Intermediate Accounting

9th Edition

ISBN: 9781259722660

Author: J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 20.3E

Change from the

• LO20–2

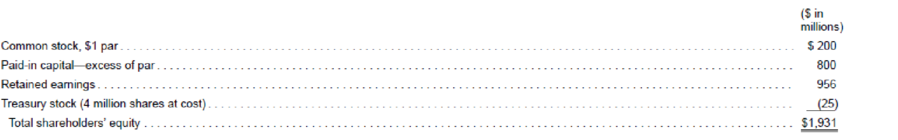

In keeping with a modernization of corporate statutes in its home state, UMC Corporation decided in 2018 to discontinue accounting for reacquired shares as treasury stock. Instead, shares repurchased will be viewed as having been retired, reassuming the status of unissued shares. As part of the change, treasury shares held were reclassified as retired stock. At December 31, 2017, UMC’s

Required:

Identify the type of accounting change this decision represents and prepare the

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Please explain the solution to this general accounting problem with accurate principles.

None

Can you explain this general accounting question using accurate calculation methods?

Chapter 20 Solutions

Intermediate Accounting

Ch. 20 - Prob. 20.1QCh. 20 - There are three basic accounting approaches to...Ch. 20 - Prob. 20.3QCh. 20 - Lynch Corporation changes from the...Ch. 20 - Sugarbaker Designs Inc. changed from the FIFO...Ch. 20 - Most changes in accounting principles are recorded...Ch. 20 - Southeast Steel, Inc., changed from the FIFO...Ch. 20 - Prob. 20.8QCh. 20 - Its not easy sometimes to distinguish between a...Ch. 20 - For financial reporting, a reporting entity can be...

Ch. 20 - Prob. 20.11QCh. 20 - Describe the process of correcting an error when...Ch. 20 - Prob. 20.13QCh. 20 - If it is discovered that an extraordinary repair...Ch. 20 - Prob. 20.15QCh. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in inventory methods; average cost method...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in depreciation methods LO203 Irwin, Inc.,...Ch. 20 - Prob. 20.5BECh. 20 - Book royalties LO204 Three programmers at Feenix...Ch. 20 - Warranty expense LO204 In 2017, Quapau Products...Ch. 20 - Change in estimate; useful life of patent LO204...Ch. 20 - Prob. 20.9BECh. 20 - Error correction LO206 In 2018, internal auditors...Ch. 20 - Prob. 20.11BECh. 20 - Error correction LO206 In 2018, the internal...Ch. 20 - Change in principle; change in inventory methods ...Ch. 20 - Change in principle; change in inventory methods ...Ch. 20 - Change from the treasury stock method to retired...Ch. 20 - Change in principle; change to the equity method ...Ch. 20 - Prob. 20.5ECh. 20 - FASB codification research LO202 Access the FASB...Ch. 20 - Change in principle; change in inventory cost...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in depreciation methods LO203 For...Ch. 20 - Change in depreciation methods LO203 The Canliss...Ch. 20 - Book royalties LO204 Dreighton Engineering Group...Ch. 20 - Loss contingency LO204 The Commonwealth of...Ch. 20 - Warranty expense LO204 Woodmier Lawn Products...Ch. 20 - Prob. 20.15ECh. 20 - Accounting change LO204 The Peridot Company...Ch. 20 - Change in estimate; useful life and residual value...Ch. 20 - Classifying accounting changes LO201 through...Ch. 20 - Error correction; inventory error LO206 During...Ch. 20 - Error corrections; investment LO206 Required: 1....Ch. 20 - Prob. 20.21ECh. 20 - Prob. 20.22ECh. 20 - Prob. 20.23ECh. 20 - Inventory errors LO206 Indicate with the...Ch. 20 - Classifying accounting changes and errors LO201...Ch. 20 - Change in inventory costing methods; comparative...Ch. 20 - P 20-2 Change in principle; change in method of...Ch. 20 - Change in inventory costing methods; comparative...Ch. 20 - Change in inventory methods LO202 The Rockwell...Ch. 20 - Change in inventory methods LO202 Fantasy...Ch. 20 - Change in principle; change in depreciation...Ch. 20 - Depletion; change in estimate LO204 In 2018, the...Ch. 20 - Accounting changes; six situations LO201, LO203,...Ch. 20 - Prob. 20.9PCh. 20 - Inventory errors LO206 You have been hired as the...Ch. 20 - Error correction; change in depreciation method ...Ch. 20 - Accounting changes and error correction; seven...Ch. 20 - Prob. 20.13PCh. 20 - Prob. 20.14PCh. 20 - Prob. 20.15PCh. 20 - Prob. 20.16PCh. 20 - Prob. 20.17PCh. 20 - Integrating Case 201 Change to dollar-value LIFO ...Ch. 20 - Prob. 20.2BYPCh. 20 - Prob. 20.3BYPCh. 20 - Analysis Case 204 Change in inventory methods;...Ch. 20 - Prob. 20.5BYPCh. 20 - Prob. 20.6BYPCh. 20 - Analysis Case 208 Various changes LO201 through...Ch. 20 - Analysis Case 209 Various changes LO201 through...Ch. 20 - Prob. 20.10BYPCh. 20 - Prob. 20.11BYPCh. 20 - Prob. 20.12BYPCh. 20 - Prob. 1CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain the solution to this financial accounting problem with accurate explanations.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardPlease provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Earnings per share (EPS), basic and diluted; Author: Bionic Turtle;https://www.youtube.com/watch?v=i2IJTpvZmH4;License: Standard Youtube License