Concept explainers

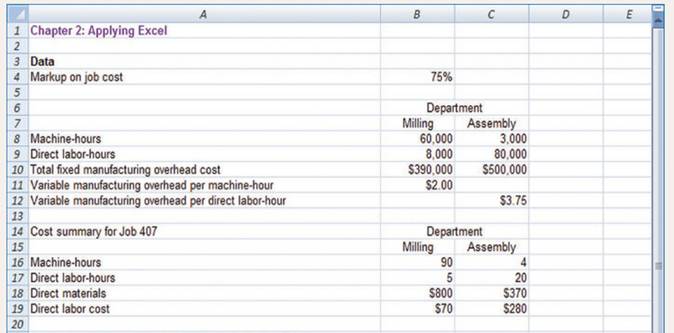

This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5. Download the workbook containing this form from Connect, where you will also find instructions about how to use this worksheet form.

You should proceed to the requirements below only after completing your worksheet.

Required:

2. Change the total fixed

Selling price: The cost incurred by selling the product in the market is known as the selling price.

Determine the missing figures in the sheet. After finding the missing figures determine the selling price of Job 408 by replacing the current data with the data given in the question.

Answer to Problem 2AE

Solution: The selling price of Job 408 using current data is $4348.75 and the selling price of Job 408 after replacing the current data with the given data is $2800.

Explanation of Solution

This calculation is done in the workbook and it is explained below,

Part -1- The missing figures in the sheet is determined here.

| Chapter 2: Applying Excel | |||

| Data | |||

| Mark-up on job cost | 75% | ||

| Department | |||

| Milling | Assembly | ||

| 1 | Machine hours | 60000 | 3000 |

| 2 | Direct Labour Hours | 8000 | 80000 |

| 3 | Total fixed manufacturing overhead cost | $3,90,000.00 | $5,00,000.00 |

| 4 | Variable manufacturing overhead per machine hour | $2.00 | $ - |

| 5 | Variable manufacturing overhead per direct labour hour | $ - | $ 3.75 |

| Cost Summary for job 407 | Department | ||

| Milling | Assembly | ||

| 6 | Machine hours | 90 | 4 |

| 7 | Direct Labour Hours | 5 | 20 |

| 8 | Direct Materials | $800.00 | $370.00 |

| 9 | Direct Labour cost | $70.00 | $280.00 |

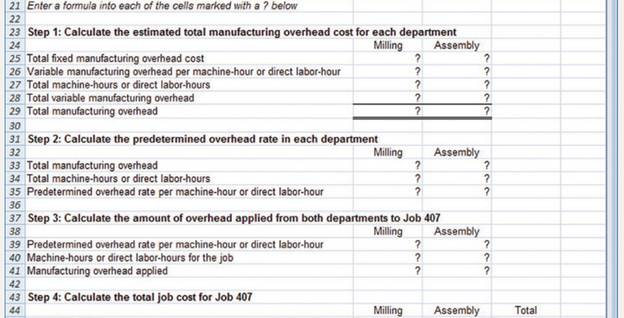

| Enter a formula into each of the cells marked with? below | |||

| Step 1: Calculate the estimated total manufacturing overhead cost for each department | |||

| Milling | Assembly | ||

| 10 | Total fixed manufacturing overhead (given) | $3,90,000.00 | $5,00,000.00 |

| 11 | Variable manufacturing overhead per machine hour or direct labour hour (given) | $2.00 | $3.75 |

| 12 | Total machine hours or direct labour hours (given) | 60000 | 80000 |

| 13 | Total Variable manufacturing overhead (11 x 12) | $1,20,000.00 | $3,00,000.00 |

| 14 | Total manufacturing overhead (10 + 13) | $5,10,000.00 | $8,00,000.00 |

| Step 2: Calculate the pre-determined overhead rate in each department | |||

| Milling | Assembly | ||

| 15 | Total manufacturing overhead (14) | $5,10,000.00 | $8,00,000.00 |

| 16 | Total machine hours or direct labour hours (given) | 60000 | 80000 |

| 17 | Pre-determined overhead rate per machine hour or direct labour hour (15 divided by 16) | $8.50 | $10.00 |

| Step 3: Calculate the amount of overhead applied to both departments to Job 407 | |||

| Milling | Assembly | ||

| 18 | Pre-determined overhead rate per machine hour or direct labour hour (17) | $8.50 | $10.00 |

| 19 | Machine hours or direct labour hours for the job (given) | 90 | 20 |

| 20 | Manufacturing overhead applied (18 x 19) | $765.00 | $200.00 |

| Step 4: Calculate the total job cost for Job 407 | |||

| Milling | Assembly | ||

| 21 | Direct Materials (given) | $800.00 | $370.00 |

| 22 | Direct Labour cost (given) | $70.00 | $280.00 |

| 23 | Manufacturing overhead applied (20) | $765.00 | $200.00 |

| 24 | Total cost of Job 407 (21 + 22 + 23) | $1,635.00 | $850.00 |

| Total cost of Job 407 (Milling + Assembly) | $2,485.00 | ||

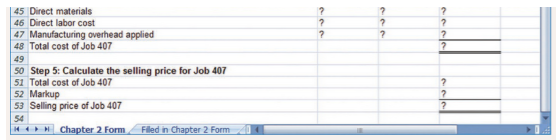

| Step 5: Calculate the selling price for Job 407 | |||

| Milling | Assembly | ||

| 25 | Total cost of Job 407 ( 24) | $1,635.00 | $850.00 |

| 26 | Mark-up (24 x 75%) | $1,226.25 | $637.50 |

| 27 | Selling price of Job 407 (25 + 26) | $2,861.25 | $1,487.50 |

| Total Selling Price (Milling + Assembly) | $4,348.75 | ||

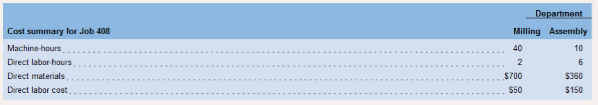

Part 2 - The selling price of Job 408 by replacing the current data with data given

| Chapter 2: Applying Excel | |||

| Data | |||

| Mark-up on job cost | 75% | ||

| Department | |||

| Milling | Assembly | ||

| 1 | Machine hours | 60000 | 3000 |

| 2 | Direct Labour Hours | 8000 | 80000 |

| 3 | Total fixed manufacturing overhead cost | $3,90,000.00 | $5,00,000.00 |

| 4 | Variable manufacturing overhead per machine hour | $2.00 | $ - |

| 5 | Variable manufacturing overhead per direct labour hour | $ - | $3.75 |

| Cost Summary for job 408 | Department | ||

| Milling | Assembly | ||

| 6 | Machine hours | 40 | 10 |

| 7 | Direct Labour Hours | 2 | 6 |

| 8 | Direct Materials | $700.00 | $360.00 |

| 9 | Direct Labour cost | $50.00 | $150.00 |

| Enter a formula into each of the cells marked with? Below | |||

| Step 1: Calculate the estimated total manufacturing overhead cost for each department | |||

| Milling | Assembly | ||

| 10 | Total fixed manufacturing overhead (given) | $3,00,000.00 | $5,00,000.00 |

| 11 | Variable manufacturing overhead per machine hour or direct labour hour (given) | $2.00 | $3.75 |

| 12 | Total machine hours or direct labour hours (given) | 60000 | 80000 |

| 13 | Total Variable manufacturing overhead (11 x 12) | $1,20,000.00 | $3,00,000.00 |

| 14 | Total manufacturing overhead (10 + 13) | $4,20,000.00 | $8,00,000.00 |

| Step 2: Calculate the pre-determined overhead rate in each department | |||

| Milling | Assembly | ||

| 15 | Total manufacturing overhead (14) | $4,20,000.00 | $8,00,000.00 |

| 16 | Total machine hours or direct labour hours (given) | 60000 | 80000 |

| 17 | Pre-determined overhead rate per machine hour or direct labour hour (15 divided by 16) | $7.00 | $10.00 |

| Step 3: Calculate the amount of overhead applied to both departments to Job 408 | |||

| Milling | Assembly | ||

| 18 | Pre-determined overhead rate per machine hour or direct labour hour (17) | $7.00 | $10.00 |

| 19 | Machine hours or direct labour hours for the job (given) | 40 | 6 |

| 20 | Manufacturing overhead applied (18 x 19) | $280.00 | $60.00 |

| Step 4: Calculate the total job cost for Job 408 | |||

| Milling | Assembly | ||

| 21 | Direct Materials (given) | $700.00 | $360.00 |

| 22 | Direct Labour cost (given) | $50.00 | $150.00 |

| 23 | Manufacturing overhead applied (20) | $280.00 | $60.00 |

| 24 | Total cost of Job 407 (21 + 22 + 23) | $1,030.00 | $570.00 |

| Total cost of Job 407 (Milling + Assembly) | $1,600.00 | ||

| Step 5: Calculate the selling price for Job 408 | |||

| Milling | Assembly | ||

| 25 | Total cost of Job 407 ( 24) | $1,030.00 | $570.00 |

| 26 | Mark-up (24 x 75%) | $772.50 | $427.50 |

| 27 | Selling price of Job 407 (25 + 26 ) | $1,802.50 | $997.50 |

| 28 | Total Selling Price of Job 408 (Milling + Assembly) | $2,800.00 | |

Thus, the selling price of Job 408 after replacing the current data with the given data is $2800.

Want to see more full solutions like this?

Chapter 2 Solutions

Introduction To Managerial Accounting

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understated i need help in this question quiarrow_forwardI need correct answer 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardNo chatgpt 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedneed anarrow_forwardNo ai 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardDevelopment costs in preparing the mine $ 3,400,000 Mining equipment 159,600 Construction of various structures on site 77,900 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $12,000. The structures will be torn down. Geologists estimate that 820,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow Probability $ 620,000 40% 720,000 30% 820,000 30% Hecala’s credit-adjusted risk-free interest rate is 7%. During 2024, Hecala extracted 122,000 tons of ore from the mine. The company’s fiscal year ends on December 31. Required: Determine the amount at which Hecala will record the mine. Calculate the…arrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

- what are the Five List of Michael Porter's 5 Force Framework that describes the competitive dynamics of a firm and the industry they are in?arrow_forwardHello tutor i need help I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwarddefine each item below: A competitive advantage. 2) Data incorporation. 3) Financial Statement Analysis. 4) Product Differentiation. 5) Strategic positioning for a business firmarrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College