Concept explainers

Inventory Costing Methods

On June 1, Welding Products Company had a beginning inventory of 210 cases of welding rods that had been purchased for S88 per case. Welding Products purchased 1,150 cases at a cost of

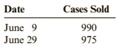

$95 per case on June 3. On June 19, the company purchased another 950 cases at a cost of $112 per case. Sales data for the welding rods are:

Welding Products uses a perpetual inventory system, and the sales price of the welding rods was $130 per case.

Required:

1. Compute the cost of ending inventory and cost of goods sold using the FIFO method.

2. Compute the cost of ending inventory and cost of goods sold using the LIFO method.

3. Compute the cost of ending inventory and cost of goods sold using the average cost method.

( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)

4. CONCEPTUAL CONNECTION Assume that operating expenses are $21,600 and Welding

Products has a 30% tax rate. How much will the cash paid for income taxes differ among the three inventory methods?

5. CONCEPTUAL CONNECTION Compute Welding Products' gross profit ratio (rounded to two decimal places) and inventory turnover ratio (rounded to three decimal places) under each of the three inventory costing methods. How would the choice of inventory costing method affect these ratios?

(a)

Inventory costing methods:

FIFO, LIFO and average cost method, are those method which used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the FIFO.

Answer to Problem 51E

| Particular | |

| Cost of goods sold | |

| Closing inventory value |

Explanation of Solution

The given information is as follows:

Total available units are:

Calculation of Closing Inventory as per FIFO Method:

Under this method, which material purchased first, issued first for production. However closing inventory includes last purchased materials in stock. Due to latest purchase in closing inventory, higher value of latest purchase effects cost of goods sold as lower and profit margin will be high.

| Closing inventory | Cost of Goods sold | |

| Total |

(b)

Inventory costing methods:

FIFO, LIFO and average cost method, are those method which used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the LIFO.

Answer to Problem 51E

| Particular | |

| Cost of goods sold | |

| Closing inventory value |

Explanation of Solution

The given information is as follows:

The given information is as follows:

Total available units are:

Calculation of closing inventory as per LIFO Method:

Under this method, which material purchased last, issued first for production. However closing inventory includes earliest purchased material in stock. Due to earliest purchase material in stock, lower value of earliest purchased effects cost of goods sold as high and profit margin will be lower.

| Ending Inventory | Cost of Goods sold | |

| Total |

(c)

Inventory costing methods:

FIFO, LIFO and average cost method, are those method which used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the average cost method.

Answer to Problem 51E

| Particular | |

| Cost of goods sold | |

| Closing inventory value |

Explanation of Solution

The given information is as follows:

The given information is as follows:

Total available units are:

Calculation of closing inventory as per weighted average method:

Under this method, average cost per unit of inventory is calculated and closing inventory value is to be calculated on that basis. Average cost of inventory is changed on purchase high or low. However we follow indirect method of average cost to calculate closing inventory.

As the fist two sales are done only from two purchases and beginning inventory and the third sale is done including all purchases. Hence, there will requirement of two average cost for computing the cost of goods sold.

| Closing inventory | Cost of Goods sold | |

| Total |

(d)

Inventory costing methods:

FIFO, LIFO and average cost method, are those method which used for calculation of closing inventory and cost of goods sold.

The cash paid for income as per three inventory costing methods.

Answer to Problem 51E

| FIFO |

LIFO |

Average Cost |

|

| Profit/ Loss before tax | |||

| Income Tax Expense | |||

| Net Income |

Explanation of Solution

The available information by calculating in the above parts as:

| Particular | |||

| Cost of goods sold | |||

| Closing inventory value |

The computation of income before taxes, income tax expenses and net income as per three inventory costing methods are:

| FIFO |

LIFO |

Average Cost |

|

| Sales | |||

| Less: COGS | |||

| Gross Profit | |||

| Less: Operating Expenses | |||

| Profit/ Loss before tax | |||

| Less: Income Tax |

|||

| Net Income |

The lowest cash paid for income is in LIFO method.

(e)

Gross profit margin ratio:

The gross margin ratio is a type of profitability ratio which is used to measure the returns and earning after direct expenses and compute the ratio in respect to the sales of the business.

Inventory Turnover ratio:

The ratio which measures the efficiency of the company in managing their inventory by diving the cost of goods sold by the average inventory.

The gross margin ratio and inventory turnover ratio.

Answer to Problem 51E

| Particulars | FIFO | LIFO | Average Cost |

| Gross Profit Ratio | |||

| Inventory Turnover Ratio |

Explanation of Solution

The available information by calculating in the above parts as:

| Particular | |||

| Cost of goods sold | |||

| Closing inventory value |

The formula for computing the gross profit margin is:

The formula for computing inventory turnover ratio is:

| Particulars | FIFO | LIFO | Average Cost |

| Sales |

|||

| Less: Cost of goods sold |

|||

| Gross Profit |

|||

| Opening Inventory |

|||

| Closing Inventory |

|||

| Average Inventory |

|||

| Gross Profit Ratio |

|||

| Inventory Turnover Ratio |

By analyzing the above table, it can be said that FIFO has the highest gross margin ratio and LIFO has the highest inventory turnover ratio.

Want to see more full solutions like this?

Chapter 6 Solutions

Cornerstones of Financial Accounting

- I need help solving this financial accounting question with the proper methodology.arrow_forward18. Inventory shrinkage is recorded as:A. Increase in revenueB. Decrease in liabilitiesC. Inventory loss expenseD. Owner withdrawalarrow_forward19. What does a classified balance sheet show?A. Net cash from operationsB. Revenue by categoryC. Assets and liabilities in current and long-term sectionsD. Owners' drawings helparrow_forward

- I am trying to find the accurate solution to this financial accounting problem with the correct explanation.arrow_forward19. What does a classified balance sheet show?A. Net cash from operationsB. Revenue by categoryC. Assets and liabilities in current and long-term sectionsD. Owners' drawingsarrow_forwardPlease explain the correct approach for solving this financial accounting question.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,