Concept explainers

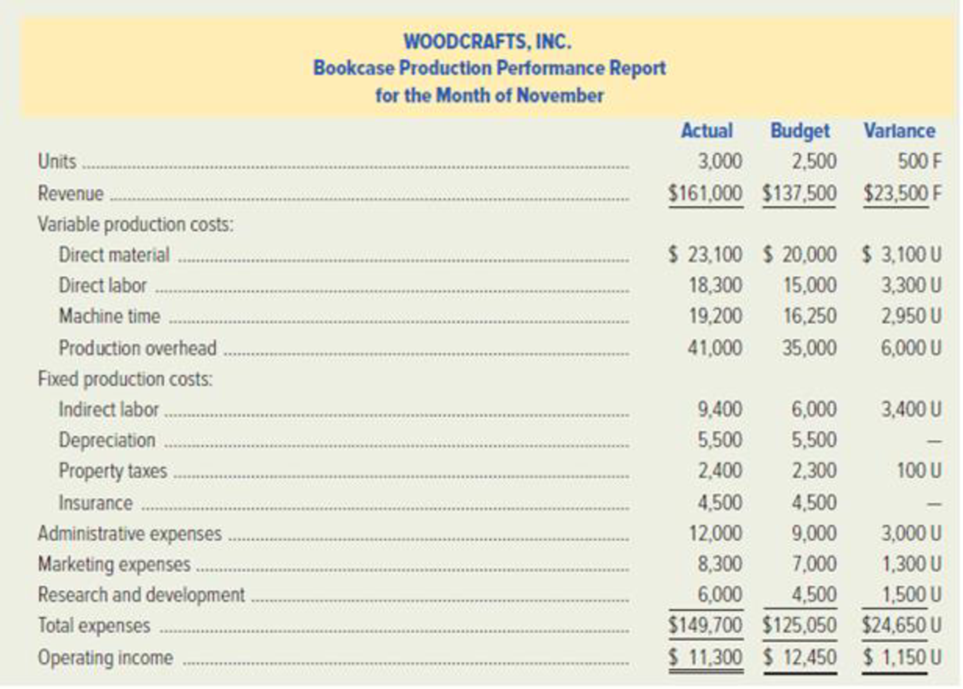

WoodCrafts, Inc. is a manufacturer of furniture for specialty shops throughout the Northeast and has an annual sales volume of $12 million. The company has four major product lines: bookcases, magazine racks, end tables, and bar stools. Each line is managed by a production manager. Since production is spread fairly evenly over the 12 months of operation. Sara McKinley, WoodCrafts’ controller, has pre pared an annual budget divided into 12 periods for monthly reporting purposes.

WoodCrafts uses a standard-costing system and applies variable

While distributing the monthly reports at the meeting, McKinley remarked to Clark, “We need to talk about getting your division back on track. Be sure to see me after the meeting.”

Clark had been so convinced that his division did well in November that McKinlcy’s remark was a real surprise. He spent the balance of the meeting avoiding the looks of his fellow managers and trying to figure out what could have gone wrong. The monthly performance report was no help.

Required:

- 1. a. Identify three weaknesses in WoodCrafts, Inc.’s monthly Bookcase Production Performance Report.

b. Discuss the behavioral implications of Sara McKinley’s remarks to Steve Clark during the meeting.

- 2. WoodCrafts, Inc. could do a better job of reporting monthly performance to the production managers.

- a. Recommend how the report could be improved to eliminate weaknesses, and revise it accordingly.

- b. Discuss how the recommended changes in reporting are likely to affect Steve Clark’s behavior.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- Please give me answer accountingarrow_forwardPlease correct answer with accounting questionarrow_forwardA company has decided to purchase equipment, needing to borrow $100,000 from its local bank to make the purchase. The bank gives the company two options: (a) 60-month installment note with 4% interest or (b) 120-month installment note with 8% interest. Lenders often charge a higher interest rate for longer-term loans to compensate for additional risk of lending for a longer time period. Record $100,000 cash received from the issuance of the 120-month installment note with 8% interest.Record $100,000 cash received from the issuance of the 120-month installment note with 8% interest. Select the options to display a 120-month installment note with 12% interest. How much of the principal amount is due after the 60th payment?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning