Concept explainers

( Appendices 6A and 6B) Inventory Costing Methods

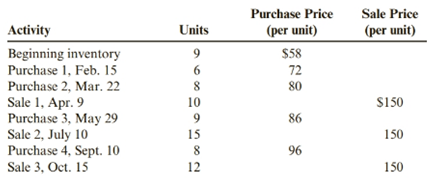

Edwards Company began operations in February 2019. Edwards accounting records provide the following data for the remainder of 2019 for one of the items the company sells:

Edwards uses a periodic inventory system. All purchases and sales were for cash.

Required:

1. Compute cost of goods sold and the cost of ending inventory using FIFO.

2. Compute cost of goods sold and the cost of ending inventory using LIFO.

3. Compute cost of goods sold and the cost of ending inventory using the average cost method. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)

4. Prepare the

5. CONCEPTUAL CONNECTION Which method would result in the lowest amount paid for taxes?

6. CONCEPTUAL CONNECTION Refer to Problem 6-67B and compare your results. What are the differences? Be sure to explain why the differences occurred.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Cornerstones of Financial Accounting

- A pet store sells a pet waste disposal system for $60 each. The cost per unit, including the system and enzyme digester, is $42.50. What is the contribution margin per unit? A. $15.00 B. $17.50 C. $12.25 D. $19.00arrow_forwardNarchie sells a single product for $40. Variable costs are 80% of the selling price, and the company has fixed costs that amount to $152,000. Current sales total 16,000 units. What is the break-even point in units?arrow_forwardA company sells 32,000 units at $25 per unit. The variable cost per unit is $20.50, and fixed costs are $52,000. (a) Determine the contribution margin ratio. (b) Determine the unit contribution margin. (c) Determine the income from operations.arrow_forward

- hello tutor provide solutionarrow_forwardGerry Co. has a gross profit of $990,000 and $290,000 in depreciation expenses. Selling and administrative expense is $129,000. Given that the tax rate is 37%, compute the cash flow for Gerry Co. a. $700,000 b. $128,963 c. $649,730 d. $652,230arrow_forwardProvide correct answer this financial accounting questionarrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College