Concept explainers

Business Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows:

The standard price paid per pound of direct materials is $1.60. The standard rate for labor is $8.00.

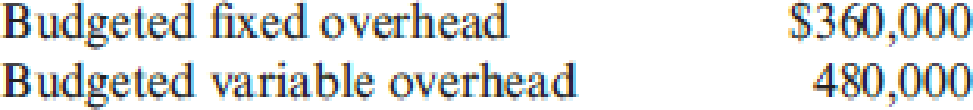

The company expects to work 12,000 direct labor hours during the year; standard overhead rates are computed using this activity level. For every small stapler produced, the company produces two regular staplers.

Actual operating data for the year are as follows:

- a. Units produced: small staplers, 35,000; regular staplers, 70,000.

- b. Direct materials purchased and used: 56,000 pounds at $1.55—13,000 for the small stapler and 43,000 for the regular stapler. There were no beginning or ending direct materials inventories.

- c. Direct labor: 14,800 hours—3,600 hours for the small stapler and 11,200 hours for the regular stapler. Total cost of direct labor: $114,700.

- d. Variable overhead: $607,500.

- e. Fixed overhead: $350,000.

Required:

- 1. Prepare a

standard cost sheet showing the unit cost for each product. - 2. Compute the direct materials price and usage variances for each product. Prepare

journal entries to record direct materials activity. - 3. Compute the direct labor rate and efficiency variances for each product. Prepare journal entries to record direct labor activity.

- 4. Compute the variances for fixed and variable overhead. Prepare journal entries to record overhead activity. All variances are closed to Cost of Goods Sold.

- 5. Assume that you know only the total direct materials used for both products and the total direct labor hours used for both products. Can you compute the total direct materials and direct labor usage variances? Explain.

1.

Prepare a standard cost sheet and show the unit cost for each product.

Explanation of Solution

Standard Cost: An estimated cost which is used for delivering a product under normal condition and it determine the performance of the company is called standard cost. The standard cost is expected cost which can be taken to compare with the actual cost to measure the operating efficiency of the company.

Prepare a standard cost sheet and show the unit cost for each product:

Small staplers:

| Particulars | Standard Price ($) | Standard Usage | Standard Cost ($) |

| (a) | (b) | ||

| Direct materials | 1.60 | 0.375 lb | 0.60 |

| Direct labor | 8.00 | 0.100 hr | .80 |

| Fixed overhead | 30.00 | 0.100 hr | 3.00 |

| Variable overhead | 40.00 | 0.100hr | 4.00 |

| Unit cost | $8.40 |

Table (1)

Regular staplers:

| Particulars | Standard Price ($) | Standard Usage | Standard Cost ($) |

| (a) | (b) | ||

| Direct materials | 1.60 | 0.625 lb. | 1.00 |

| Direct labor | 8.00 | 0.150 hr. | 1.20 |

| Fixed overhead | 30.00 | 0.150 hr. | 4.50 |

| Variable overhead | 40.00 | 0.150 hr. | 6.00 |

| Unit cost | $12.70 |

Table (1)

Working note 1: Calculate the standard usage for direct materials:

For small staplers:

Working note 2: Calculate the standard usage for direct materials:

For regular staplers:

Therefore, the standard cost for small staplers and regular staplers are $8.40 and $12.70 respectively.

2.

Calculate the direct materials price variance and the direct materials usage variance and prepare journal entries to record direct material activity.

Explanation of Solution

Direct material price variance: The variation in between actual price and estimated price paid for materials multiplied by the actual quantity is called material price variance. It is used to determine difference in price paid for material the price that was supposed to be paid for material.

The following formula is used to calculate direct material price variance:

Direct material usage (efficiency) variance: It is a measure that determines the variation in between actual and standard quantity of input multiplied by the standard unit price is called material usage variance.

The following formula is used to calculate direct material usage variance:

Compute the direct materials price variance:

Compute the direct materials usage variance:

For small staplers:

For regular staplers:

Prepare journal entries to record direct material activity:

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Direct Materials | 89,600 | ||

| Direct Materials Price variance | 2,800 | ||

| Accounts Payable | 86,800 | ||

| (To record the purchase of direct materials) | |||

| Work in Process | 91,000 | ||

| Direct Materials Usage Variance | 1,400 | ||

| Direct Materials | 89,600 | ||

| (To record the usage of direct materials) | |||

| Direct Materials Price variance | 2,800 | ||

| Direct Materials Usage Variance | 1,400 | ||

| Cost of Goods Sold | 4,200 | ||

| (To close the purchase and usage of direct materials) |

Table (2)

Therefore, the direct materials price variance and the usage variance is $200 F and $1,200 F respectively.

2.

Calculate the direct labor rate variance and labor efficiency variance and prepare journal entries to record direct material activity.

Explanation of Solution

Direct Labor Rate Variance: The direct labor rate variance is a measure to determine the variation in the estimated cost of the direct labor and the actual cost of the direct labor and is multiplied by the actual hours is called direct labor rate variance.

The following formula is used to calculate the direct labor rate variance:

Direct labor efficiency variance is a measure that determines the difference between the estimated labor hours and the actual labor hours used and is multiplied by the standard rate per hour is called material usage variance.

The following formula is used to calculate direct labor efficiency variance:

Calculate the direct labor rate variance:

Calculate the labor efficiency variance:

For small staplers:

Calculate the labor efficiency variance:

For regular staplers:

Prepare journal entries to record direct material activity:

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Work in Process | 112,000 | ||

| Direct Labor Efficiency Variance | 6,400 | ||

| Direct Labor Rate Variance | 3,700 | ||

| Wages Payable | 114,700 | ||

| (To record the use of direct labor) | |||

| Cost of Goods Sold | 2,700 | ||

| Direct Labor Rate Variance | 3,700 | ||

| Direct Labor Efficiency Variance | 6,400 | ||

| (To record the direct labor variances) |

Table (3)

Working note 3:

Calculate the amount of work-in process:

Therefore, the direct labor rat variance and the efficiency variance are $800 U and $5,600 U respectively.

3.

Calculate the fixed overhead spending and variable overhead and prepare journal entries to record overhead activity.

Explanation of Solution

Fixed overhead spending variance: It is the difference between actual fixed overhead and the budgeted fixed overhead.

Favorable variance occurs only when the fixed overhead is less than the budgeted overhead. Unfavorable variance occurs only when the fixed overhead is more than the budgeted overhead.

The following formula is used to calculate fixed overhead spending variance:

Fixed overhead volume variance: It is the difference between budgeted fixed overhead and the applied fixed overhead.

The following formula is used to calculate fixed overhead volume variance:

Calculate the fixed overhead spending variance:

Calculate the volume variance:

Step 1: Compute the applied fixed overhead.

Step 2: Compute the volume variance.

Working note 4: Calculate the standard fixed overhead rate:

Working note 5: Calculate the standard hours:

Overhead Variance: The overhead variance is the difference arising between the real overhead consumed in the production of a product, and the estimated overhead determined in the production of that product.

Spending variances: It arises when management pays an amount which is different from the standard price for purchasing an item. The variable overhead spending variance measures the total effect of differences in the actual variable overhead rate (AVOR) and the standard variable overhead rate (SVOR).

Efficiency variances: It arises when standard direct labor hours expected for actual production different from labor the actual direct labor hours used.

Variable overhead efficiency variance tells managers how much of the total variable manufacturing overhead variance is due to using more or fewer machine hours than anticipated for the actual volume of output.

Compute the variable overhead spending variance:

Step 1: Compute the budgeted variable overhead cost.

Step 2: Compute the variable overhead spending variance.

Compute the variable overhead efficiency variance:

Step 1: Compute the applied variable overhead.

Step 2: Compute the variable overhead efficiency variance.

Prepare journal entries to record overhead activity:

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Work in Process | 560,000 | ||

| Variable Overhead Control | 560,000 | ||

| (To close the overhead variances) | |||

| Work in Process | 420,000 | ||

| Fixed Overhead Control | 420,000 | ||

| (To close the overhead variances) | |||

| Variable Overhead Control | 607,500 | ||

| Miscellaneous Accounts | 607,500 | ||

| (To record incurrence of actual overhead) | |||

| Fixed Overhead Control | 350,000 | ||

| Miscellaneous Accounts | 350,000 | ||

| (To record incurrence of actual overhead) | |||

| Fixed Overhead Control | 70,000 | ||

| Variable Overhead Spending Variance | 15,500 | ||

| Variable Overhead Efficiency Variance | 32,000 | ||

| Fixed Overhead Spending Variance | 10,000 | ||

| Fixed Overhead Volume Variance | 60,000 | ||

| Variable Overhead Control | 47,500 | ||

| (To close the overhead variances) | |||

| Cost of Goods Sold | 47,500 | ||

| Variable Overhead Spending Variance | 15,500 | ||

| Variable Overhead Efficiency Variance | 32,000 | ||

| (To close the overhead variances) | |||

| Fixed Overhead Spending Variance | 10,000 | ||

| Fixed Overhead Volume Variance | 60,000 | ||

| Cost of Goods Sold | 70,000 | ||

| (To close the cost of goods sold) |

Table (3)

Therefore, the fixed overhead spending and volume variance are $10,000 F and $60,000 U respectively.

Therefore, the variable overhead spending and efficiency variance are $15,500 U and $32,000 U respectively.

5.

Calculate the total direct materials and direct labor usage variances.

Explanation of Solution

Calculate the total direct materials variances:

Calculate the total direct labor usage variances:

Therefore, the total direct materials and direct labor usage variances are $1,400 F and $6,400 U respectively.

Want to see more full solutions like this?

Chapter 9 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning