Concept explainers

Departmental Predetermined

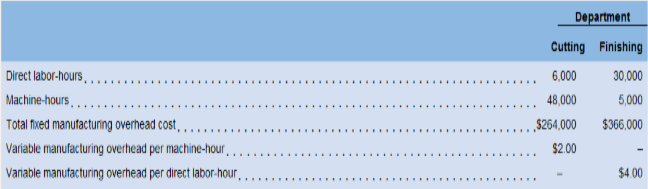

White Company has two departments, Cutting and Finishing. The company uses a job-order costing system and computes a predeterminedoverhead rate in each department. The Cutting Department bases its rate on machine-hours, and the Finishing Department bases its rate ondirect labor-hours. At the beginning of the year, the company made the following estimates:

Required:

1. Compute the predetermined overhead rate for each department.

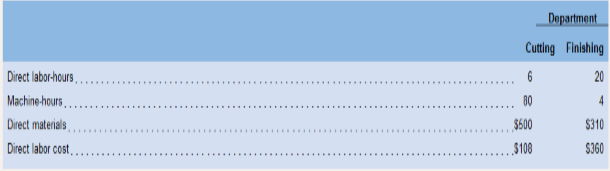

2. The

Using the predetermined overhead rates that you computed in (1) above, compute the total

3. Would you expect substantially different amounts of overhead cost to be assigned to some jobs if the company used a plantwidepredetermined overhead rate based on direct labor-hours, rather than using departmental rates? Explain. No computations are necessary.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Introduction To Managerial Accounting

- Primera Company produces two products and uses a predetermined overhead rate to apply overhead. Primera currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates where overhead would be applied on the basis of direct labor hours in Department 1 and on the basis of machine hours in Department 2. At the beginning of the year, the following estimates are provided: Actual results reported by department and product during the year are as follows: Required: 1. Compute the plantwide predetermined overhead rate and calculate the overhead assigned to each product. 2. Calculate the predetermined departmental overhead rates and calculate the overhead assigned to each product. 3. Using departmental rates, compute the applied overhead for the year. What is the under- or overapplied overhead for the firm? 4. Prepare the journal entry that disposes of the overhead variance calculated in Requirement 3, assuming it is not material in amount. What additional information would you need if the variance is material to make the appropriate journal entry?arrow_forwardDetermining job costcalculation of predetermined rate for applying overhead by direct labor cost and direct labor hour methods Beemer Products Inc. has its factory divided into three departments, with individual factory overhead rates for each department. In each department, all the operations are sufficiently alike for the department to be regarded as a cost center. The estimated monthly factory overhead for the departments is as follows: Forming, 64,000; Shaping, 36,000; and Finishing, 10,080. The estimated production data include the following: The job cost ledger shows the following data for X6, which was completed during the month: Required: Determine the cost of X6. Assume that the factory overhead is applied to production orders, based on the following: 1. Direct labor cost 2. Direct labor hours (Hint: You must first determine overhead rates for each department, rounding rates to the nearest cent.)arrow_forwardMinor Co. has a job order cost system and applies overhead based on departmental rates. Service Department 1 has total budgeted costs of 168,000 for next year. Service Department 2 has total budgeted costs of 280,000 for next year. Minor allocates service department costs solely to the producing departments. Service Department 1 cost is allocated to producing departments on the basis of machine hours. Service Department 2 cost is allocated to producing departments on the basis of direct labor hours. Producing Department 1 has budgeted 8,000 machine hours and 12,000 direct labor hours. Producing Department 2 has budgeted 2,000 machine hours and 12,000 direct labor hours. What is the total cost allocation from the two service departments to Producing Department 1? a. 173,600 b. 140,000 c. 134,400 d. 274,400arrow_forward

- Lansing. Inc., provided the following data for its two producing departments: Machine hours are used to assign the overhead of the Molding Department, and direct labor hours are used to assign the overhead of the Polishing Department. There are 30,000 units of Form A produced and sold and 50,000 of Form B. Required: 1. Calculate the overhead rates for each department. 2. Using departmental rates, assign overhead to live two products and calculate the overhead cost per unit. How does this compare with the plantwide rate unit cost, using direct labor hours? 3. What if the machine hours in Molding were 1,200 for Form A and 3,800 for Form B and the direct labor hours used in Polishing were 5,000 and 15,000, respectively? Calculate the overhead cost per unit for each product using departmental rates, and compare with the plantwide rate unit costs calculated in Requirement 2. What can you conclude from this outcome?arrow_forwardA manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardRockford Company has four departmental accounts: Building Maintenance, General Factory Overhead, Machining, and Assembly. The direct labor hour method is used to apply factory overhead to the jobs being worked on in Machining and Assembly. The company expects each production department to use 30,000 direct labor hours during the year. The estimated overhead rates for the year include the following: During the year, both Machining and Assembly used 28,000 direct labor hours. Factory overhead costs incurred during the year follow: In determining application rates at the beginning of the year, cost allocations were made as follows, using the sequential distribution method: Building Maintenance to: General Factory Overhead, 10%; Machining, 50%; Assembly, 40%. General factory overhead was distributed according to direct labor hours. Required: Determine the under- or overapplied overhead for each production department. (Hint: First you must distribute the service department costs.)arrow_forward

- A manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardRipley, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. Required: 1. What was the predetermined overhead rate? 2. What was the applied overhead for last year? 3. Was overhead over- or underapplied, and by how much? 4. What was the total cost per unit produced (carry your answer to four significant digits)?arrow_forwardOverhead application rate Creole Manufacturing Inc. uses a job order cost system and standard costs. It manufactures one product, whose standard cost follows: The standards are based on normal capacity of 2,400 direct labor hours. Actual activity for October follows: Required: 1. Compute the variable and fixed factory overhead rates per unit. 2. Compute the variable and fixed overhead rates per direct labor hour. 3. Determine the total fixed factory overhead based on normal capacity.arrow_forward

- Premier Products Inc. has three departments and uses the process cost system of accounting. A portion of the departmental cost work sheet prepared by the cost accountant at the end of July is reproduced below. Required: Prepare a cost of production summary for each department. (Round unit costs to three decimal places and totals to the nearest whole dollar.)arrow_forwardBasic Cost Flows Linsenmeyer Company produces a common machine component for industrial equipment in three departments: molding, grinding, and finishing. The following data are available for September: During September, 18,000 components were completed. There is no beginning or ending WIP in any department. Required: 1. Prepare a schedule showing, for each department, the cost of direct materials, direct labor, applied overhead, product transferred in from a prior department, and total manufacturing cost. 2. Calculate the unit cost. (Note: Round the unit cost to two decimal places.)arrow_forwardJohn Sheng, a cost accountant at Starlet Company, is developing departmental factory overhead application rates for the companys Tooling and Fabricating departments. The budgeted overhead for each department and the data for one job are as follows: Using the departmental overhead application rates, total overhead applied to Job 231 in the Tooling and Fabricating departments will be: a. 225. b. 303. c. 537. d. 671.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,