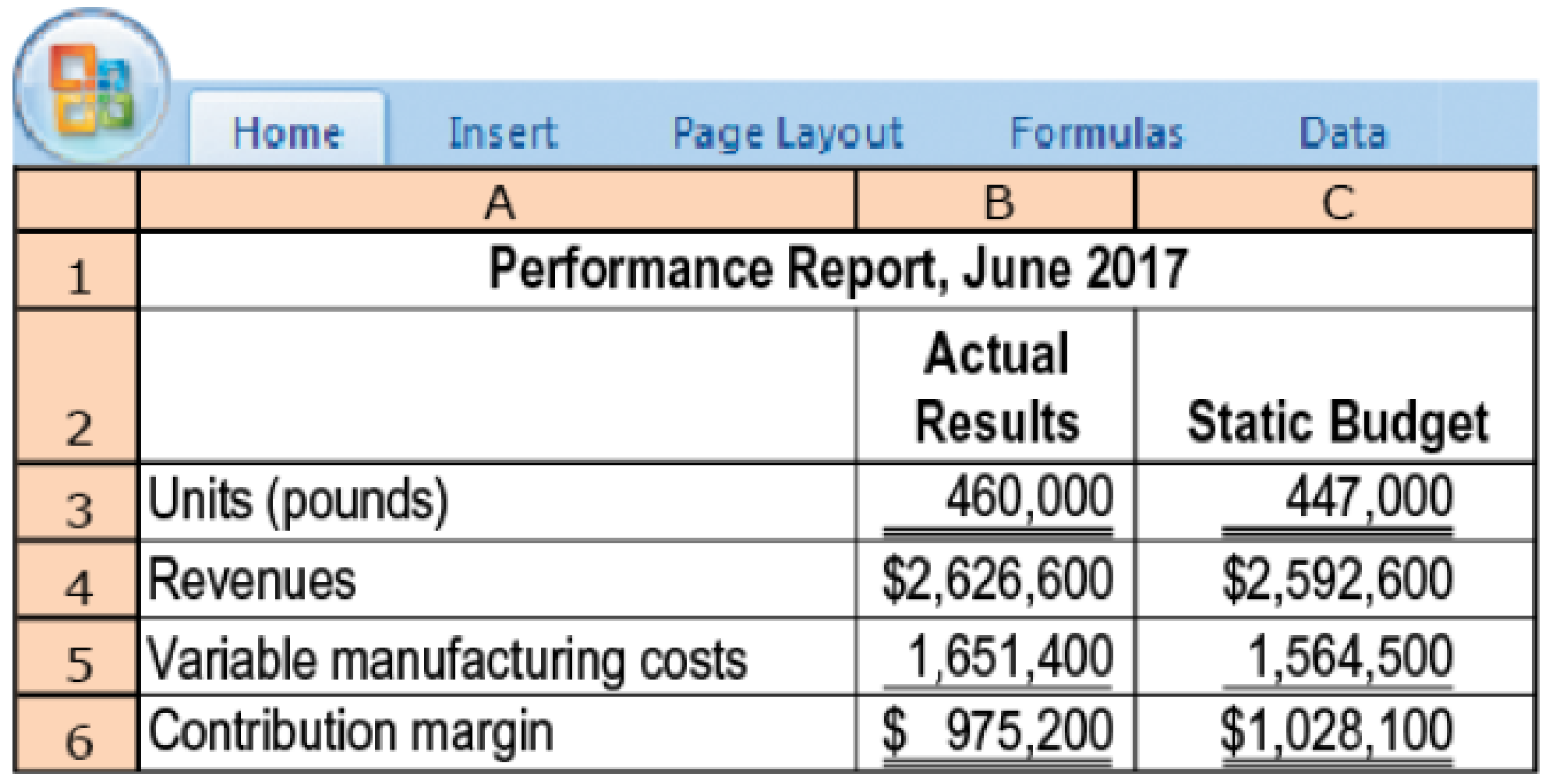

Flexible-budget and sales volume variances. Cascade, Inc., produces the basic fillings used in many popular frozen desserts and treats—vanilla and chocolate ice creams, puddings, meringues, and fudge. Cascade uses

Jeff Geller, the business manager for ice-cream products, is pleased that more pounds of ice cream were sold than budgeted and that revenues were up. Unfortunately, variable

- 1. Calculate the static-

budget variance in units, revenues, variable manufacturing costs, and contribution margin. What percentage is each static-budget variance relative to its static-budget amount? - 2. Break down each static-budget variance into a flexible-budget variance and a sales-volume variance.

- 3. Calculate the selling-price variance.

- 4. Assume the role of

management accountant at Cascade. How would you present the results to Jeff Geller? Should he be more concerned? If so, why?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Logan Enterprises purchased a forklift for $45,000 on January 1, 2018. The forklift has an expected salvage value of $2,500 and is expected to be used for 150,000 hours over its estimated useful life of 6 years. Actual usage was 17,500 hours in 2018 and 14,200 hours in 2019. Calculate depreciation expense per hour under the units-of-activity method. (Round the answer to 2 decimal places.)arrow_forwardGeneral accountingarrow_forwardCalculate depreciation expense per hour under the unit of activity method??arrow_forward

- What is the depreciation expense to be recorded on December 31, 2021 for this financial accounting question?arrow_forwardOriginal cost of fixed assets?arrow_forwardOn Jan 1, Year 1, White Co grants its three top employees, Mr. Blue, Ms. Orange, and Mrs. Green, 3,000 options each to purchase its $10-par common stock. Each option allows the purchase of 10 shares at $25 per share during Years 3 and 4. In order for these options to be exercisable, each of the top employees must demonstrate a high level of performance during years 1 and 2. The fair market value of these options was $90,000. At that grant date, Mr. Blue declined the offer. How much will White record for compensation expense each year for years 1 and 2?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning