Change in principle; change in

• LO20–3

During 2016 and 2017, Faulkner Manufacturing used the sum-of-the-years’-digits (SYD) method of depreciation for its depreciable assets, for both financial reporting and tax purposes. At the beginning of 2018, Faulkner decided to change to the straight-line method for both financial reporting and tax purposes. A tax rate of 40% is in effect for all years.

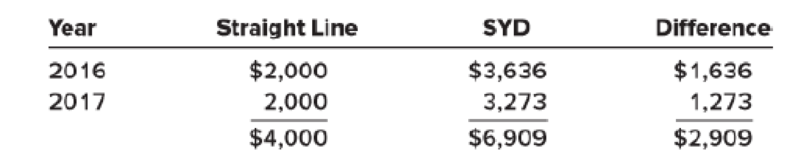

For an asset that cost $21,000 with an estimated residual value of $1,000 and an estimated useful life of 10 years, the depreciation under different methods is as follows:

Required:

1. Describe the way Faulkner should account for the change described. Include in your answer any

2. Suppose instead that Faulkner previously used straight-line depreciation and changed to sum-of-the-years’-digits in 2018. Describe the way Faulkner should account for the change. Include in your answer any journal entry Faulkner will record in 2018 related to the change and any required note disclosures.

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Intermediate Accounting

- Please help me solve this financial accounting question using the right financial principles.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardA business has accounts receivable of $180,000, an allowance for doubtful accounts balance of $7,200, and estimates that 5% of outstanding receivables will be uncollectible. What is the required adjustment to the allowance for doubtful accounts?arrow_forward

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardMeridian Corporation started the year with total assets of $480,000 and total liabilities of $215,000. During the year the business recorded $425,000 in revenues, $240,000 in expenses, and dividends of $75,000. Stockholders' equity at the end of the year was____.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT