Warranty expense

• LO20–4

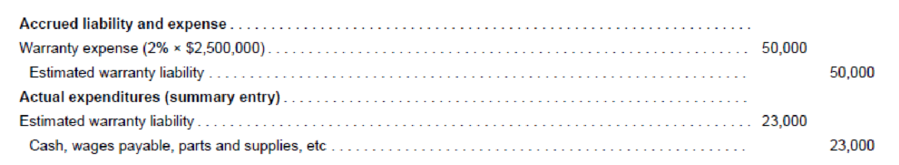

Woodmier Lawn Products introduced a new line of commercial sprinklers in 2017 that carry a one-year warranty against manufacturer’s defects. Because this was the first product for which the company offered a warranty, trade publications were consulted to determine the experience of others in the industry. Based on that experience, warranty costs were expected to approximate 2% of sales. Sales of the sprinklers in 2017 were $2,500,000. Accordingly, the following entries relating to the contingency for warranty costs were recorded during the first year of selling the product:

In late 2018, the company’s claims experience was evaluated and it was determined that claims were far more than expected—3% of sales rather than 2%.

Required:

1. Assuming sales of the sprinklers in 2018 were $3,600,000 and warranty expenditures in 2018 totaled $88,000, prepare any

2. Assuming sales of the sprinklers were discontinued after 2017, prepare any journal entries in 2018 related to the warranty.

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Intermediate Accounting

- Cariveh Co sells automotive supplies from 25 different locations in one country. Each branch has up to 30 staff working there, although most of the accounting systems are designed and implemented from the company's head office. All accounting systems, apart from petty cash, are computerised, with the internal audit department frequently advising and implementing controls within those systems. Cariveh has an internal audit department of six staff, all of whom have been employed at Cariveh for a minimum of five years and some for as long as 15 years. In the past, the chief internal auditor appoints staff within the internal audit department, although the chief executive officer (CEO) is responsible for appointing the chief internal auditor. The chief internal auditor reports directly to the finance director. The finance director also assists the chief internal auditor in deciding on the scope of work of the internal audit department. You are an audit manager in the internal audit…arrow_forwardProvide solution of this all Question please Financial Accountingarrow_forwardDon't Use AIarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning