Concept explainers

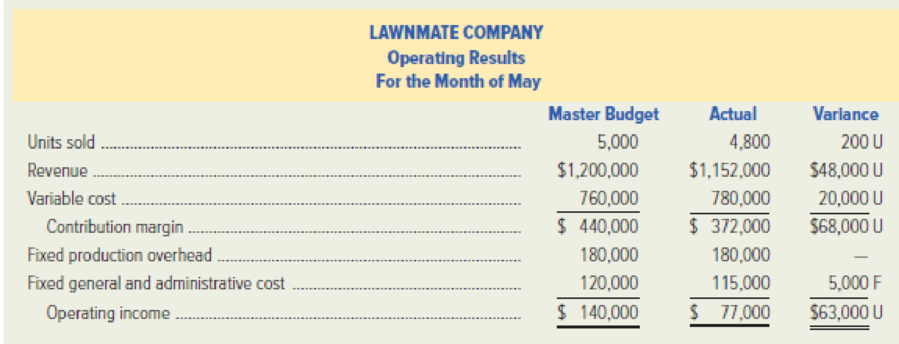

LawnMate Company manufactures power mowers that are sold throughout the United States and Canada. The company uses a comprehensive budgeting process and compares actual results to budgeted amounts on a monthly basis. Each month, LawnMate’s accounting department prepares a

When the

The total variable costs of $780,000 for May include $320,000 for direct material, $192,000 for direct labor, $176,000 for variable production overhead, and $92,000 for variable selling expenses. Ballard believes that LawnMate’s monthly reports would be more meaningful to everyone if the company adopted flexible budgeting and prepared more detailed analyses.

Required:

- 1. Prepare a flexible budget for LawnMate Company for the month of May that includes separate variable-cost budgets for each type of cost (direct material, etc.).

- 2. Determine the variance between the flexible budget and actual cost for each cost item.

- 3. Discuss how the revised

budget and variance data are likely to impact the behavior of Al Richmond, the production manager. - 4. Build a spreadsheet: Construct an Excel spreadsheet to solve requirements (1) and (2) above. Show how the solution will change if the following information changes: actual sales amounted to 4,700 units, and actual fixed overhead was $179,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- As part of its cost control program, Tracer Company uses a standard costing system for all manufactured items. The standard cost for each item is established at the beginning of the fiscal year, and the standards are not revised until the beginning of the next fiscal year. Changes in costs, caused during the year by changes in direct materials or direct labor inputs or by changes in the manufacturing process, are recognized as they occur by the inclusion of planned variances in Tracers monthly operating budgets. The following direct labor standard was established for one of Tracers products, effective June 1, 2012, the beginning of the fiscal year: The standard was based on the direct labor being performed by a team consisting of five persons with Assembler A skills, three persons with Assembler B skills, and two persons with machinist skills; this team represents the most efficient use of the companys skilled employees. The standard also assumed that the quality of direct materials that had been used in prior years would be available for the coming year. For the first seven months of the fiscal year, actual manufacturing costs at Tracer have been within the standards established. However, the company has received a significant increase in orders, and there is an insufficient number of skilled workers to meet the increased production. Therefore, beginning in January, the production teams will consist of eight persons with Assembler A skills, one person with Assembler B skills, and one person with machinist skills. The reorganized teams will work more slowly than the normal teams, and as a result, only 80 units will be produced in the same time period in which 100 units would normally be produced. Faulty work has never been a cause for units to be rejected in the final inspection process, and it is not expected to be a cause for rejection with the reorganized teams. Furthermore, Tracer has been notified by its direct materials supplier that lower-quality direct materials will be supplied beginning January 1. Normally, one unit of direct materials is required for each good unit produced, and no units are lost due to defective direct materials. Tracer estimates that 6 percent of the units manufactured after January 1 will be rejected in the final inspection process due to defective direct materials. Required: 1. Determine the number of units of lower quality direct materials that Tracer Company must enter into production in order to produce 47,000 good finished units. 2. How many hours of each class of direct labor must be used to manufacture 47,000 good finished units? 3. Determine the amount that should be included in Tracers January operating budget for the planned direct labor variance caused by the reorganization of the direct labor teams and the lower quality direct materials. (CMA adapted)arrow_forwardThe controller for Muir Companys Salem plant is analyzing overhead in order to determine appropriate drivers for use in flexible budgeting. She decided to concentrate on the past 12 months since that time period was one in which there was little important change in technology, product lines, and so on. Data on overhead costs, number of machine hours, number of setups, and number of purchase orders are in the following table. Required: 1. Calculate an overhead rate based on machine hours using the total overhead cost and total machine hours. (Round the overhead rate to the nearest cent and predicted overhead to the nearest dollar.) Use this rate to predict overhead for each of the 12 months. 2. Run a regression equation using only machine hours as the independent variable. Prepare a flexible budget for overhead for the 12 months using the results of this regression equation. (Round the intercept and x-coefficient to the nearest cent and predicted overhead to the nearest dollar.) Is this flexible budget better than the budget in Requirement 1? Why or why not?arrow_forwardGreiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiner’s master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employer’s share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the company’s union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 25 percent of the following month’s projected sales in inventory. Information on the first four months of the coming year is as follows: January February March April Estimated unit sales 37,000 34,600 39,600 40,400 Sales price per unit $80 $80 $76 $76 Direct labor hours per unit 2.70 2.70 2.40 2.40 Direct labor hourly rate $17 $17 $18…arrow_forward

- Greiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiner’s master budget and has assembled the fol-lowing data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employer’s share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the company’s union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 35 percent of the following month’s projected sales in inventory. Information on the first four months of the coming year is as follows: Required:1. Prepare the following monthly budgets for Greiner Company for the first quarter of thecoming year. Be sure to show supporting calculations.a. Production budget in unitsb. Direct labor budget in hours c.…arrow_forwardSheridan Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes. As part of its annual budgeting process, Sheridan is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be assigned to each product line. The following information relates to overhead. Units planned for production Material moves per product line Purchase orders per product line Direct labor hours per product line Manufacturing overhead $ eTextbook and Media Material handling costs $ Purchasing activity costs $ (c) Mobile Safes Mobile Safe The total estimated manufacturing overhead was $270,000. Under traditional costing (which assigns overhead on the basis of direct labor hours), what amount of manufacturing overhead costs are assigned to: (Round answers to 2 decimal places, e.g. 15.25.) Well, in fata 200 $ 350 ९ 500 900 Walk-In Safes 1. One mobile safe 2. What amount of purchasing activity costs are assigned to:…arrow_forwardThe Terminator Inc. provides on-site residential pest extermination services. The company has severalmobile teams who are dispatched from a central location in company-owned trucks. The company usesthe number of jobs to measure activity. At the beginning of April, the company budgeted for 100 jobs, butthe actual number of jobs turned out to be 105. A report comparing the budgeted revenues and costs to theactual revenues and costs appears below:The Terminator Inc.Variance ReportFor the Month Ended April 30Planning ActualBudget Results VariancesJobs ............................................ 100 105Revenue ...................................... $19,500 $20,520 $1,020 FExpenses:Mobile team operating costs ..... 10,000 10,320 320 UExterminating supplies ............ 1,800 960 840 FAdvertising ............................... 800 800 0Dispatching costs .................... 2,200 2,340 140 UOffice rent ................................ 1,800 1,800 0Insurance .................................…arrow_forward

- Crane Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes. As part of its annual budgeting process, Crane is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be assigned to each product line. The information shown below relates to overhead. Units planned for production Material moves per product line Purchase orders per product line Direct labor hours per product line Mobile Safes 200 300 450 800 Walk-in Safes 50 200 350 1,700arrow_forwardSunland Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes. As part of its annual budgeting process, Sunland is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be assigned to each product line. The information shown below relates to overhead, Units planned for production Material moves per product line Purchase orders per product line Direct labor hours per product line (1) One mobile safe (2) Mobile Safes One walk-in safe 200 300 450 800 Walk-in Safes 435.2 50 The total estimated manufacturing overhead was $272,000. Under traditional costing (which assigns overhead on the basis of direct labor hours), what amount of manufacturing overhead costs are assigned to: (Round answers to 2 decimal places, e.g. 12.25.) 200 350 1.700 per unit per unitarrow_forwardSeveral years ago, Westmont Corporation developed a comprehensive budgeting system for planning and control purposes. While departmental supervisors have been happy with the system, the factory manager has expressed considerable dissatisfaction with the information being generated by the system. A report for the company's Assembly Department for the month of March follows: Assembly Department Cost Report For the Month Ended March 31 Machine-hours Variable costs: Supplies Scrap Indirect materials Fixed costs: Wages and salaries Equipment depreciation Total cost Actual Results 25,000 Planning Budget Variances 30,000 $ 5,700 $ 6,300 $ 600 F 15,400 16,500 1,100 F 50,600 57,000 6,400 F 63,100 61,000 2,100 U 91,000 91,000 $ 225,800 $ 231,800 $ 6,000 F After receiving a copy of this cost report, the supervisor of the Assembly Department stated, "These reports are super. It makes me feel really good to see how well things are going in my department. I can't understand why those people upstairs…arrow_forward

- Fire King manufactures safes- mobile safes, and walk-in stationary bank safes. As part of its annual budgeting process, Custer is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be allocated to each product line. The following information relates to overhead. (a) The total estimated manufacturing overhead was $235,000. Under traditional costing (which assigns overhead on the basis of direct-labor hours), what amount of manufacturing overhead costs are assigned to One mobile safe? The total estimated manufacturing overhead of $235,000 was comprised of $150,000 for material-handling costs and $85,000 for purchasing activity costs. Under activity-based costing (ABC): (b) What amount of material handling costs are assigned to One mobile safe? (c) What amount of purchasing activity costs are assigned to One mobile safe?arrow_forwardSwifty Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes. As part of its annual budgeting process, Swifty is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be assigned to each product line. The information shown below relates to overhead. Units planned for production Material moves per product line Purchase orders per product line Direct labor hours per product line (a) (1) One mobile safe $ (2) Your answer is correct. (b1) eTextbook and Media (a) One walk-in safe (b) The total estimated manufacturing overhead was $260,000. Under traditional costing (which assigns overhead on the basis of direct labor hours), what amount of manufacturing overhead costs are assigned to: (Round answers to 2 decimal places, e.g. 12.25.) One mobile safe $ One walk-in safe Mobile Safes Walk-in Safes $ 200 $ 300 450 800 416 50 3,536 200 The total estimated manufacturing overhead of $260,000 was…arrow_forwardPlease show your work.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning