Concept explainers

Effects of Inventory Costing Methods

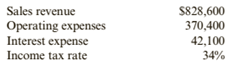

Jefferson Enterprises has the following income statement data available for 2019:

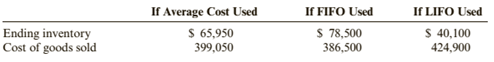

Jefferson uses a perpetual inventory accounting system and the average cost method. Jefferson is considering adopting the FIFO or LIFO method for costing inventory. Jefferson’s accountant prepared the following data:

Required:

1. Compute income before taxes, income taxes expense, and net income for each of the three inventory costing methods. (Round to the nearest dollar.)

2. CONCEPTUAL CONNECTION Why are the cost of goods sold and ending inventory amounts different for each of the three methods? What do these amounts tell us about the purchase price of inventory during the year?

3. CONCEPTUAL CONNECTION Which method produces the most realistic amount for net income? For inventory? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Cornerstones of Financial Accounting

- How do composite measurement systems enhance traditional accounting metrics? a) Composite views create confusion b) Single measures always suffice alone c) Traditional metrics need no enhancement d) Multiple measurement bases combine to provide comprehensive insights. Give me answerarrow_forwardgive me answer of this General accounting questionarrow_forwardprovide correct answer subject accountarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage