Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

11th Edition

ISBN: 9781259727788

Author: Hilton & Platt

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 36P

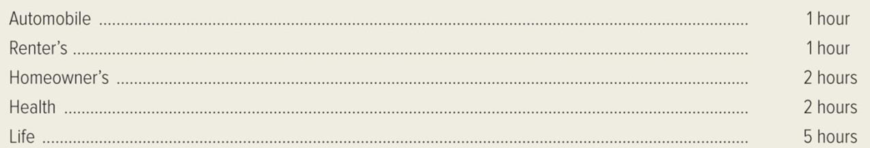

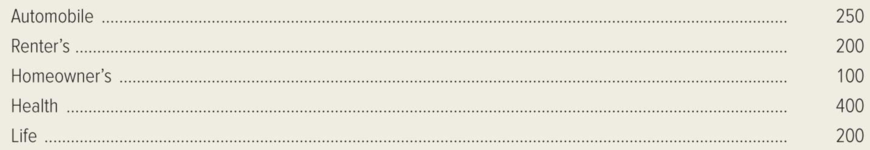

Gibralter Insurance Company uses a flexible

The following numbers of insurance applications were processed during July.

The controller estimates that the variable-overhead rate in the application-processing department is $4.00 per clerical hour, and that fixed-overhead costs will amount to $2,000 per month.

Required:

- 1. How many standard clerical hours are allowed in July, given actual application activity?

- 2. Why would it not be sensible to base the company’s flexible budget on the number of applications processed instead of the number of clerical hours allowed?

- 3. Construct a formula flexible overhead budget for the company.

- 4. What is the flexible budget for total overhead cost in July?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Becker Bikes manufactures tricycles. The company expects to sell 360 units in May and 490 units in June. Beginning and ending

finished goods for May is expected to be 100 and 65 units, respectively. June's ending finished goods is expected to be 75 units. The

company's variable overhead is $3.00 per unit produced and its fixed overhead is $3,500 per month.

Compute Becker's manufacturing overhead budget for May and June. (Do not round intermediate calculations. Round your final

answers to 2 decimal places.)

Budgeted manufacturing overhead

May

June

Becker Bikes manufactures tricycles. The company expects to sell 380 units in May and 510 units in June. Beginning and ending

finished goods for May are expected to be 110 and 75 units, respectively. June's ending finished goods are expected to be 85 units.

The company's variable overhead is $4.00 per unit produced and its fixed overhead is $4,500 per month.

Compute Becker's manufacturing overhead budget for May and June.

Note: Do not round intermediate calculations. Round your final answers to 2 decimal places.

Budgeted manufacturing overhead

May

June

MCO Leather manufactures leather purses. Each purse requires 2 pounds of direct materials at a cost of $4 per pound and 0.7 direct

labor hour at a rate of $18 per hour. Variable overhead is budgeted at a rate of $2 per direct labor hour. Budgeted fixed overhead is

$18,000 per month. The company's policy is to end each month with direct materials inventory equal to 20% of the next month's direct

materials requirement. At the end of August the company had 1,880 pounds of direct materials in inventory. The company's production

budget reports the following.

Production Budget September October November

Units to produce

4,700

7,100

6,200

(1) Prepare direct materials budgets for September and October.

(2) Prepare direct labor budgets for September and October.

(3) Prepare factory overhead budgets for September and October.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Prepare direct labor budgets for September and October. (Round "DL hours…

Chapter 11 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

Ch. 11 - Distinguish between static and flexible budgets.Ch. 11 - Explain the advantage of using a flexible budget.Ch. 11 - Why are flexible overhead budgets based on...Ch. 11 - Distinguish between a columnar and a formula...Ch. 11 - Show, using T-accounts, how production overhead is...Ch. 11 - How have advances in manufacturing technology...Ch. 11 - What is the interpretation of the...Ch. 11 - Jeffries Companys only variable-overhead cost is...Ch. 11 - What is the interpretation of the...Ch. 11 - Distinguish between the interpretations of the...

Ch. 11 - What is the fixed-overhead budget variance?Ch. 11 - What is the correct interpretation of the...Ch. 11 - Describe a common but misleading interpretation of...Ch. 11 - Draw a graph showing budgeted and applied fixed...Ch. 11 - What types of organizations use flexible budgets?Ch. 11 - What is the conceptual problem of applying fixed...Ch. 11 - Distinguish between the control purpose and the...Ch. 11 - Why are fixed-overhead costs sometimes called...Ch. 11 - Draw a graph showing both budgeted and applied...Ch. 11 - Give one example of a plausible activity base to...Ch. 11 - Explain how an activity-based flexible budget...Ch. 11 - Crystal Glassware Company has the following...Ch. 11 - Refer to the data in the preceding exercise. Use...Ch. 11 - Crystal Glassware Company has the following...Ch. 11 - The following data are the actual results for...Ch. 11 - Evening Star, Inc. produces binoculars of two...Ch. 11 - The controller for Rainbow Childrens Hospital,...Ch. 11 - You recently received the following note from the...Ch. 11 - You brought your work home one evening, and your...Ch. 11 - Refer to DCdesserts.coms activity-based flexible...Ch. 11 - Montoursville Control Company, which manufactures...Ch. 11 - Prob. 33ECh. 11 - The following data pertain to Aurora Electronics...Ch. 11 - Calgary Paper Company produces paper for...Ch. 11 - Gibralter Insurance Company uses a flexible...Ch. 11 - Country time Studios is a recording studio in...Ch. 11 - Newark Plastics Corporation developed its overhead...Ch. 11 - Johnson Electrical produces industrial ventilation...Ch. 11 - Fall City Hospital has an outpatient clinic....Ch. 11 - Maxwell Company uses a standard cost accounting...Ch. 11 - Mark Fletcher, president of SoftGro, Inc., was...Ch. 11 - LawnMate Company manufactures power mowers that...Ch. 11 - For each of the following independent Cases A and...Ch. 11 - Prob. 45PCh. 11 - Prob. 46PCh. 11 - WoodCrafts, Inc. is a manufacturer of furniture...Ch. 11 - Rutherford Wheel and Axle, Inc. has an automated...Ch. 11 - Chillco Corporation produces containers of frozen...Ch. 11 - Montreal Scholastic Supply Company uses a...Ch. 11 - College Memories, Inc. publishes college...Ch. 11 - While Mountain Sled Company manufactures childrens...Ch. 11 - Cleveland Computer Accessory Company (CCAC)...Ch. 11 - Prob. 54CCh. 11 - Prob. 55C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Greiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiners master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employers share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the companys union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 35 percent of the following month's projected sales in inventory. Information on the first four months of the coming year is as follows: Required: 1. Prepare the following monthly budgets for Greiner Company for the first quarter of the coming year. Be sure to show supporting calculations. a. Production budget in units b. Direct labor budget in hours c. Direct materials cost budget d. Sales budget 2. Calculate the total budgeted contribution margin for Greiner Company by month and in total for the first quarter of the coming year. Be sure to show supporting calculations. (CMA adapted)arrow_forwardIf a factory operates at 100% of capacity one month, 90% of capacity the next month, and 105% of capacity the next month, will a different cost per unit be charged to the work-in-process account each month for factory overhead assuming that a predetermined annual overhead rate is used?arrow_forwardKrouse Company produces two products, forged putter heads and laminated putter heads, which are sold through specialty golf shops. The company is in the process of developing itsoperating budget for the coming year. Selected data regarding the companys two products areas follows: Manufacturing overhead is applied to units using direct labor hours. Variable manufacturing overhead Ls projected to be 25,000, and fixed manufacturing overhead is expected to be15,000. The estimated cost to produce one unit of the laminated putter head is: a. 42. b. 46. c. 52. d. 62.arrow_forward

- Firenza Company manufactures specialty tools to customer order. Budgeted overhead for the coming year is: Previously, Sanjay Bhatt, Firenza Companys controller, had applied overhead on the basis of machine hours. Expected machine hours for the coming year are 50,000. Sanjay has been reading about activity-based costing, and he wonders whether or not it might offer some advantages to his company. He decided that appropriate drivers for overhead activities are purchase orders for purchasing, number of setups for setup cost, engineering hours for engineering cost, and machine hours for other. Budgeted amounts for these drivers are 5,000 purchase orders, 500 setups, and 2,500 engineering hours. Sanjay has been asked to prepare bids for two jobs with the following information: The typical bid price includes a 40 percent markup over full manufacturing cost. Required: 1. Calculate a plantwide rate for Firenza Company based on machine hours. What is the bid price of each job using this rate? 2. Calculate activity rates for the four overhead activities. What is the bid price of each job using these rates? 3. Which bids are more accurate? Why?arrow_forwardDouglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred: Marston applies overhead using rates based on direct labor hours, machine hours, number of moves, and number of batches. The second level of activity (the right column in the preceding table) is the practical level of activity (the available activity for resources acquired in advance of usage) and is used to compute predetermined overhead pool rates. Required: 1. Prepare a performance report for Marstons manufacturing costs in the current year. 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost. 3. One of Marstons managers said the following: Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at 10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of 30,000 per year. Also, I know that fuel costs about 0.25 per move. Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)arrow_forwardBusiness Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per pound of direct materials is 1.60. The standard rate for labor is 8.00. Overhead is applied on the basis of direct labor hours. A plantwide rate is used. Budgeted overhead for the year is as follows: The company expects to work 12,000 direct labor hours during the year; standard overhead rates are computed using this activity level. For every small stapler produced, the company produces two regular staplers. Actual operating data for the year are as follows: a. Units produced: small staplers, 35,000; regular staplers, 70,000. b. Direct materials purchased and used: 56,000 pounds at 1.5513,000 for the small stapler and 43,000 for the regular stapler. There were no beginning or ending direct materials inventories. c. Direct labor: 14,800 hours3,600 hours for the small stapler and 11,200 hours for the regular stapler. Total cost of direct labor: 114,700. d. Variable overhead: 607,500. e. Fixed overhead: 350,000. Required: 1. Prepare a standard cost sheet showing the unit cost for each product. 2. Compute the direct materials price and usage variances for each product. Prepare journal entries to record direct materials activity. 3. Compute the direct labor rate and efficiency variances for each product. Prepare journal entries to record direct labor activity. 4. Compute the variances for fixed and variable overhead. Prepare journal entries to record overhead activity. All variances are closed to Cost of Goods Sold. 5. Assume that you know only the total direct materials used for both products and the total direct labor hours used for both products. Can you compute the total direct materials and direct labor usage variances? Explain.arrow_forward

- MCO Leather manufactures leather purses. Each purse requires 2 pounds of direct materials at a cost of $3 per pound and 0.7 direct labor hour at a rate of $19 per hour. Variable overhead is budgeted at a rate of $2 per direct labor hour. Budgeted fixed overhead is $12,000 per month. The company’s policy is to end each month with direct materials inventory equal to 30% of the next month’s direct materials requirement. At the end of August the company had 2,640 pounds of direct materials in inventory. The company’s production budget reports the following. Production Budget September October November Units to produce 4,400 7,000 6,000 (1) Prepare direct materials budgets for September and October.(2) Prepare direct labor budgets for September and October.(3) Prepare factory overhead budgets for September and October.arrow_forwardMCO Leather manufactures leather purses. Each purse requires 2 pounds of direct materials at a cost of $3 per pound and 0.7 direct labor hour at a rate of $17 per hour. Variable overhead is budgeted at a rate of $3 per direct labor hour. Budgeted fixed overhead is $14,000 per month. The company’s policy is to end each month with direct materials inventory equal to 30% of the next month’s direct materials requirement. At the end of August the company had 2,880 pounds of direct materials in inventory. The company’s production budget reports the following. Production Budget September October November Units to produce 4,800 6,800 6,400 (1) Prepare direct materials budgets for September and October.(2) Prepare direct labor budgets for September and October.(3) Prepare factory overhead budgets for September and October.arrow_forwardMCO Leather manufactures leather purses. Each purse requires 2 pounds of direct materials at a cost of $3 per pound and 0.7 direct labor hour at a rate of $12 per hour. Variable overhead is budgeted at a rate of $2 per direct labor hour. Budgeted fixed overhead is $11,000 per month. The company's policy is to end each month with direct materials Inventory equal to 30% of the next month's direct materials requirement. At the end of August the company had 2,580 pounds of direct materials in Inventory. The company's production budget reports the following. Production Budget Units to produce September 4,300 (1) Prepare direct materials budgets for September and October. (2) Prepare direct labor budgets for September and October. (3) Prepare factory overhead budgets for September and October. Direct labor hours needed October 6,800 Complete this question by entering your answers in the tabs below. Budgeted variable overhead Required 1 Required 2 Required 3 Prepare factory overhead budgets…arrow_forward

- MCO Leather manufactures leather purses. Each purse requires 2 pounds of direct materials at a cost of $3 per pound and 0.7 direct labor hour at a rate of $12 per hour. Variable overhead is budgeted at a rate of $2 per direct labor hour. Budgeted fixed overhead is $11,000 per month. The company's policy is to end each month with direct materials Inventory equal to 30% of the next month's direct materials requirement. At the end of August the company had 2,580 pounds of direct materials in Inventory. The company's production budget reports the following. Production Budget Units to produce Required 1 (1) Prepare direct materials budgets for September and October. (2) Prepare direct labor budgets for September and October. (3) Prepare factory overhead budgets for September and October. September 4,300 Complete this question by entering your answers in the tabs below. Units to produce October 6,800 Required 2 Required 3 Prepare direct labor budgets for September and October. (Round "DL…arrow_forwardMCO Leather manufactures leather purses. Each purse requires 2 pounds of direct materials at a cost of $3 per pound and 0.7 direct labor hour at a rate of $12 per hour. Variable overhead is budgeted at a rate of $2 per direct labor hour. Budgeted fixed overhead is $11,000 per month. The company's policy is to end each month with direct materials inventory equal to 30% of the next month's direct materials requirement. At the end of August the company had 2,580 pounds of direct materials in Inventory. The company's production budget reports the following. Production Budget Units to produce September 4,380 (1) Prepare direct materials budgets for September and October. (2) Prepare direct labor budgets for September and October. (3) Prepare factory overhead budgets for September and October. Units to produce Complete this question by entering your answers in the tabs below. October 6,880 Required 1 Required 2 Prepare direct materials budgets for September and October. Total materials…arrow_forwardMCO Leather manufactures leather purses. Each purse requires 2 pounds of direct materials at a cost of $4 per pound and 0.7 direct labor hour at a rate of $11 per hour. Variable overhead is budgeted at a rate of $2 per direct labor hour. Budgeted fixed overhead is $20,000 per month. The company's policy is to end each month with direct materials inventory equal to 20% of the next month's direct materials requirement. At the end of August the company had 1,760 pounds of direct materials in inventory. The company's production budget reports the following. Production Budget September Units to produce 4,400 (1) Prepare direct materials budgets for September and October. (2) Prepare direct labor budgets for September and October. (3) Prepare factory overhead budgets for September and October. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 October 6,900 Units to produce Prepare direct materials budgets for September and October. Total…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY