Concept explainers

Plantwide and Departmental Predetermined

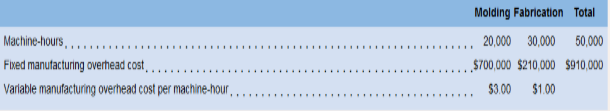

Delph Company uses a job-order costing system and bas two manufacturing departments- Molding and Fabrication. The company provided the following estimates at the be2innina of the year:

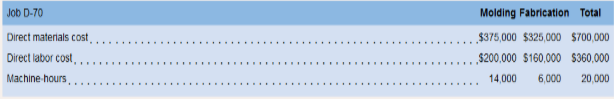

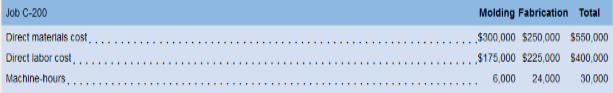

During the year, the company had no beginning or ending inventories and it stated, completed, and sold only two jobs—Job D-70 and Job C-200. It provided the following information related to those two jobs:

Delph had no underapplied or overapplied overhead during the year.

Required:

Assume Delph uses a p1antide predetermined overhead rate based on machine-hours.

a. Compute the pIantwide predetermined overhead rate.

b. Compute the total manufacturing cost assigned to Job D-70 and Job C-200.

c. If Delph establishes bid prices that are 150% of total manufacturing cost what bid prices would it have established for Job D-70 and Job C-200?

d. What is Delph’s cost of goods sold for the year?

2. Assume Delph uses departmental predetermined overhead rates based on machine-hours.

a. Compute the departmental predetermined overhead rates.

b. Compute the total manufacturing cost assigned to Job D-70 and Job C-200.

c. If Delph establishes bid prices that are 150% of total

d. What is Delph’s cost of goods sold for the year?

3. What managerial insights are revealed by the computations that you performed in this problem? (Hint: Do the cost of goods sold amounts that you computed in requirements 1 and 2 differ from one another? Do the bid prices that you computed in requirements 1 and 2 differ from one another? Why?

Requirement − 1:

(a).

Predetermined overhead rate: Predetermined overhead rate refers to the rate of estimated overhead which need to be followed by a firm.

To find: Plant wide predetermined overhead rate.

Answer to Problem 15E

Solution:

Explanation of Solution

- Given: Following information are given in the question:

Fixed manufacturing overhead for molding department = $700000

Fixed manufacturing overhead for fabrication department = $210000

Variable manufacturing overhead rate for molding department= $3

Variable manufacturing overhead rate for fabrication department = * $1

Machine hours for molding department= 20000

Machine hours for fabrication department = 30000

- Formula: Following formula will be used;

- Calculation:

As per formula it is clear that we need to know estimated total manufacturing overhead and estimated total machine hours.

Fixed manufacturing overheadfor molding department = $700000

Fixed manufacturingoverheadfor fabrication department = $210000

Now let’s put values in the above given formula;

Thus, above calculated is the plantwide predetermined overhead rate.

(b).

Total manufacturing cost: Total manufacturing cost refers to the overall costs of manufacturing a specific product..

To identify: Total manufacturing cost assigned to Job D-70 and Job C-200.

Formula:

Total manufacturing cost = (Direct materials + Direct labor cost + Manufacturing overhead applied)

Answer to Problem 15E

Solution:

For Job D-70;

For Job C-200;

Explanation of Solution

- Given: Following information are given;

For Job D-70;

Direct material costs = $700000

Direct labor cost = $360000

For Job C-200;

Direct material costs = $550000

Direct labor cost = $400000

- Formula used: Following formula will be used;

- Calculation:

As per information of the question direct materials, direct labor cost are given but we have to calculate manufacturing overhead applied.

For Job D-70;

For Job C-200;

So far we have calculated total manufacturing cost of each job. Thus for calculating total manufacturing cost of both job, we need to add both manufacturing costs.

Thus, above calculated is the total manufacturing cost assigned to Job D-70 and Job C-200.

(c).

Bid price per unit: Bid price refers to the maximum price at which Delph Company would sale its’ manufactured to the customers.

To identify: Bid price for Job D-70 and for Job C-200, if Delph established bid price 150% of it’s total manufacturing cost.

Answer to Problem 15E

Solution:

Bid price for Job D-70;

Bid price for Job C-200;

Explanation of Solution

- Given: Following information are given;

Manufacturing cost for Job D-70 = $1460000

Manufacturing cost for Job C-200 = $1550000

Bid price is 150% of manufacturing cost

- Formula used: Following formula will be used;

- Calculation:

Bid price for Job D-70;

As we know that;

Total manufacturing cost for Job D-70 = $1460000

Bid price is (150% of total manufacturing cost) =

Bid price for Job C-200;

As we know that;

Total manufacturing cost for Job C-200 = $1550000

Bid price is (150% of total manufacturing cost) =

Thus, above calculated is the bid price for job D-70 and for Job C-200.

(d).

Cost of Goods Sold: Cost of goods sold refers to the cost which incurrred till the saleof product by a firm.

To identify: Cost of goods sold for the year.

Answer to Problem 15E

Solution:

Explanation of Solution

- Given: Following information are given;

Total manufacturing cost for Job D-70 = $1460000

Total manufacturing cost for Job C-200 = $1550000

- Formula used: Following formula will be used;

- Calculation:

As we have already calculated manufacturing cost of each job.

Total manufacturing cost for Job D-70 = $1460000

Total manufacturing cost for Job C-200 = $1550000

Thus, above calculated is the cost of goods sold for the year.

Requirement − 2

(a).

Predetermined overhead rate: Predetermined overhead rate refers to the rate of estimated overhead which need to be followed by a firm.

To identify: Departmental predetermined overhead rate.

Answer to Problem 15E

Solution:

As per formula it is clear that we need to know estimated total manufacturing overhead and estimated total machine hours for each department.

For Molding Department;

For Fabrication Department;

Explanation of Solution

- Given: Following information are given;

For Molding Department;

Fixed manufacturing overhead for molding department = $700000

Variable manufacturing overhead rate for molding department = $3

Estimated machine hours for molding department = 20000

For Fabrication Department;

Fixed manufacturing overhead for fabrication department = $210000

Variable manufacturing overhead rate for molding department = $1

Estimated machine hours for fabrication department = 30000

- Formula used: Following formula will be used;

- Calculation:

As per formula it is clear that we need to know estimated total manufacturing overhead and estimated total machine hours for each department.

For Molding Department;

Fixed manufacturing overhead for molding department = $700000

Estimated machine hours for molding department = 20000

Now let’s put values in the above given formula;

For Fabrication Department;

Estimated machine hours for fabrication department = 30000

Now let’s put values in the above given formula;

Thus, above calculated is the departmental predetermined overhead rate for each department.

(b).

Total manufacturing cost: Total manufacturing cost refers to the overall costs of manufacturing a specific product..

To identify: Total manufacturing cost assigned to Job D-70 and Job C-200.

Answer to Problem 15E

Solution:

For Job D-70;

For Job C-200;

So far we have calculated total manufacturing cost of each job. Thus for calculating total manufacturing cost of both job, we need to add both manufacturing costs.

Explanation of Solution

- Given: Following information are given;

For Job D-70;

Direct material costs = $700000

Direct labor cost = $360000

Manufacturing overhead rate = $38

For Job C-200;

Direct material costs = $550000

Direct labor cost = $400000

Manufacturing overhead rate = $8

- Formula used: Following formula will be used;

- Calculation:

As per information of the question direct materials, direct labor cost are given but we have to calculate manufacturing overhead applied.

For Job D-70; Direct material costs = $700000

Direct labor cost = $360000

For Job C-200; Direct material costs = $550000

Direct labor cost = $400000

So far we have calculated total manufacturing cost of each job. Thus for calculating total manufacturing cost of both job, we need to add both manufacturing costs.

Thus, above calculated is the total manufacturing cost assigned to Job D-70 and Job C-200.

(c).

Bid price per unit: Bid price refers to the maximum sale price at which Delph Company would sale its’ manufactured goods to the customers.

To identify: Bid price for Job D-70 and for Job C-200, if Delph established bid price 150% of it’s total manufacturing cost.

Answer to Problem 15E

Solution:

Bid price for Job D-70;

Bid price for Job C-200;

Explanation of Solution

- Given: following information are given;

Total manufacturing cost for Job D-70 = $1820000

Total manufacturing cost for Job C-200 = $1190000

Bid price is 150% of manufacturing costs

- Formula used: Following formula will be used;

- Calculation:

Bid price for Job D-70;

As we know that;

Total manufacturing cost for Job D-70 = $1820000

Bid price is (150% of total manufacturing cost) =

Bid price for Job C-200;

As we know that;

Total manufacturing cost for Job C-200 = $1190000

Bid price is (150% of total manufacturing cost) =

Thus, above calculated is the bid price for job D-70 and for Job C-200.

(d).

Cost of Goods Sold: Cost of goods sold refers to the cost which incurrred till the sale of product by a firm.

To identify: Cost of goods sold for the year.

Answer to Problem 15E

Solution:

Explanation of Solution

- Given: Following information are given;

Total manufacturing cost for Job D-70 = $1820000

Total manufacturing cost for Job C-200 = $1190000

- Formula used: Following formula will be used;

- Calculation:

As we have already calculated manufacturing cost of each job.

Total manufacturing cost for Job D-70 = $1820000

Total manufacturing cost for Job C-200 = $1190000

Now let’s put the values in above given formula;

Thus, above calculated is the cost of goods sold for the year.

Requirement − 3

To Explain: Critically analysis of differences in bid price and cost of goods sold.

Explanation of Solution

As per information of the question it is clear that Delph Company is establishing it’s bid price at 150% markup. It means Delph Company is establishing bid price 150% of manufacturing costs.

When manufacturing costs are different in case of plantwide overhead rate and in case of departmental overhead rate then bid price will also be different because bid price is calculated on the basis of manufacturing costs.

We know that cost of goods sold is total of manufacturing costs of all jobs. So when manufacturing cost is different in case of plantwide overhead rate and in case of departmental overhead rate then cost of goods sold will also be different because cost of goods sold is calculated on the basis of manufacturing costs.

Thus overall we can say that bid price and cost of goods sold differs in both cases due to difference between manufacturing costs.

Want to see more full solutions like this?

Chapter 2 Solutions

Introduction To Managerial Accounting

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,