Intermediate Accounting

9th Edition

ISBN: 9781259722660

Author: J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 20, Problem 20.24E

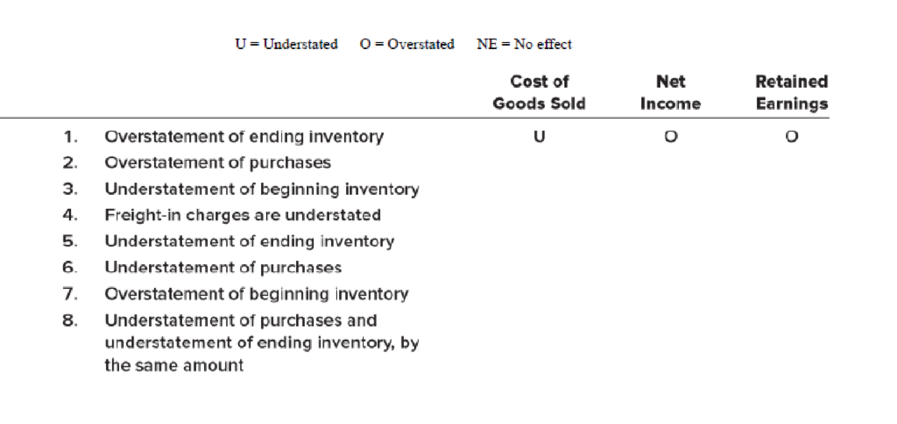

Inventory errors

• LO20–6

Indicate with the appropriate letter the nature of each adjustment described below:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide the answer to this general accounting question with proper steps.

Please help me solve this general accounting question using the right accounting principles.

Can you solve this general accounting problem using accurate calculation methods?

Chapter 20 Solutions

Intermediate Accounting

Ch. 20 - Prob. 20.1QCh. 20 - There are three basic accounting approaches to...Ch. 20 - Prob. 20.3QCh. 20 - Lynch Corporation changes from the...Ch. 20 - Sugarbaker Designs Inc. changed from the FIFO...Ch. 20 - Most changes in accounting principles are recorded...Ch. 20 - Southeast Steel, Inc., changed from the FIFO...Ch. 20 - Prob. 20.8QCh. 20 - Its not easy sometimes to distinguish between a...Ch. 20 - For financial reporting, a reporting entity can be...

Ch. 20 - Prob. 20.11QCh. 20 - Describe the process of correcting an error when...Ch. 20 - Prob. 20.13QCh. 20 - If it is discovered that an extraordinary repair...Ch. 20 - Prob. 20.15QCh. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in inventory methods; average cost method...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in depreciation methods LO203 Irwin, Inc.,...Ch. 20 - Prob. 20.5BECh. 20 - Book royalties LO204 Three programmers at Feenix...Ch. 20 - Warranty expense LO204 In 2017, Quapau Products...Ch. 20 - Change in estimate; useful life of patent LO204...Ch. 20 - Prob. 20.9BECh. 20 - Error correction LO206 In 2018, internal auditors...Ch. 20 - Prob. 20.11BECh. 20 - Error correction LO206 In 2018, the internal...Ch. 20 - Change in principle; change in inventory methods ...Ch. 20 - Change in principle; change in inventory methods ...Ch. 20 - Change from the treasury stock method to retired...Ch. 20 - Change in principle; change to the equity method ...Ch. 20 - Prob. 20.5ECh. 20 - FASB codification research LO202 Access the FASB...Ch. 20 - Change in principle; change in inventory cost...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in depreciation methods LO203 For...Ch. 20 - Change in depreciation methods LO203 The Canliss...Ch. 20 - Book royalties LO204 Dreighton Engineering Group...Ch. 20 - Loss contingency LO204 The Commonwealth of...Ch. 20 - Warranty expense LO204 Woodmier Lawn Products...Ch. 20 - Prob. 20.15ECh. 20 - Accounting change LO204 The Peridot Company...Ch. 20 - Change in estimate; useful life and residual value...Ch. 20 - Classifying accounting changes LO201 through...Ch. 20 - Error correction; inventory error LO206 During...Ch. 20 - Error corrections; investment LO206 Required: 1....Ch. 20 - Prob. 20.21ECh. 20 - Prob. 20.22ECh. 20 - Prob. 20.23ECh. 20 - Inventory errors LO206 Indicate with the...Ch. 20 - Classifying accounting changes and errors LO201...Ch. 20 - Change in inventory costing methods; comparative...Ch. 20 - P 20-2 Change in principle; change in method of...Ch. 20 - Change in inventory costing methods; comparative...Ch. 20 - Change in inventory methods LO202 The Rockwell...Ch. 20 - Change in inventory methods LO202 Fantasy...Ch. 20 - Change in principle; change in depreciation...Ch. 20 - Depletion; change in estimate LO204 In 2018, the...Ch. 20 - Accounting changes; six situations LO201, LO203,...Ch. 20 - Prob. 20.9PCh. 20 - Inventory errors LO206 You have been hired as the...Ch. 20 - Error correction; change in depreciation method ...Ch. 20 - Accounting changes and error correction; seven...Ch. 20 - Prob. 20.13PCh. 20 - Prob. 20.14PCh. 20 - Prob. 20.15PCh. 20 - Prob. 20.16PCh. 20 - Prob. 20.17PCh. 20 - Integrating Case 201 Change to dollar-value LIFO ...Ch. 20 - Prob. 20.2BYPCh. 20 - Prob. 20.3BYPCh. 20 - Analysis Case 204 Change in inventory methods;...Ch. 20 - Prob. 20.5BYPCh. 20 - Prob. 20.6BYPCh. 20 - Analysis Case 208 Various changes LO201 through...Ch. 20 - Analysis Case 209 Various changes LO201 through...Ch. 20 - Prob. 20.10BYPCh. 20 - Prob. 20.11BYPCh. 20 - Prob. 20.12BYPCh. 20 - Prob. 1CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cost of Production Report The debits to Work in Process-Roasting Department for Morning Brew Coffee Company for August, together with Information concerning production, are as follows: Work in process, August 1, 700 pounds, 10% completed *Direct materials (700 x $2.60) Conversion (700 x 10% x $1.00) Coffee beans added during August, 22,000 pounds Conversion costs during August Work in process, August 31, 1,100 pounds, 40% completed Goods finished during August, 21,600 pounds < All direct materials are placed in process at the beginning of production. $1,890* $1,820 70 $1,890 56,100 24,167 ? ? a. Prepare a cost of production report, presenting the following computations: 1. Direct materials and conversion equivalent units of production for August 2. Direct materials and conversion costs per equivalent unit for August 3. Cost of goods finished during August 4. Cost of work in process at August 31 If an amount is zero, enter in "0". For the cost per equivalent unit, round your answer to…arrow_forwardPlease provide the answer to this financial accounting question using the right approach.arrow_forwardPlease help me solve this financial accounting problem with the correct financial process.arrow_forward

- V The debits to Work In Process-Roasting Department for Morning Brew Coffee Company for August, together with Information concerning production, are as follows: Work in process, August 1, 700 pounds, 10% completed *Direct materials (700 x $2.60) Conversion (700 x 10% x $1.00) Coffee beans added during August, 22,000 pounds Conversion costs during August Work in process, August 31, 1,100 pounds, 40% completed Goods finished during August, 21,600 pounds All direct materials are placed in process at the beginning of production. a. Prepare a cost of production report, presenting the following computations: 1. Direct materials and conversion equivalent units of production for August 2. Direct materials and conversion costs per equivalent unit for August 3. Cost of goods finished during August 4. Cost of work in process at August 31 $1,890* $1,820 70 $1,890 56,100 24,167 ? ? If an amount is zero, enter in "0". For the cost per equivalent unit, round your answer to the near st cent. Morning…arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardPlease help me solve this financial accounting problem with the correct financial process.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Accounting Information Systems

Finance

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

INVENTORY & COST OF GOODS SOLD; Author: Accounting Stuff;https://www.youtube.com/watch?v=OB6RDzqvNbk;License: Standard Youtube License