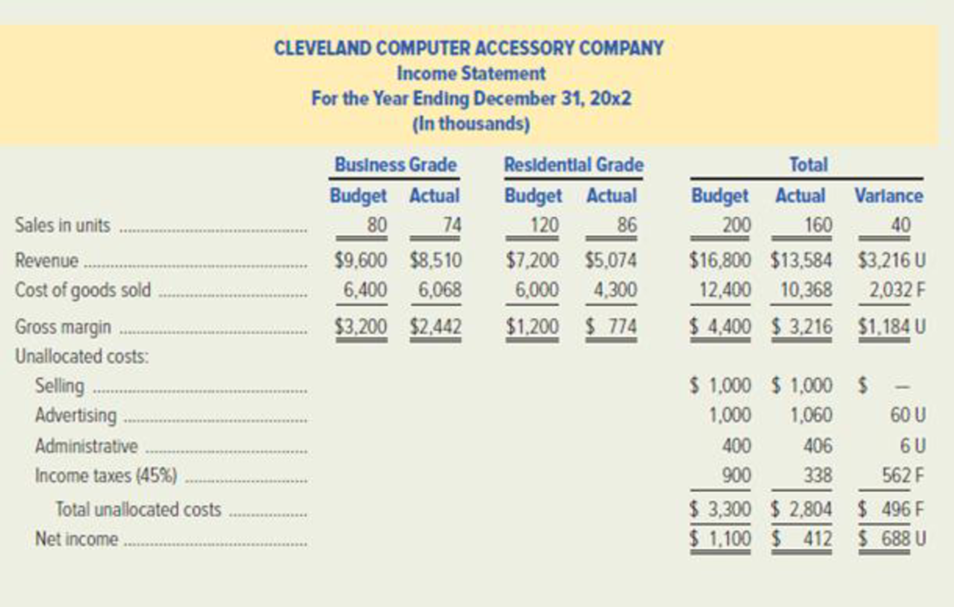

Cleveland Computer Accessory Company (CCAC) distributes keyboard trays to computer stores. The keyboard trays can be attached to the underside of a desk, effectively turning it into a computer table. The keyboard trays are purchased from a manufacturer that attaches CCAC’s private label to the trays. The wholesale selling prices to the computer stores are $120 for the business-grade keyboard tray and $60 for the residential-grade product. The 20x2 budget and actual results are as follows. The budget was adopted in late 20x1 and was based on CCAC’s estimated share of the market for the two types of keyboard trays.

During the first quarter of 20x2, management estimated that the total market for these products actually would be 10 percent below the original estimates. In an attempt to prevent unit sales from declining as much as industry projections, management implemented a marketing program. Included in the program were dealer discounts and increased direct advertising. The business-grade line was emphasized in this program.

Required:

- 1. Compute the sales-price and sales-volume variances for each product line. Indicate whether each variance is favorable or unfavorable.

- 2. Discuss the apparent effect of CCAC’s special marketing program (i.e., dealer discounts and additional advertising) on the 20x2 operating results.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- History 口 AA 1 ୪ Fri Feb 14 2:45 PM Mc Gw Mini Cases Qmcgrow hill goodweek tires pr × | Ask a Question | bartleby × + Bookmarks Profiles Tab Window Help Graw McGraw Hill MC ☑ Hill prod.reader-ui.prod.mheducation.com/epub/sn_d82a5/data-uuid-0e12dd568f3f4e438c00faed4ea436f1 Chrome File Edit View Λ LTI Launch 88 Netflix YouTube A BlackBoard Mail - Stiffler, Zac... SBI Jobs E Aa Finish update: ☐ All Bookmarks Goodweek Tires, Inc. After extensive research and development, Goodweek Tires, Inc., has recently developed a new tire, the SuperTread, and must decide whether to make the investment necessary to produce and market it. The tire would be ideal for drivers doing a large amount of wet weather and off-road driving in addition to normal freeway usage. The research and development costs so far have totaled about $10 million. The SuperTread would be put on the market beginning this year, and Goodweek expects it to stay on the market for a total of four years. Test marketing costing $5…arrow_forwardDamerly Company (a Utah employer) wants to give a holiday bonus check of $375 to each employee. As it wants the check amount to be $375, it will need to gross-up the amount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to John Rolen if his cumulative earnings for the year are $46,910. Besides being subject to social security taxes and federal income tax (supplemental rate), a 4.95% Utah income tax must be withheld on supplemental payments.arrow_forwardPlease given correct answer general Accountingarrow_forward

- How much will you accumulated after 35 year?arrow_forwardOn a particular date, FedEx has a stock price of $89.27 and an EPS of $7.11. Its competitor, UPS, had an EPS of $0.38. What would be the expected price of UPS stock on this date, if estimated using the method of comparables? A) $4.77 B) $7.16 C) $9.54 D) $10.50arrow_forwardHow much will you accumulated after 35 year? General accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning