Concept explainers

Change in inventory methods

• LO20–2

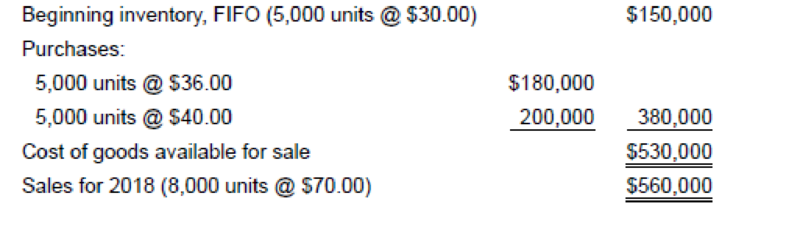

The Rockwell Corporation uses a periodic inventory system and has used the FIFO cost method since inception of the company in 1979. In 2018, the company decided to change to the average cost method. Data for 2018 are as follows:

Additional Information:

1. The company’s effective income tax rate is 40% for all years.

2. If the company had used the average cost method prior to 2018, ending inventory for 2017 would have been $130,000.

3. 7,000 units remained in inventory at the end of 2018.

Required:

1. Prepare the

2. In the 2018–2016 comparative financial statements, what will be the amounts of cost of goods sold and inventory reported for 2018?

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Intermediate Accounting

- Provide correct answer this general accounting questionarrow_forwardKenzo Distribution updates its inventory perpetually. Its beginning inventory is $62,000, goods purchased during the period cost $178,000, and the cost of goods sold for the period is $195,000. What is the amount of the ending inventory?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

- Please show me the correct approach to solving this financial accounting question with proper techniques.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardBansai, age 66, retires and receives a $1,450 per month annuity from his employer's qualified pension plan. Bansai made $87,600 of after-tax contributions to the plan before retirement. Under the simplified method, Bansai's number of anticipated payments is 240. What is the amount includible in income in the first year of withdrawals assuming 12 monthly payments? A. $10,560 B. $13,020 C. $17,400 D. $8,220arrow_forward

- Please provide the correct answer to this financial accounting problem using accurate calculations.arrow_forwardCan you demonstrate the accurate method for solving this financial accounting question?arrow_forwardPlease help me solve this financial accounting question using the right financial principles.arrow_forward

- I need help with this general accounting question using standard accounting techniques.arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forwardMidori Hardware uses the perpetual inventory system. At the beginning of the quarter, Midori Hardware has $56,000 in inventory. During the quarter, the company purchased $12,500 of new inventory from a vendor, returned $2,200 of inventory to the vendor, and took advantage of discounts from the vendor of $600. At the end of the quarter, the balance in inventory is $48,300. What is the cost of goods sold? i. $16,900 ii. $17,400 iii. $18,200 iv. $19,500 v. $15,800arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning