Effects of an Inventory Error

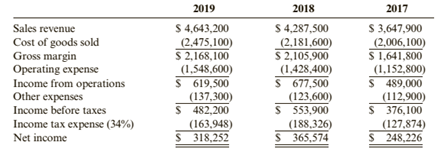

The income statements for Graul Corporation for the 3 years ending in 2019 appear below.

During 2019, Graul discovered that the 2017 ending inventory had been misstated due to the following two transactions being recorded incorrectly.

a. A purchase return of inventory costing $42,000 was recorded twice.

b. A credit purchase of inventory' made on December 20 for $28,500 was not recorded. The goods were shipped F.O.B. shipping point and were shipped on December 22, 2017.

Required:

1. Was ending inventory for 2017 overstated or understated? By how much?

2. Prepare correct income statements for all 3 years.

3. CONCEPTUAL CONNECTION Did the error in 2017 affect cumulative net income for the 3-year period? Explain your response.

4. CONCEPTUAL CONNECTION Why was the 2019 net income unaffected?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Cornerstones of Financial Accounting

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning