Concept explainers

Firenza Company manufactures specialty tools to customer order. Budgeted

Previously, Sanjay Bhatt, Firenza Company’s controller, had applied overhead on the basis of machine hours. Expected machine hours for the coming year are 50,000. Sanjay has been reading about activity-based costing, and he wonders whether or not it might offer some advantages to his company. He decided that appropriate drivers for overhead activities are purchase orders for purchasing, number of setups for setup cost, engineering hours for engineering cost, and machine hours for other. Budgeted amounts for these drivers are 5,000 purchase orders, 500 setups, and 2,500 engineering hours.

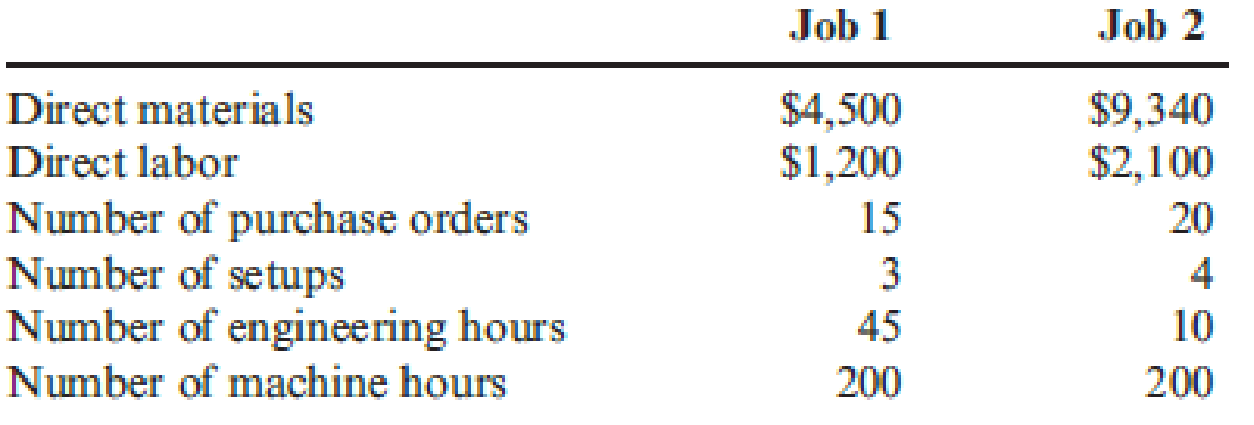

Sanjay has been asked to prepare bids for two jobs with the following information:

The typical bid price includes a 40 percent markup over full

Required:

- 1. Calculate a plantwide rate for Firenza Company based on machine hours. What is the bid price of each job using this rate?

- 2. Calculate activity rates for the four overhead activities. What is the bid price of each job using these rates?

- 3. Which bids are more accurate? Why?

1.

Calculate the plant wide overhead rate for F Company based on machine hours and bid price for each job using plant wide overhead rate.

Explanation of Solution

Plant wide overhead rate: Plant wide overhead rate is the rate a company uses to allocate its manufacturing overhead costs to products and cost centers.

Calculate the overhead rate:

Working note:

- a) Calculate the budgeted overhead.

Calculate the bid price for job 1 and job 2.

| F company | ||

| Particulars | Job 1 | Job 2 |

| Direct materials | $4,500 | $9,340 |

| Direct labor | 1,200 | 2,100 |

| Overhead | $650 (b) | $650 (c) |

| Total manufacturing cost | $6,350 | $12,090 |

| Add: 40% markup | 2,540 (d) | 4,836 (e) |

| Bid price | $8,890 | $16,926 |

Table (1)

Working notes:

- b) Calculate the overhead for job 1.

- c) Calculate the overhead for job 2.

- d) Calculate the 40% markup for job 1.

- e) Calculate the 40% markup for job 2.

2.

Calculate the activity rate for all the overhead activities and bid price for both jobs using activity price.

Explanation of Solution

Calculate the purchasing rate per order.

Calculate the setup cost rate per setup.

Calculate the engineering rate per engineering hour.

Calculate the other cost rate per machine hour.

Calculate the bid price for job 1 and job 2.

| F company | ||

| Particulars | Job 1 | Job 2 |

| Direct materials | $4,500 | $9,340 |

| Direct labor | $1,200 | $2,100 |

| Overhead: | ||

| Purchasing | 120 (f) | 160 (g) |

| Setup | 225 (h) | 300 (i) |

| Engineering | 810 (j) | 180 (k) |

| Other | 160 (l) | 160 (m) |

| Total manufacturing cost | $7,015 | $12,240 |

| Add: 40% markup | 2,806 (n) | 4,896 (o) |

| Bid price | $9,281 | $17,136 |

Table (2)

Working notes:

- f) Calculate the purchasing overhead for job 1.

- g) Calculate the purchasing overhead for job 2.

- h) Calculate the setup overhead for job 1.

- i) Calculate the setup overhead for job 2.

- j) Calculate the engineering overhead for job 1.

- k) Calculate the engineering overhead for job 2.

- l) Calculate the other overhead for job 1.

- m) Calculate the other overhead for job 2.

- n) Calculate the 40% markup for job 1.

- o) Calculate the 40% markup for job 2.

3.

Identify the accurate bid price and explain the reason behind it.

Explanation of Solution

Assigning the overhead using activity based approach shows the accurate cost figure because most of the overheads are non-unit level and there is a variety of products.

Want to see more full solutions like this?

Chapter 5 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Suppose Chrysler Motors has 720 million shares outstanding with a share price of $68.25, and $30 billion in debt. If in three years, Chrysler has 750 million shares outstanding trading for $76 per share, how much debt will Chrysler have if it maintains a constant debt-equity ratio?arrow_forwardCalculate the predetermined overheadarrow_forwardCompute the variable overhead spending variancearrow_forward

- Harrison Home Maintenance bought equipment for $12,600 on January 1, 2020. It has an estimated useful life of six years and zero residual value. Harrison uses the straight-line method to calculate depreciation and records depreciation expense at the end of every month. As of June 30, 2020, the book value of this equipment shown on its balance sheet will be:arrow_forwardNonearrow_forwardcorrect answer is accountingarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College