Intermediate Accounting

9th Edition

ISBN: 9781259722660

Author: J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 20.1E

Change in principle; change in inventory methods

• LO20–2

During 2016 (its first year of operations) and 2017, Batali Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2018, Batali decided to change to the average method for both financial reporting and tax purposes.

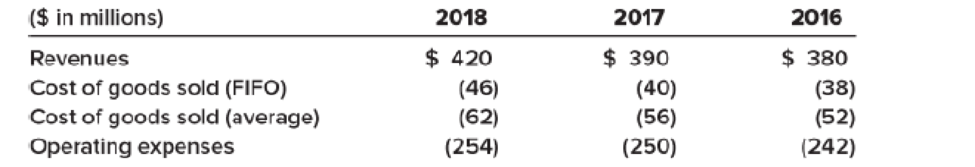

Income components before income tax for 2018, 2017, and 2016 were as follows:

Dividends of $20 million were paid each year. Batali’s fiscal year ends December 31.

Required:

- 1. Prepare the

journal entry at the beginning of 2018 to record the change in accounting principle. (Ignore income taxes.) - 2. Prepare the 2018–2017 comparative income statements.

- 3. Determine the balance in

retained earnings at January 1, 2017, as Batali reported previously using the FIFO method. - 4. Determine the adjustment to the January 1, 2017, balance in retained earnings that Batali would include in the 2018–2017 comparative statements of retained earnings or retained earnings column of the statements of shareholders’ equity to revise it to the amount it would have been if Batali had used the average method.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

No AI

4. If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assets

Need help !

4. If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assets

4. If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assets

Chapter 20 Solutions

Intermediate Accounting

Ch. 20 - Prob. 20.1QCh. 20 - There are three basic accounting approaches to...Ch. 20 - Prob. 20.3QCh. 20 - Lynch Corporation changes from the...Ch. 20 - Sugarbaker Designs Inc. changed from the FIFO...Ch. 20 - Most changes in accounting principles are recorded...Ch. 20 - Southeast Steel, Inc., changed from the FIFO...Ch. 20 - Prob. 20.8QCh. 20 - Its not easy sometimes to distinguish between a...Ch. 20 - For financial reporting, a reporting entity can be...

Ch. 20 - Prob. 20.11QCh. 20 - Describe the process of correcting an error when...Ch. 20 - Prob. 20.13QCh. 20 - If it is discovered that an extraordinary repair...Ch. 20 - Prob. 20.15QCh. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in inventory methods; average cost method...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in depreciation methods LO203 Irwin, Inc.,...Ch. 20 - Prob. 20.5BECh. 20 - Book royalties LO204 Three programmers at Feenix...Ch. 20 - Warranty expense LO204 In 2017, Quapau Products...Ch. 20 - Change in estimate; useful life of patent LO204...Ch. 20 - Prob. 20.9BECh. 20 - Error correction LO206 In 2018, internal auditors...Ch. 20 - Prob. 20.11BECh. 20 - Error correction LO206 In 2018, the internal...Ch. 20 - Change in principle; change in inventory methods ...Ch. 20 - Change in principle; change in inventory methods ...Ch. 20 - Change from the treasury stock method to retired...Ch. 20 - Change in principle; change to the equity method ...Ch. 20 - Prob. 20.5ECh. 20 - FASB codification research LO202 Access the FASB...Ch. 20 - Change in principle; change in inventory cost...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in depreciation methods LO203 For...Ch. 20 - Change in depreciation methods LO203 The Canliss...Ch. 20 - Book royalties LO204 Dreighton Engineering Group...Ch. 20 - Loss contingency LO204 The Commonwealth of...Ch. 20 - Warranty expense LO204 Woodmier Lawn Products...Ch. 20 - Prob. 20.15ECh. 20 - Accounting change LO204 The Peridot Company...Ch. 20 - Change in estimate; useful life and residual value...Ch. 20 - Classifying accounting changes LO201 through...Ch. 20 - Error correction; inventory error LO206 During...Ch. 20 - Error corrections; investment LO206 Required: 1....Ch. 20 - Prob. 20.21ECh. 20 - Prob. 20.22ECh. 20 - Prob. 20.23ECh. 20 - Inventory errors LO206 Indicate with the...Ch. 20 - Classifying accounting changes and errors LO201...Ch. 20 - Change in inventory costing methods; comparative...Ch. 20 - P 20-2 Change in principle; change in method of...Ch. 20 - Change in inventory costing methods; comparative...Ch. 20 - Change in inventory methods LO202 The Rockwell...Ch. 20 - Change in inventory methods LO202 Fantasy...Ch. 20 - Change in principle; change in depreciation...Ch. 20 - Depletion; change in estimate LO204 In 2018, the...Ch. 20 - Accounting changes; six situations LO201, LO203,...Ch. 20 - Prob. 20.9PCh. 20 - Inventory errors LO206 You have been hired as the...Ch. 20 - Error correction; change in depreciation method ...Ch. 20 - Accounting changes and error correction; seven...Ch. 20 - Prob. 20.13PCh. 20 - Prob. 20.14PCh. 20 - Prob. 20.15PCh. 20 - Prob. 20.16PCh. 20 - Prob. 20.17PCh. 20 - Integrating Case 201 Change to dollar-value LIFO ...Ch. 20 - Prob. 20.2BYPCh. 20 - Prob. 20.3BYPCh. 20 - Analysis Case 204 Change in inventory methods;...Ch. 20 - Prob. 20.5BYPCh. 20 - Prob. 20.6BYPCh. 20 - Analysis Case 208 Various changes LO201 through...Ch. 20 - Analysis Case 209 Various changes LO201 through...Ch. 20 - Prob. 20.10BYPCh. 20 - Prob. 20.11BYPCh. 20 - Prob. 20.12BYPCh. 20 - Prob. 1CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the times-interest-earned ratios for PEPSI CO, Given the following informationarrow_forwardCalculate the times-interest-earned ratios for Coca Cola in 2020. Explain if the times-interest-earned ratios is adequate? Is the times-interest-earned ratio greater than or less than 2.5? What does that mean for the companies' income? Can the company afford the interest expense on a new loan?arrow_forwardWhich of the following is a temporary account?A. EquipmentB. Accounts PayableC. Utilities ExpenseD. Common Stockarrow_forward

- Unearned revenue becomes revenue when:A. A sale is madeB. Cash is receivedC. The service is performedD. The revenue is recordedarrow_forwardWhat is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardIf total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forward

- Which of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License