Concept explainers

Leather Works is a family-owned maker of leather travel bags and briefcases located in the northeastern part of the United States. Foreign competition has forced its owner, Heather Gray, to explore new ways to meet the competition. One of her cousins, Wallace Hayes, who recently graduated from college with a major in accounting, told her about the use of cost

In May of last year, Heather asked Matt Jones, chief accountant, and Alfred Prudest, production manager, to implement a

Recently, the following dialogue took place among Heather, Matt, and Alfred:

HEATHER: How is the business performing?

ALFRED: You know, we are producing a lot more than we used to, thanks to the contract that you helped obtain from Lean, Inc., for laptop covers. (Lean is a national supplier of computer accessories.)

MATT: Thank goodness for that new product. It has kept us from sinking even more due to the inroads into our business made by those foreign suppliers of leather goods.

HEATHER: What about the standard costing system?

MATT: The variances are mostly favorable, except for the first few months when the supplier of leather started charging more.

HEATHER: How did the union members take to the standards?

ALFRED: Not bad. They grumbled a bit at first, but they have taken it in stride. We’ve consistently shown favorable direct labor efficiency variances and direct materials usage variances. The direct labor rate variance has been flat.

MATT: It should be since direct labor rates are negotiated by the union representative at the start of the year and remain the same for the entire year.

HEATHER: Matt, would you send me the variance report for laptop covers immediately?

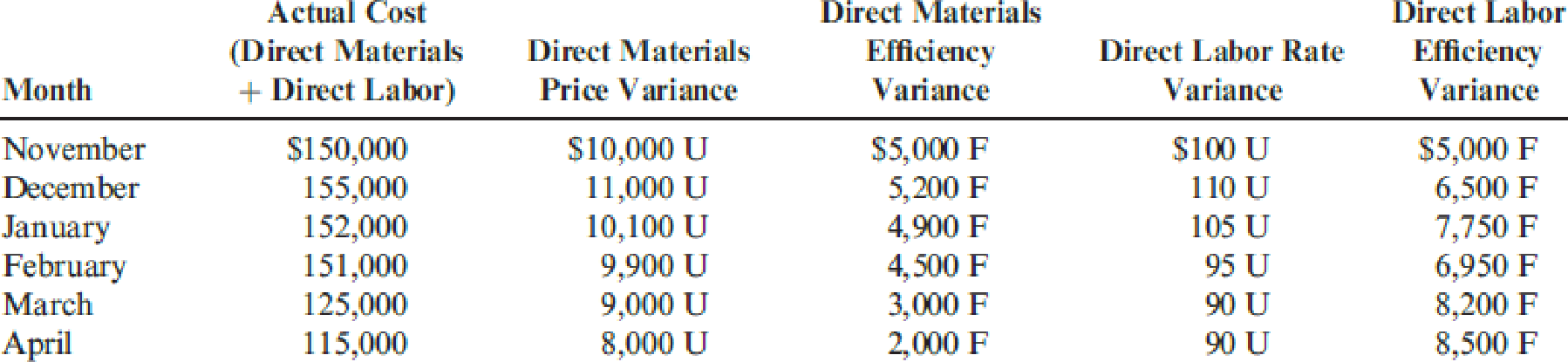

The following chart summarizes the direct materials and direct labor variances from November of last year through April of this year (extracted from the report provided by Matt). Standards for each laptop cover are as follows:

- a. Three feet of direct materials at $7.50 per foot

- b. Forty-five minutes of direct labor at $14 per hour

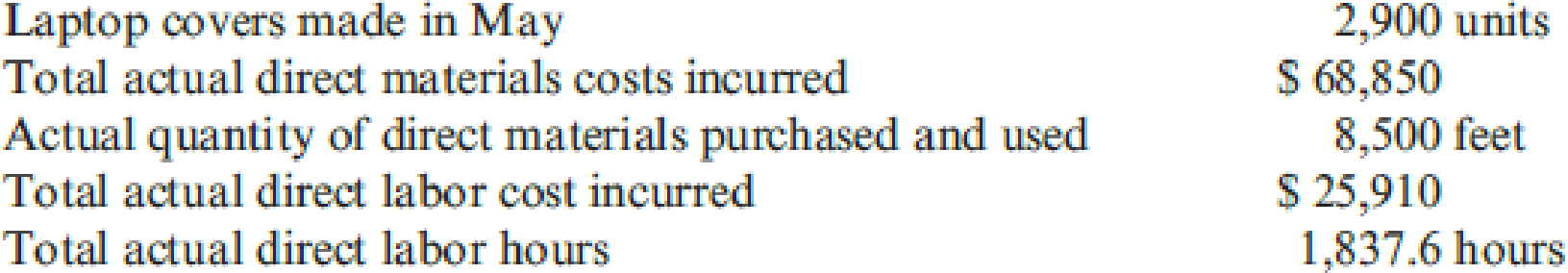

In addition, the data for May of this year, but not the variances for the month, are as follows:

Actual direct labor cost per hour exceeded the budgeted rate by $0.10 per hour.

Required:

- 1. For May of this year, calculate the price and quantity variances for direct labor and direct materials.

- 2. Discuss the trend of the direct materials and labor variances.

- 3. What type of actions must the workers have taken during the period they were being observed for the setting of standards?

- 4. What can be done to ensure that the standards are set correctly? (CMA adapted)

Trending nowThis is a popular solution!

Chapter 9 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning