Concept explainers

Computing Predetermined

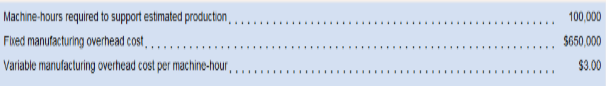

Moody Corporation uses a job-order costing system with a p1antide predetermined overhead rate based on machine-hours. At the beginningof the year, the company made the following estimates:

Required:

1. Compute the p1antide predetermined overhead rate.

2. During the year, Job 400 was started and completed. The following information was available with respect to this job:

Compute the total

3. If Job 400 includes 52 units, what is the unit product cost for this job?

4. If Moody uses a markup percentage of 120% of its total manufacturing cost then what selling price per unit would it have established forJob 400?

5. If Moody hired you as a consultant to critique its pricing methodology, what would you say?

Predetermined overhead rate: Predetermined overhead rate refers to the rate of estimated overhead which need to be followed by a firm.

Total manufacturing cost: Total manufacturing cost refers to the overall costs of manufacturing a specific product.

Requirement − 1:

Plant wide predetermined overhead rate.

Answer to Problem 12E

Solution: Plant wide predetermined overhead rate is $9.5 per machine hour

Explanation of Solution

- Given: Following information are given in the question:

Fixed manufacturing overhead cost = $650000

Machine hours required = 100000

Variable manufacturing overhead cost per machine hour = $3.00

- Formula used: Following formula will be used for calculating plant wide predetermined overhead rate;

- Calculation: As per formula it is clear that we need to know estimated total manufacturing overhead and estimated total machine hours.

Fixed manufacturing overhead = $650000

Estimated machine hours = 100000

Now let’s put values in the above given formula;

Thus, above calculated is the plant wide predetermined overhead rate.

Requirement − 2:

Total manufacturing cost assigned to job-400.

Answer to Problem 12E

Solution:

Total manufacturing cost assigned to job is $1040

Explanation of Solution

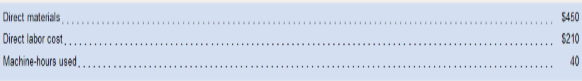

- Given: Following information are given in the question:

Direct materials = $450

Direct labor cost = $210

Machine hours used = 40

- Formula used: Following formula will be used for calculating total manufacturing cost:

- Calculation: As per information of the question direct materials, direct labor cost are given but we have to calculate manufacturing overhead applied.

Direct materials = $450

Direct labor cost = $210

Now let’s put the values in the above mentioned formula;

Thus, above calculated is the total manufacturing cost assigned to job-400.

Requirement − 3

Unit product cost: Unit product cost refers to the average cost of goods manufactured. In other words we can say that when total manufacturing cost is divided by the number of units manufactured then we will get unit product cost.

To identify: Unit product cost for job-400.

Answer to Problem 12E

Solution:

Explanation of Solution

- Given: Following information are given in the question:

Direct materials = $450

Direct labor cost = $210

Machine hours used = 40

Overhead rate = $9.50 per machine hour

Number of units = 52

- Formula used: Following formula will be used;

- Calculation: First of all we have to calculate total manufacturing overhead;

Number of units in the job = 52 units

Now let’s put the values in the above given formula;

Thus, above calculated is the unit product cost for job-400.

Requirement − 4

Selling price per unit: Selling price per unit refers to the price at which manufactured units can be sold.

To identify: Selling price per unit if moody uses a markup percentage of 120% of it’s total manufacturing cost.

Answer to Problem 12E

Solution:

Per unit selling price will be calculated as follow:

Explanation of Solution

- Given:

Following information are available as per question:

Markup = 120% of manufacturing cost

- Formula used:

- Calculation:

Markup (120% of manufacturing cost) =

Number of units in the job = 52 units

Now let’s put the values in the above given formula;

Thus, above calculated is the per unit selling price for job-400.

Requirement − 5

To Explain: Critically analysis of pricing methodology of Moody Corporation.

Explanation of Solution

As per information of the question it is clear that Moody Corporation is selling it’s product at 120% markup. It means Moody corporation is charging 120% more than its’ manufacturing costs. So no doubt this selling price methodology is profitable to this corporation because it will result into higher amount of profits.

But we know that such high markup can make some negative impact on the overall sale of this corporation hence high markup can result into lower quantity of sale. Thus it should be kept in mind that before deciding for such high markup, a corporation must consider selling price being offered by other manufacturers too.

Thus overall we can say that although this pricing methodology of Moody Corporation is is good but negative impact of this pricing methodology must be considered.

Want to see more full solutions like this?

Chapter 2 Solutions

Introduction To Managerial Accounting

- 9. In a bank reconciliation, a bank service charge would be:A. Deducted from the book balanceB. Added to the bank balanceC. Deducted from the bank balanceD. Ignoredarrow_forwardWhich statement is prepared first in the accounting cycle?A. Balance SheetB. Statement of Retained EarningsC. Income StatementD. Cash Flow Statement need helparrow_forward10. Which statement is prepared first in the accounting cycle?A. Balance SheetB. Statement of Retained EarningsC. Income StatementD. Cash Flow Statementhelp mearrow_forward

- I need help The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardNo use chatgpt 1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forward1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forward

- Don't use chatgpt The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardThe normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetneed help in this .arrow_forwardThe normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the asset Help!arrow_forward

- No AI The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardWhich item would appear on the statement of retained earnings?A. DividendsB. InventoryC. Prepaid RentD. Notes Payablearrow_forwardWhat does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,