Concept explainers

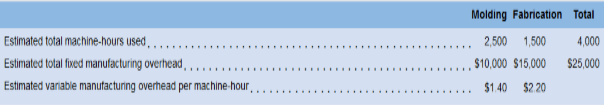

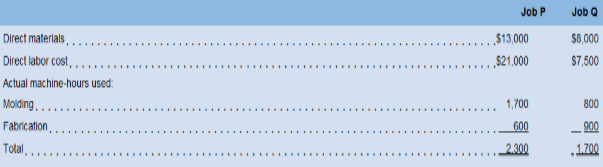

Sweeten Company bad no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during March—Job P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March):

Sweeten Company bad no under applied or over applied

Required:

For questions 1-8, assume that Sweeten Company uses a plant wide predetermined overhead rate with machine-hours as the allocation base.

For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments.

8. What was Sweeten Company’s cost of goods sold for March?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Introduction To Managerial Accounting

- need help this questionsarrow_forwardAnswer to below Questionarrow_forwardDuring September, the assembly department completed 10,500 units of a product that had a standard materials cost of 3.0 square feet per unit at $2.40 per square foot. The actual materials purchased consisted of 22,000 square feet at $2.60 per square foot, for a total cost of $57,200. The actual material used during this period was 25,500 square feet. Compute the materials price variance and materials usage variance.arrow_forward

- St. Joseph’s Hospital began operations in December 2023 with patient service revenues totaling $1,030,000 (based on customary rates) for the month. Of this, $219,000 is billed to patients, representing their insurance deductibles and copayments. The balance is billed to third-party payors, including insurance companies and government health care agencies. St. Joseph’s estimates that 20 percent of these third-party payor charges will be deducted by contractual adjustment. The hospital’s fiscal year ends on December 31. Required: Prepare the journal entries for December 2023. Assume 15 percent of the amounts billed to patients will be reduced through implicit price adjustments. Prepare the journal entries for 2024 assuming the following: $107,000 is collected from the patients during the year, and $10,300 of price adjustments are granted to individuals. Actual contractual adjustments total $168,000. The remaining receivable from third-party payors is collected.arrow_forwardThe owner's equity at the beginning of the period for Vivo Enterprises was $52,000. At the end of the period, assets totaled $110,000, and liabilities were $28,000. If the owner made an additional investment of $12,000 and withdrew $9,000 during the period, what is the net income or (net loss) for the period?arrow_forwardWhat is the DOL for Creston Technologies?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning