Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 7.24E

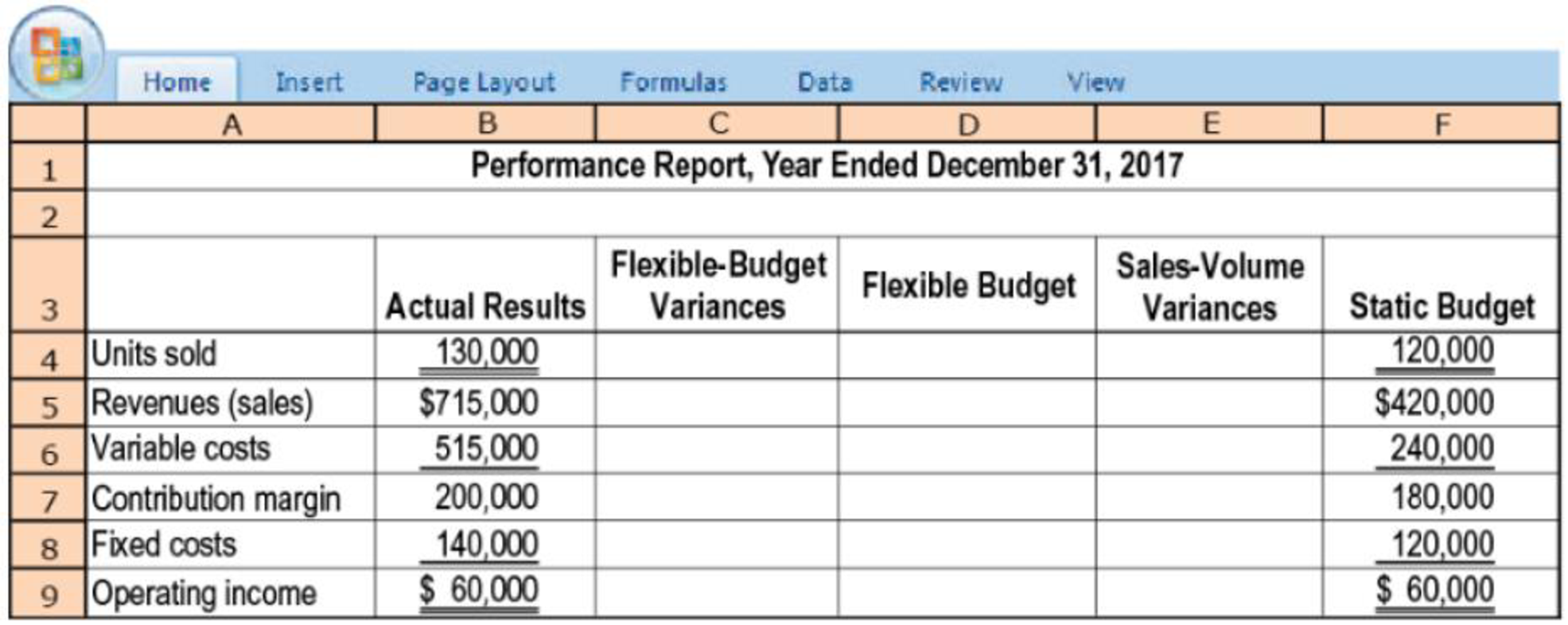

Flexible budget, working backward. The Clarkson Company produces engine parts for car manufacturers. A new accountant intern at Clarkson has accidentally deleted the company’s

- 1. Calculate all the required variances. (If your work is accurate, you will find that the total static-

budget variance is $0.)

Required

- 2. What are the actual and budgeted selling prices? What are the actual and budgeted variable costs per unit?

- 3. Review the variances you have calculated and discuss possible causes and potential problems. What is the important lesson learned here?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the correct option? General accounting question

Please see an attachment for details of this general accounting question

Answer

Chapter 7 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 7 - What is the relationship between management by...Ch. 7 - What are two possible sources of information a...Ch. 7 - Distinguish between a favorable variance and an...Ch. 7 - What is the key difference between a static budget...Ch. 7 - Why might managers find a flexible-budget analysis...Ch. 7 - Describe the steps in developing a flexible...Ch. 7 - List four reasons for using standard costs.Ch. 7 - How might a manager gain insight into the causes...Ch. 7 - List three causes of a favorable direct materials...Ch. 7 - Describe three reasons for an unfavorable direct...

Ch. 7 - How does variance analysis help in continuous...Ch. 7 - Why might an analyst examining variances in the...Ch. 7 - Prob. 7.13QCh. 7 - When inputs are substitutable, how can the direct...Ch. 7 - Benchmarking against other companies enables a...Ch. 7 - Metal Shelf Companys standard cost for raw...Ch. 7 - All of the following statements regarding...Ch. 7 - Amalgamated Manipulation Manufacturings (AMM)...Ch. 7 - Atlantic Company has a manufacturing facility in...Ch. 7 - Basix Inc. calculates direct manufacturing labor...Ch. 7 - Flexible budget. Sweeney Enterprises manufactures...Ch. 7 - Flexible budget. Bryant Companys budgeted prices...Ch. 7 - Flexible-budget preparation and analysis. Bank...Ch. 7 - Flexible budget, working backward. The Clarkson...Ch. 7 - Flexible-budget and sales volume variances....Ch. 7 - Price and efficiency variances. Sunshine Foods...Ch. 7 - Materials and manufacturing labor variances....Ch. 7 - Direct materials and direct manufacturing labor...Ch. 7 - Price and efficiency variances, journal entries....Ch. 7 - Materials and manufacturing labor variances,...Ch. 7 - Journal entries and T-accounts (continuation of...Ch. 7 - Price and efficiency variances, benchmarking....Ch. 7 - Static and flexible budgets, service sector....Ch. 7 - Flexible budget, direct materials, and direct...Ch. 7 - Variance analysis, nonmanufacturing setting. Joyce...Ch. 7 - Comprehensive variance analysis review. Ellis...Ch. 7 - Possible causes for price and efficiency...Ch. 7 - Material-cost variances, use of variances for...Ch. 7 - Direct manufacturing labor and direct materials...Ch. 7 - Direct materials efficiency, mix, and yield...Ch. 7 - Direct materials and manufacturing labor...Ch. 7 - Direct materials and manufacturing labor...Ch. 7 - Use of materials and manufacturing labor variances...Ch. 7 - Direct manufacturing labor variances: price,...Ch. 7 - Direct-cost and selling price variances. MicroDisk...Ch. 7 - Variances in the service sector. Derek Wilson...Ch. 7 - Prob. 7.47P

Additional Business Textbook Solutions

Find more solutions based on key concepts

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

CHAPTER CASE

S&S Air’s Mortgage

Mark Sexton and Todd Story, the owners of S&S Air, Inc., were impressed by the ...

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

(Interest rate determination) You’re looking at some corporate bonds issued by Ford, and you are trying to det...

Foundations Of Finance

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ??arrow_forwardChoose the correct optionarrow_forwardagree of disagree with this paragraph Accounting is the information system that identifies, records, and communicates the economic events of an organization to invested users. The Securities and Exchange Commission (SEC), oversees U.S. financial markets and accounting standard-setting bodies, whereas the Financial Accounting Standards Board (FASB) is the primary accounting standard-setting body in the United States. These two utilize a conceptual framework that serves as a basis for future accounting standards. Its primary objective is financial reporting to investors that is useful to its creditors for making decisions about providing capital. The AICPA actually sets professional standards for the accountants, the FASB develops GAAP or generally accepted accounting practices by creating standards the SEC enforces public companies to follow, and essentially oversees the overall compliance of financial reporting for all public traded companies like Google, Apple, and Microsoft for…arrow_forward

- Don't want wrong answerarrow_forwardGeneral Accounting Reasoning Problem : Desert Sun Solar panels have a base output of 300 watts, but their efficiency is affected by temperature and dust. The temperature causes a loss of 0.5% per degree Celsius above 25°C, and dust reduces efficiency by 3% per week since the last cleaning. Calculate the output of the solar panel after 3 weeks at 35°C, considering both the temperature and dust reduction effects. a) 269.35 b) 249.35 c) 259.35 d) 239.35arrow_forward4 POINTSarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY