Concept explainers

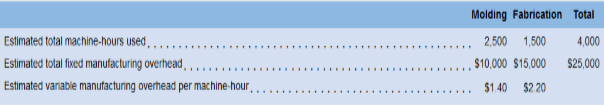

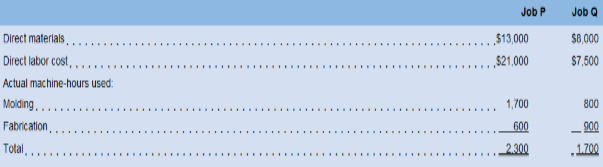

Sweeten Company bad no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments Molding and Fabrication. It started, completed, and sold only two jobs during March—Job P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March):

Sweeten Company bad no underapplied or overapplied

Required:

For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base.

For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments.

1. What was the company’s plantwide predetermined overhead rate?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Introduction To Managerial Accounting

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Essentials of MIS (13th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

- Want your help with Problemarrow_forwardWhat is the net increase in operation income from bio-bricks?arrow_forwardYour firm has been the auditor of Caribild Products, a listed company, for a number of years. The engagement partner has asked you to describe the matters you would consider when planning the audit for the year ended 31January 2022.During recent visit to the company you obtained the following information:(a) The management accounts for the 10 months to 30 November 2021 show a revenue of $260 million andprofit before tax of $8 million. Assume sales and profits accrue evenly throughout the year. In the yearended 31 January 2021 Caribild Products had sales of $220 million and profit before tax of $16 million.(b) The company installed a new computerised inventory control system which has operated from 1 June 2021. As the inventory control system records inventory movements and current inventory quantities, thecompany is proposing:(i) To use the inventory quantities on the computer to value the inventory at the year-end(ii) Not to carry out an inventory count at the year-end(c) You are…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning