Intermediate Accounting

9th Edition

ISBN: 9781259722660

Author: J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 20.10E

Change in

• LO20–3

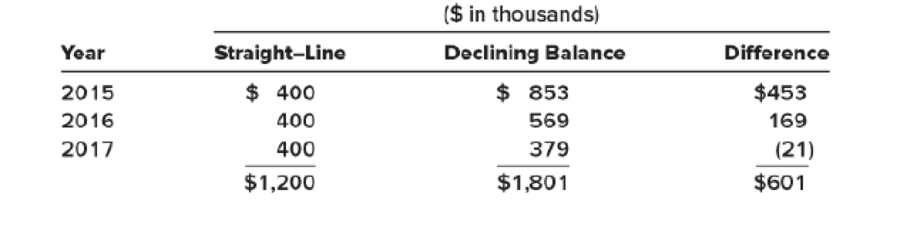

For financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2015 for $2,560,000. Its useful life was estimated to be six years with a $160,000 residual value. At the beginning of 2018, Clinton decides to change to the straight-line method. The effect of this change on depreciation for each year is as follows:

Required:

- 1. Briefly describe the way Clinton should report this accounting change in the 2017–2018 comparative financial statements.

- 2. Prepare any 2018

journal entry related to the change.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expenses

correct

Need Help of this Financial Accounting

What is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesneed help

Chapter 20 Solutions

Intermediate Accounting

Ch. 20 - Prob. 20.1QCh. 20 - There are three basic accounting approaches to...Ch. 20 - Prob. 20.3QCh. 20 - Lynch Corporation changes from the...Ch. 20 - Sugarbaker Designs Inc. changed from the FIFO...Ch. 20 - Most changes in accounting principles are recorded...Ch. 20 - Southeast Steel, Inc., changed from the FIFO...Ch. 20 - Prob. 20.8QCh. 20 - Its not easy sometimes to distinguish between a...Ch. 20 - For financial reporting, a reporting entity can be...

Ch. 20 - Prob. 20.11QCh. 20 - Describe the process of correcting an error when...Ch. 20 - Prob. 20.13QCh. 20 - If it is discovered that an extraordinary repair...Ch. 20 - Prob. 20.15QCh. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in inventory methods; average cost method...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in depreciation methods LO203 Irwin, Inc.,...Ch. 20 - Prob. 20.5BECh. 20 - Book royalties LO204 Three programmers at Feenix...Ch. 20 - Warranty expense LO204 In 2017, Quapau Products...Ch. 20 - Change in estimate; useful life of patent LO204...Ch. 20 - Prob. 20.9BECh. 20 - Error correction LO206 In 2018, internal auditors...Ch. 20 - Prob. 20.11BECh. 20 - Error correction LO206 In 2018, the internal...Ch. 20 - Change in principle; change in inventory methods ...Ch. 20 - Change in principle; change in inventory methods ...Ch. 20 - Change from the treasury stock method to retired...Ch. 20 - Change in principle; change to the equity method ...Ch. 20 - Prob. 20.5ECh. 20 - FASB codification research LO202 Access the FASB...Ch. 20 - Change in principle; change in inventory cost...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in depreciation methods LO203 For...Ch. 20 - Change in depreciation methods LO203 The Canliss...Ch. 20 - Book royalties LO204 Dreighton Engineering Group...Ch. 20 - Loss contingency LO204 The Commonwealth of...Ch. 20 - Warranty expense LO204 Woodmier Lawn Products...Ch. 20 - Prob. 20.15ECh. 20 - Accounting change LO204 The Peridot Company...Ch. 20 - Change in estimate; useful life and residual value...Ch. 20 - Classifying accounting changes LO201 through...Ch. 20 - Error correction; inventory error LO206 During...Ch. 20 - Error corrections; investment LO206 Required: 1....Ch. 20 - Prob. 20.21ECh. 20 - Prob. 20.22ECh. 20 - Prob. 20.23ECh. 20 - Inventory errors LO206 Indicate with the...Ch. 20 - Classifying accounting changes and errors LO201...Ch. 20 - Change in inventory costing methods; comparative...Ch. 20 - P 20-2 Change in principle; change in method of...Ch. 20 - Change in inventory costing methods; comparative...Ch. 20 - Change in inventory methods LO202 The Rockwell...Ch. 20 - Change in inventory methods LO202 Fantasy...Ch. 20 - Change in principle; change in depreciation...Ch. 20 - Depletion; change in estimate LO204 In 2018, the...Ch. 20 - Accounting changes; six situations LO201, LO203,...Ch. 20 - Prob. 20.9PCh. 20 - Inventory errors LO206 You have been hired as the...Ch. 20 - Error correction; change in depreciation method ...Ch. 20 - Accounting changes and error correction; seven...Ch. 20 - Prob. 20.13PCh. 20 - Prob. 20.14PCh. 20 - Prob. 20.15PCh. 20 - Prob. 20.16PCh. 20 - Prob. 20.17PCh. 20 - Integrating Case 201 Change to dollar-value LIFO ...Ch. 20 - Prob. 20.2BYPCh. 20 - Prob. 20.3BYPCh. 20 - Analysis Case 204 Change in inventory methods;...Ch. 20 - Prob. 20.5BYPCh. 20 - Prob. 20.6BYPCh. 20 - Analysis Case 208 Various changes LO201 through...Ch. 20 - Analysis Case 209 Various changes LO201 through...Ch. 20 - Prob. 20.10BYPCh. 20 - Prob. 20.11BYPCh. 20 - Prob. 20.12BYPCh. 20 - Prob. 1CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesarrow_forwardThe purpose of the trial balance is to:A. Prepare for auditB. Ensure all transactions are postedC. Check that total debits equal total creditsD. Detect all errors correct answerarrow_forwardPlease Make Perfect Answer For this Financial Accountingarrow_forward

- The purpose of the trial balance is to:A. Prepare for auditB. Ensure all transactions are postedC. Check that total debits equal total creditsD. Detect all errors correct solutarrow_forwardThe purpose of the trial balance is to:A. Prepare for auditB. Ensure all transactions are postedC. Check that total debits equal total creditsD. Detect all errors need helparrow_forwardAccounting Question Solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License