Concept explainers

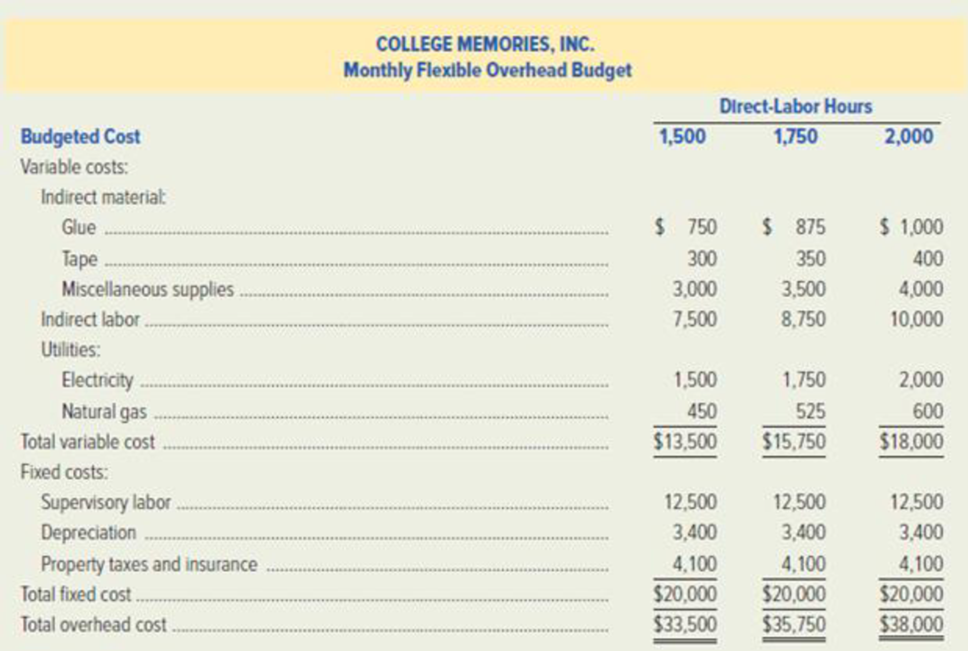

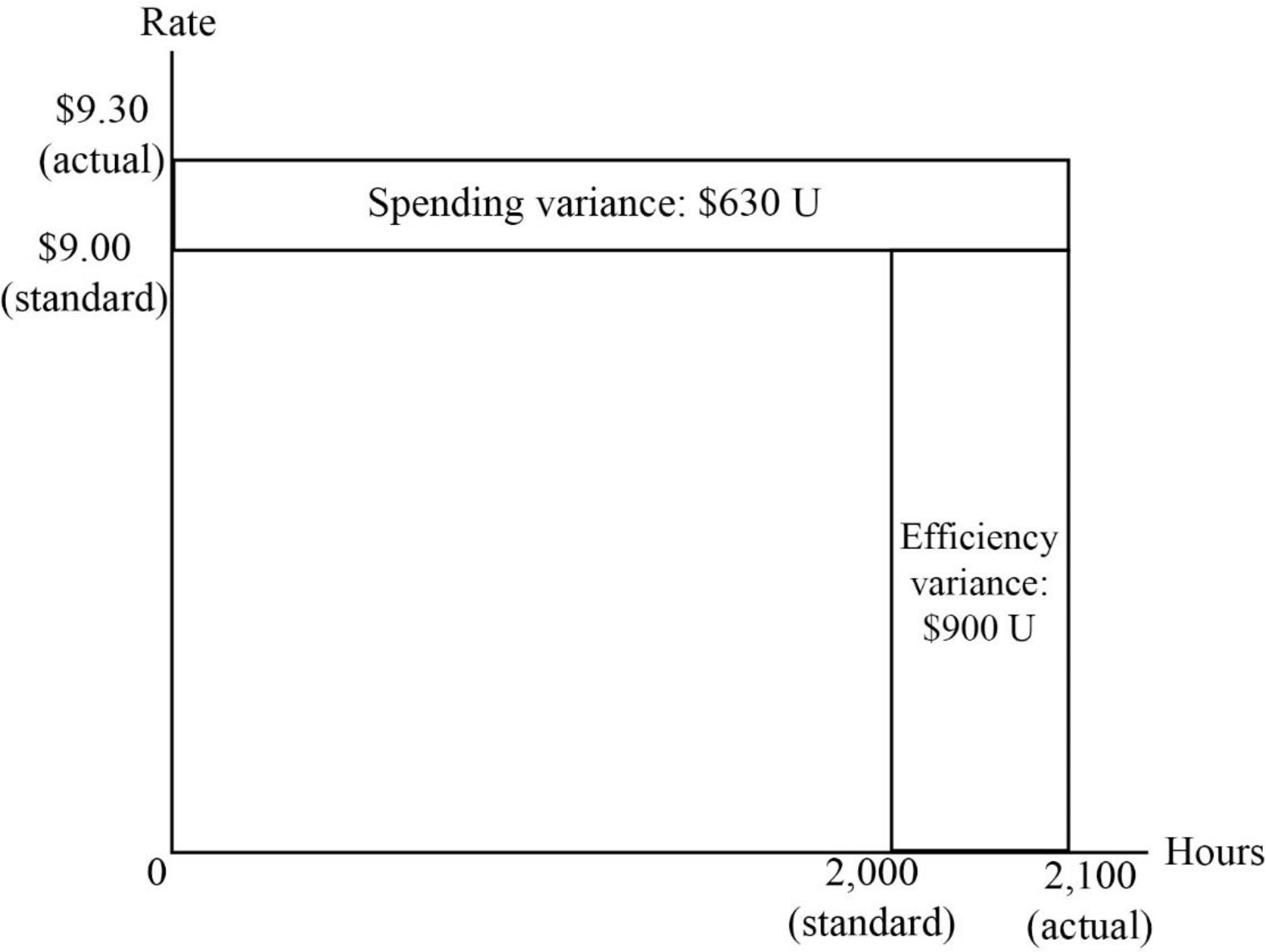

College Memories, Inc. publishes college yearbooks. A monthly flexible

The planned monthly production is 6,400 yearbooks. The standard direct-labor allowance is .25 hour per book and overhead is budgeted and applied on the basis of direct-labor hours. During February, College Memories, Inc. produced 8.000 yearbooks and actually used 2,100 direct-labor hours. The actual overhead costs for the month were as follows:

Required:

- 1. Determine the formula-style flexible overhead budget for College Memories. Inc.

- 2. Prepare a display similar to Exhibit 11–6, which shows College Memories’ variable-overhead variances for February. Indicate whether each variance is favorable or unfavorable.

- 3. Draw a graph similar to Exhibit 11–7, which shows College Memories’ variable-overhead variances for February.

- 4. Interpret each of the variances computed in requirement (2).

- 5. Prepare a display similar to Exhibit 11–8, which shows College Memories’ fixed-overhead variances for February.

- 6. Draw a graph similar to Exhibit 11–9, which depicts the company’s applied and budgeted fixed overhead for February. Show the firm’s February volume variance on the graph.

- 7. Interpret each of the variances computed in requirement (5).

- 8. Prepare

journal entries to record each of the following:- Incurrence of February’s actual overhead cost.

- Application of February’s overhead cost to Work-in-Process Inventory.

- Close underapplied or overapplied overhead into Cost of Goods Sold.

- 9. Draw T-accounts for all of the accounts used in the journal entries of requirement (8). Then

post the journal entries to the T-accounts.

1.

Compute the formula-style flexible overhead budget for incorporation C.

Explanation of Solution

Flexible Budget: A flexible budget is a budget that is prepared for different levels of the output. In other words, it is a budget that adjusts according to the changes in the volume of the activity. The main purpose of preparing flexible budget is to determine the differences among standard and actual result.

The formula-style flexible overhead budget for incorporation C is as follows:

Working note (1):

Compute the standard variable-overhead rate:

Note: X denotes the activity measured in direct-labor hours.

2.

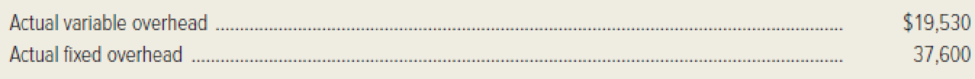

Prepare a diagram showing variable-overhead variances for the month of February and indicate whether each variance is favorable or unfavorable.

Explanation of Solution

Prepare a diagram showing variable-overhead variances for the month of February and indicate whether each variance is favorable or unfavorable as follows:

Figure (1)

Working note (2):

Compute the actual variable overhead rate:

Note:

Variable overhead applied to work-in-process is not used to compute the variances. However, it is included to point out that the flexible-budget amount for variable overhead of $18,000, is the amount that will be applied to Work-in-Process inventory for product.

3.

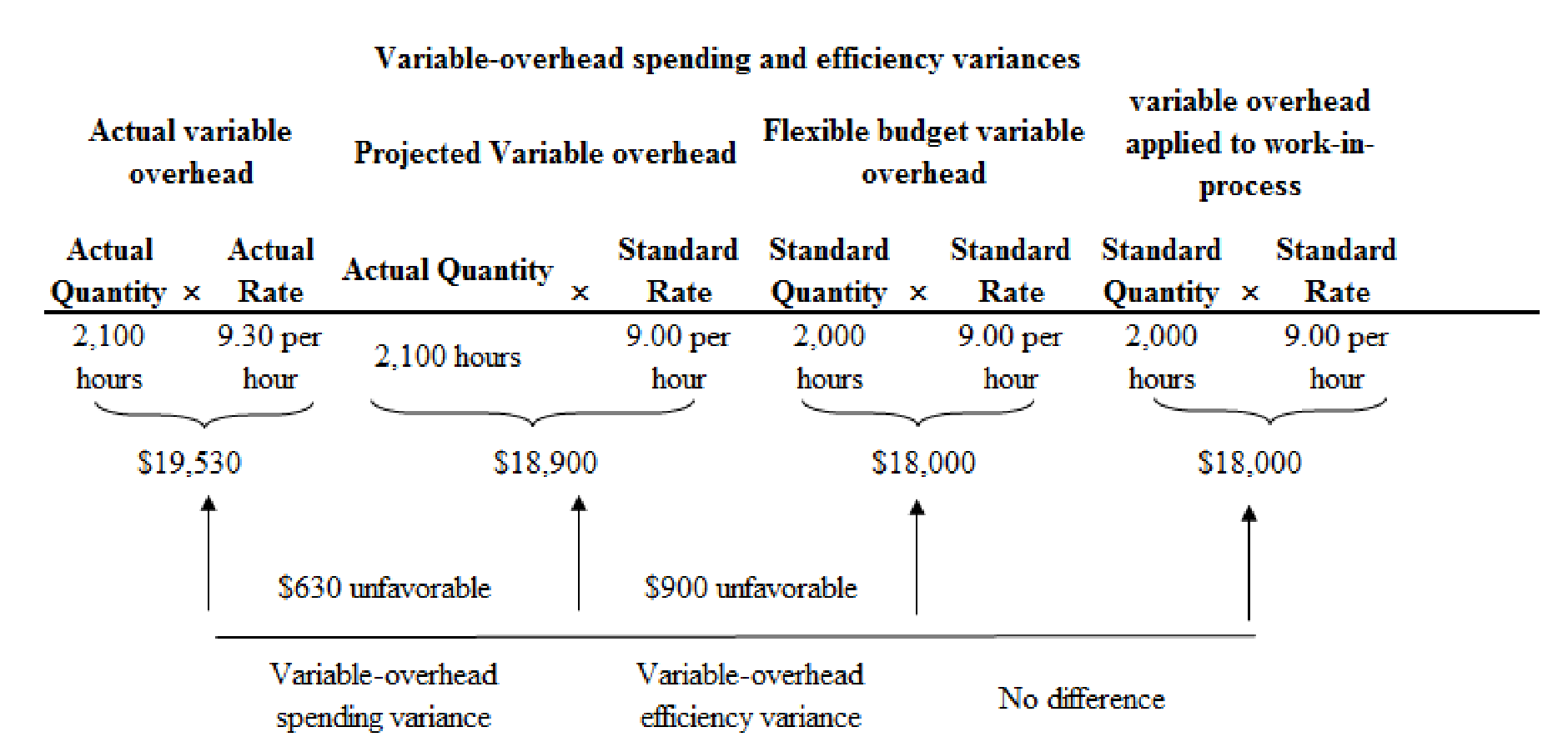

Draw a graph showing variable-overhead variances for the month of February.

Explanation of Solution

Draw a graph showing variable-overhead variances for the month of February as follows:

Figure (2)

4.

Interpret each variances calculated in requirement (2).

Explanation of Solution

- The variable-overhead spending is $630 and it is an unfavorable variance, which indicates that the company has spent more money on variable overhead in the month of February than it should have been spent, for 2,100 direct-labor hours that were used. This is the control variance for variable overhead.

- In this case, the actual direct-labor hours of February exceed the standard allowed direct-labor hours hence it results in a an unfavorable variable-overhead efficiency variance of $900. Thus, the variable-overhead efficiency variance will not disclose any information about the efficiency with which variable-overhead items such as electricity are used. Instead, it results from inefficiency or efficiency, in relation to the standards, in the usage of the cost driver (such as direct-labor hours).

5.

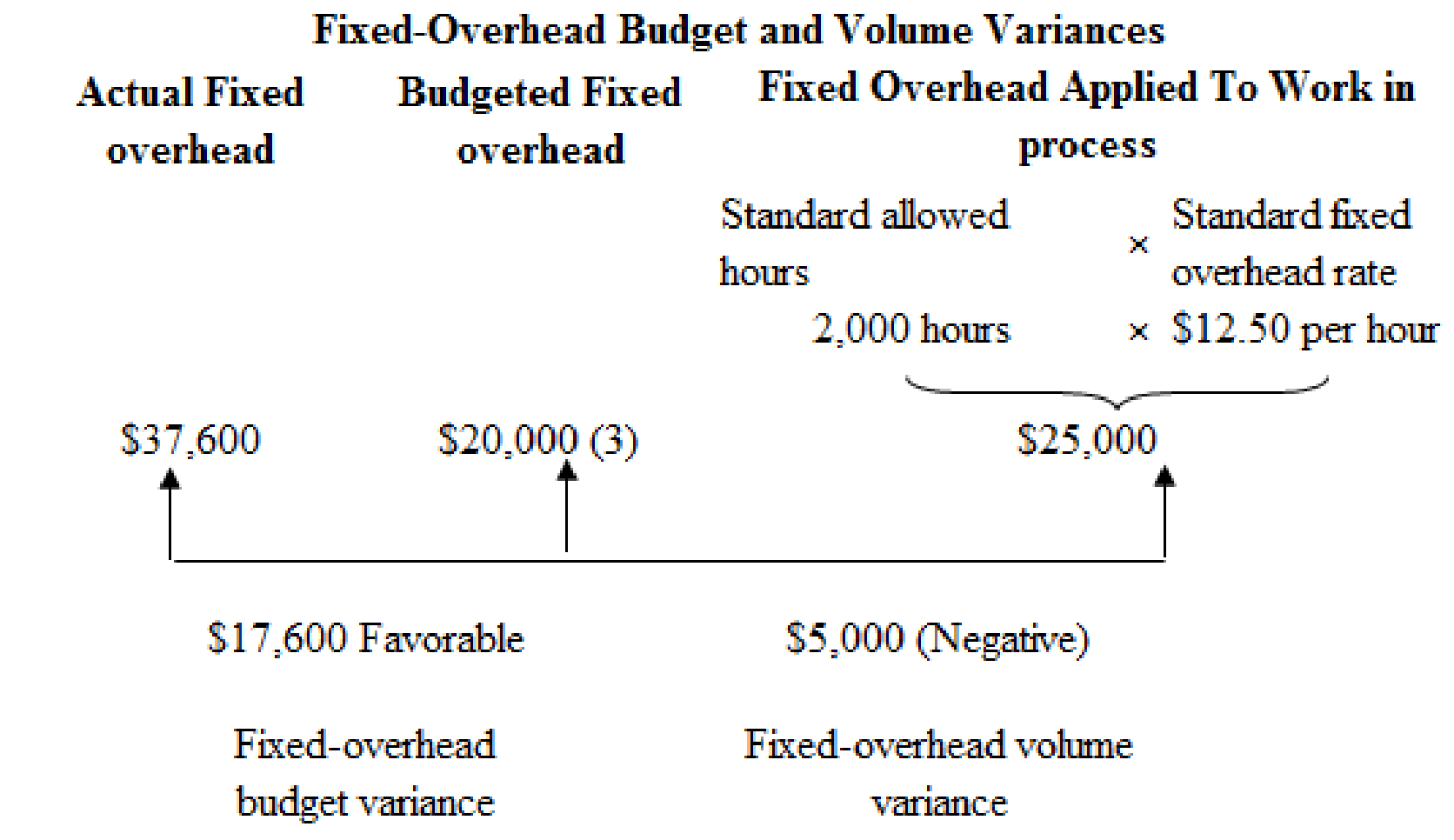

Prepare a diagram showing fixed-overhead variances for the month of February and indicate whether each variance is favorable or unfavorable.

Explanation of Solution

Prepare a diagram showing fixed-overhead variances for the month of February and indicate whether each variance is favorable or unfavorable as follows:

Figure (3)

Working note (3):

Compute the standard fixed overhead rate:

Note: Some accountants would designate a positive volume variance as "unfavorable" and a negative volume variance as "favorable.

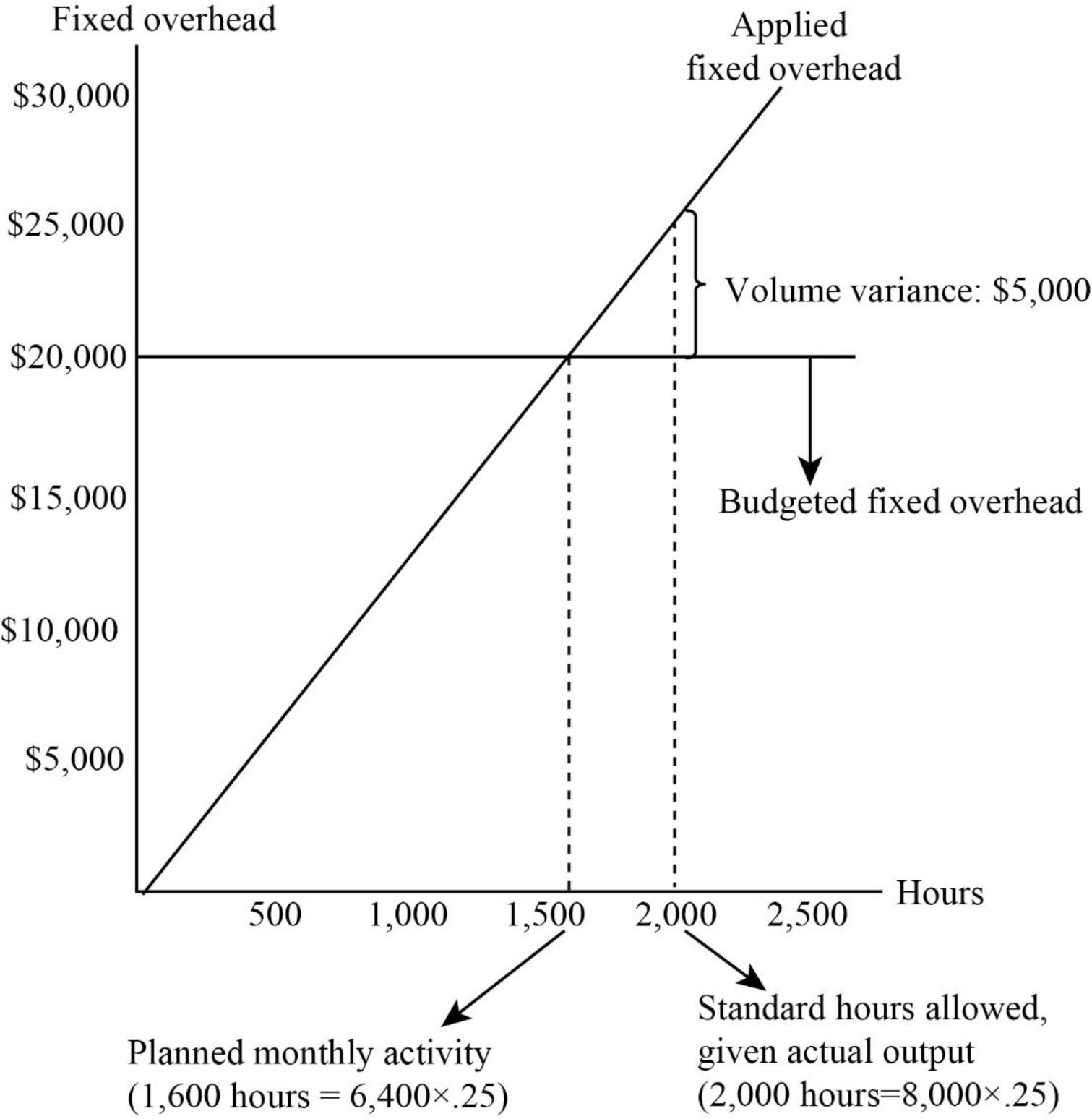

6.

Draw a graph that portrays the company’s applied overhead and budgeted fixed overhead for the month of February, also show the firm’s February volume variance on the graph.

Explanation of Solution

Draw a graph that portrays the company’s applied overhead and budgeted fixed overhead for the month of February, also show the firm’s February volume variance on the graph:

Figure (4)

7.

Interpret each variances ascertained in requirement (5).

Explanation of Solution

- In this case, the actual fixed overhead exceeded the budgeted fixed overhead by $17,600. Hence, there is an unfavorable fixed-overhead budget variance of $17,600.

- The volume variance is the difference between budgeted monthly fixed overhead ($20,000) and the applied fixed overhead ($25,000). The budgeted fixed overhead is used for planning and controlling purposes whereas, the applied fixed overhead graph is used for product costing purposes. In this case, the applied fixed overhead exceeds the budgeted fixed overhead hence there is a negative volume variance of $5,000.

8.

Prepare journal entries to record the given transaction.

Explanation of Solution

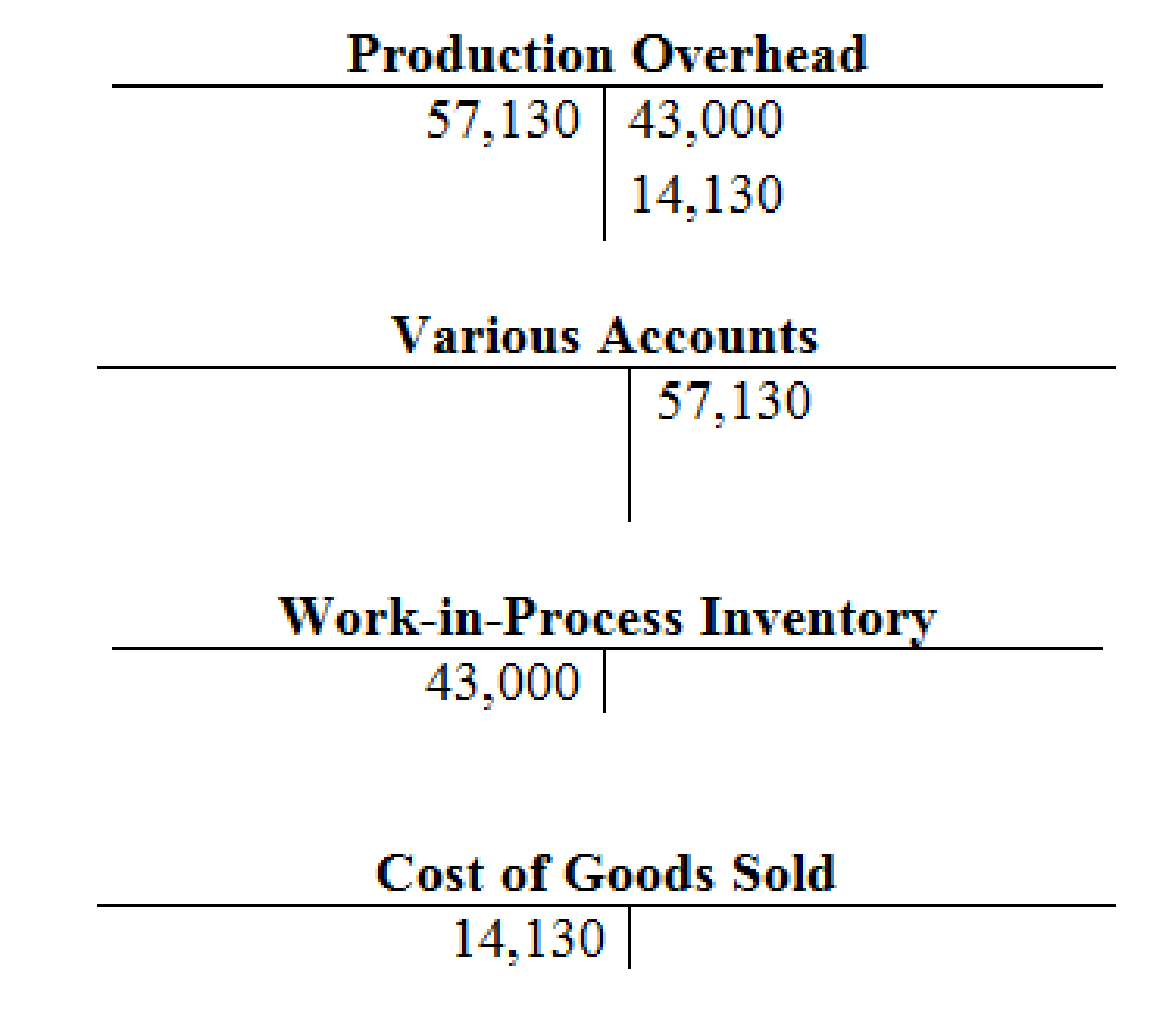

- Prepare journal entry to record the actual overhead costs:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Production overhead (4) | 57,130 | ||

| Various Accounts | 57,130 | ||

| (To record the actual overhead costs) |

Table (1)

- Production overhead is an asset account and it increases the value of an asset. Hence, debit production overhead account with $57,130.

- A various account is an asset account, and it decreases the value of an assets. Hence, credit the various account with $57,130.

Working note (4):

Calculate the raw materials inventory:

- Prepare journal entry to record the work-in-process inventory:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Work-in-Process Inventory (5) | 43,000 | ||

| Production overhead | 43,000 | ||

| (To record the applied production overhead) |

Table (2)

- Work-in-process inventory is an asset account, and it increases the value of asset. Hence, debit the work-in-process inventory account with $43,000.

- Production overhead is an asset account and it decreases the value of an asset. Hence, credit production overhead account with $43,000.

Working note (5):

Prepare journal entry to record the cost of goods sold:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Cost of goods sold | 14,130 | ||

| Production Overhead | 14,130 | ||

| (To record the under-applied overhead into cost of goods sold) |

Table (3)

- Cost of goods sold is an expense account and it decreases the value of stockholder’s equity. Hence, debit the cost of goods sold account with $14,130.

- Production overhead is an asset account and it decreases the value of an asset. Hence, credit production overhead account with $14,130.

9.

Draw T-accounts for the journal entries given in requirement (8).

Explanation of Solution

Draw T-accounts for the journal entries given in requirement (8) as follows:

Figure (5)

Want to see more full solutions like this?

Chapter 11 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- Salisbury Bottle Company manufactures plastic two-liter bottles for the beverage industry. The cost standards per 100 two-liter bottles are as follows: At the beginning of March, Salisburys management planned to produce 500,000 bottles. The actual number of bottles produced for March was 525,000 bottles. The actual costs for March of the current year were as follows: a. Prepare the March manufacturing standard cost budget (direct labor, direct materials, and factory overhead) for Salisbury, assuming planned production. b. Prepare a budget performance report for manufacturing costs, showing the total cost variances for direct materials, direct labor, and factory overhead for March. c. Interpret the budget performance report.arrow_forwardNashler Company has the following budgeted variable costs per unit produced: Budgeted fixed overhead costs per month include supervision of 98,000, depreciation of 76,000, and other overhead of 245,000. Required: 1. Prepare a flexible budget for all costs of production for the following levels of production: 160,000 units, 170,000 units, and 175,000 units. 2. What is the per-unit total product cost for each of the production levels from Requirement 1? (Round each unit cost to the nearest cent.) 3. What if Nashler Companys cost of maintenance rose to 0.22 per unit? How would that affect the unit product costs calculated in Requirement 2?arrow_forwardA company estimates its manufacturing overhead will be $840,000 for the next year. What is the predetermined overhead rate given each of the following Independent allocation bases? Budgeted direct labor hours: 90,615 Budgeted direct labor expense: $750000 Estimated machine hours: 150,000arrow_forward

- If a factory operates at 100% of capacity one month, 90% of capacity the next month, and 105% of capacity the next month, will a different cost per unit be charged to the work-in-process account each month for factory overhead assuming that a predetermined annual overhead rate is used?arrow_forwardLens Junction sells lenses for $45 each and is estimating sales of 15,000 units in January and 18,000 in February. Each lens consists of 2 pounds of silicon costing $2.50 per pound, 3 oz of solution costing $3 per ounce, and 30 minutes of direct labor at a labor rate of $18 per hour. Desired inventory levels are: Â Prepare a sales budget, production budget. direct materials budget for silicon and solution, and a direct labor budget.arrow_forwardThe sales department of F. Pollard Manufacturing Co. has forecast sales in March to be 20,000 units. Additional information follows: Materials used in production: Prepare the following: a. A production budget for March (in units). b. A direct materials budget for the month (in units and dollars).arrow_forward

- Business Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per pound of direct materials is 1.60. The standard rate for labor is 8.00. Overhead is applied on the basis of direct labor hours. A plantwide rate is used. Budgeted overhead for the year is as follows: The company expects to work 12,000 direct labor hours during the year; standard overhead rates are computed using this activity level. For every small stapler produced, the company produces two regular staplers. Actual operating data for the year are as follows: a. Units produced: small staplers, 35,000; regular staplers, 70,000. b. Direct materials purchased and used: 56,000 pounds at 1.5513,000 for the small stapler and 43,000 for the regular stapler. There were no beginning or ending direct materials inventories. c. Direct labor: 14,800 hours3,600 hours for the small stapler and 11,200 hours for the regular stapler. Total cost of direct labor: 114,700. d. Variable overhead: 607,500. e. Fixed overhead: 350,000. Required: 1. Prepare a standard cost sheet showing the unit cost for each product. 2. Compute the direct materials price and usage variances for each product. Prepare journal entries to record direct materials activity. 3. Compute the direct labor rate and efficiency variances for each product. Prepare journal entries to record direct labor activity. 4. Compute the variances for fixed and variable overhead. Prepare journal entries to record overhead activity. All variances are closed to Cost of Goods Sold. 5. Assume that you know only the total direct materials used for both products and the total direct labor hours used for both products. Can you compute the total direct materials and direct labor usage variances? Explain.arrow_forwardCase made 24,500 units during June, using 32,000 direct labor hours. They expected to use 31,450 hours per the standard cost card. Their employees were paid $15.75 per hour for the month of June. The standard cost card uses $15.50 as the standard hourly rate. A. Compute the direct labor rate and time variances for the month of June, and also calculate the total direct labor variance. B. If the standard rate per hour was $16.00, what would change?arrow_forwardAdam Corporation manufactures computer tables and has the following budgeted indirect manufacturing cost information for the next year: If Adam uses the step-down (sequential) method, beginning with the Maintenance Department, to allocate support department costs to production departments, the total overhead (rounded to the nearest dollar) for the Machining Department to allocate to its products would be: a. 407,500. b. 422,750. c. 442,053. d. 445,000.arrow_forward

- Calculating factory overhead The normal capacity of a factory is 10,000 units per month. Cost and production data follow: Calculate the amount of factory overhead allowed for the actual volume of production each month and the variance between budgeted and actual overhead for each month.arrow_forwardThomas Textiles Corporation began November with a budget for 60,000 hours of production in the Weaving Department. The department has a full capacity of 75,000 hours under normal business conditions. The budgeted overhead at the planned volumes at the beginning of November was as follows: The actual factory overhead was 725,000 for November. The actual fixed factory overhead was as budgeted. During November, the Weaving Department had standard hours at actual production volume of 64,500 hours. a. Determine the variable factory overhead controllable variance. b. Determine the fixed factory overhead volume variance.arrow_forwardDouglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred: Marston applies overhead using rates based on direct labor hours, machine hours, number of moves, and number of batches. The second level of activity (the right column in the preceding table) is the practical level of activity (the available activity for resources acquired in advance of usage) and is used to compute predetermined overhead pool rates. Required: 1. Prepare a performance report for Marstons manufacturing costs in the current year. 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost. 3. One of Marstons managers said the following: Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at 10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of 30,000 per year. Also, I know that fuel costs about 0.25 per move. Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning