Concept explainers

Varying Plantwide Predetermined

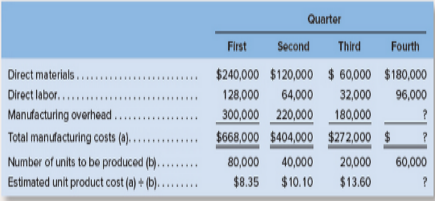

Kingsport Containers Company makes a single product that is subject to wide seasonal variations in demand. The company uses a job-ordercosting system and computes pIantwide predeterminedoverhead rates on a quarterly basis using the number of units to be produced as theallocation base. Its estimated costs, by quarter, for the coming year are given below:

Management finds the variation in quarterly unit product costs to be confusing and difficult to work with.It has been suggested that theproblem lies with manufacturing overhead because it is the largest element of total

Required:

1. Assuming the estimated variable manufacturing overhead cost per unit is $2.00, what must be the estimated total fixed manufacturing overhead cost per quarter?

2. Assuming the assumptions about cost behavior from the first three quarters hold constant what is the estimated unit product cost for thefourth quarter?

3. 1iat is causing the estimated unit product cost to fluctuate from one quarter to the next?

4. How would you recommend stabilizing the company’s unit product cost? Support your answer with computations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Introduction To Managerial Accounting

- Everest Ltd. wants to earn a pre-tax income of $75,000. The company has total fixed costs of $150,000, and the contribution margin per unit is $10.00. How many units must be sold to earn the targeted pre-tax income?arrow_forwardWhat is the total contribution marginarrow_forwardhi expert please help mearrow_forward

- Please solve. and provide correct solutionarrow_forwardBrightPrints Company plans to sell 12,000 printed posters at $20 each in the upcoming year. The product costs include: Direct materials per poster: $6.50 • Direct labor per poster: $2.00 • Variable overhead per poster: $1.20 Total fixed factory overhead: $50,000 Additionally, variable selling expenses include a promotional discount averaging $1.10 per poster, and fixed selling and administrative expenses total $25,000. Required: Calculate the following values: a. Variable product cost per unit b. Total variable cost per unit c. Contribution margin per unit d. Contribution margin ratioarrow_forwardnot use ai please don'tarrow_forward

- Delta Inc. reported earnings per share (EPS) of $10 in 2023 and paid dividends of $2 per share. The current market price per share is $80, and the book value per share is $50. What is Delta Inc.'s price-earnings ratio (P/E ratio)?arrow_forwardHow many units must be soldarrow_forwardWhat is the employee's net pay for the month of January?arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning