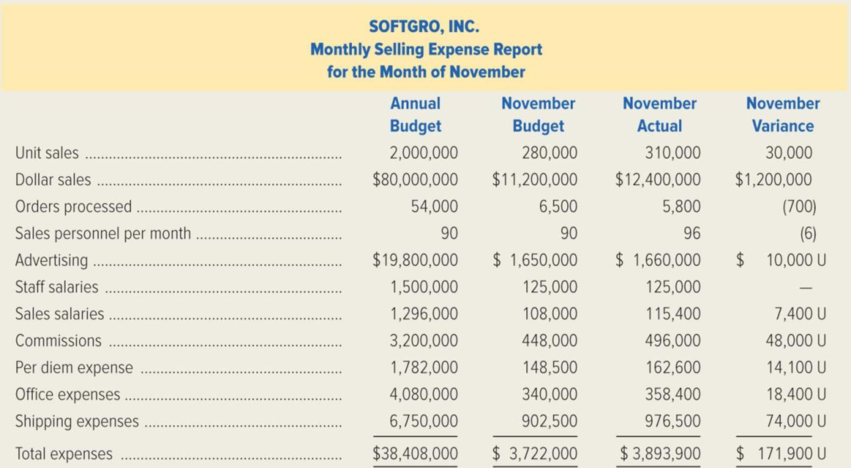

Mark Fletcher, president of SoftGro, Inc., was looking forward to seeing the performance reports for November because he knew the company’s sales for the month had exceeded budget by a considerable margin. SoftGro, a distributor of educational software packages, had been growing steadily for approximately two years. Fletcher’s biggest challenge at this point was to ensure that the company did not lose control of expenses during this growth period. When Fletcher received the November reports, he was dismayed to see the large unfavorable variance in the company’s Monthly Selling Expense Report that follows.

Fletcher called in the company’s new controller, Susan Porter, to discuss the implications of the variances reported for November and to plan a strategy for improving performance. Porter suggested that the company’s reporting format might not be giving Fletcher a true picture of the company’s operations. She proposed that SoftGro implement flexible budgeting. Porter offered to redo the Monthly Selling Expense Report for November using flexible budgeting so that Fletcher could compare the two reports and see the advantages of flexible budgeting.

Porter discovered the following information about the behavior of SoftGro’s selling expenses.

- The total compensation paid to the sales force consists of a monthly base salary and a commission; the commission varies with sales dollars.

- Sales office expense is a semi variable cost with the variable portion related to the number of orders processed. The fixed portion of office expense is $3,000,000 annually and is incurred uniformly throughout the year.

- Subsequent to the adoption of the annual budget for the current year, SoftGro decided to open a new sales territory. As a consequence, approval was given to hire six additional sales people effective November 1. Porter decided that these additional six people should be recognized in her revised report.

- Per diem reimbursement to the sales force, while a fixed amount per day, is variable with the number of sales personnel and the number of days spent traveling. SoftGro’s original budget was based on an average sales force of 90 people throughout the year with each salesperson traveling 15 days per month.

- The company’s shipping expense is a semi variable cost with the variable portion, $3.00 per unit, dependent on the number of units sold. The fixed portion is incurred uniformly throughout the year.

Required:

- 1. Citing the benefits of flexible budgeting, explain why Susan Porter would propose that Soft Grouse flexible budgeting in this situation.

- 2. Prepare a revised Monthly Selling Expense Report for November that would permit Mark Fletcher to more clearly evaluate SoftGro’s control over selling expenses. The report should have a line for each selling expense item showing the appropriate budgeted amount, the actual selling expense, and the monthly dollar variance.

Trending nowThis is a popular solution!

Chapter 11 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- If $27,000 was generated from operations, $15,000 was used for investing activities, and $11,000 was provided by financing activities, the cash balance would:arrow_forwardWhat is its ROE? Provide answer general accountingarrow_forwardhello teacher please solve questions financial accountingarrow_forward

- Nonearrow_forwardIf $27,000 was generated from operations, $15,000 was used for investing activities, and $11,000 was provided by financing activities, the cash balance would: help mearrow_forwardA stock is expected to pay a dividend of $2.75 at the end of the year and it should continue to grow at a constant rate of 5% a year. If its required return is 15%, what is the stock’s expected price 3 years from now? Carnes Cosmetics Co.’s stock price is $30, and it recently paid a dividend of $1.00. This dividend is expected to grow by 30% for the next three years, then grow forever at a constant rate of g%. If the company’s required rate of return is 9%, at what constant rate is the stock expected to grow after three years? Foodpanda is expected to pay the following dividends over the next four years: $5, $7, $3.75, and $4.26. Afterwards, the company pledges to maintain a constant 4.25% growth in dividends forever. If the required return on the stock is 9%, what is the current share price? Cardinal Corporation just paid a dividend of $15. However, the management expects to reduce the payout by 2% per year, indefinitely. If you require a return of 10% on this stock, how…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning