Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 8E

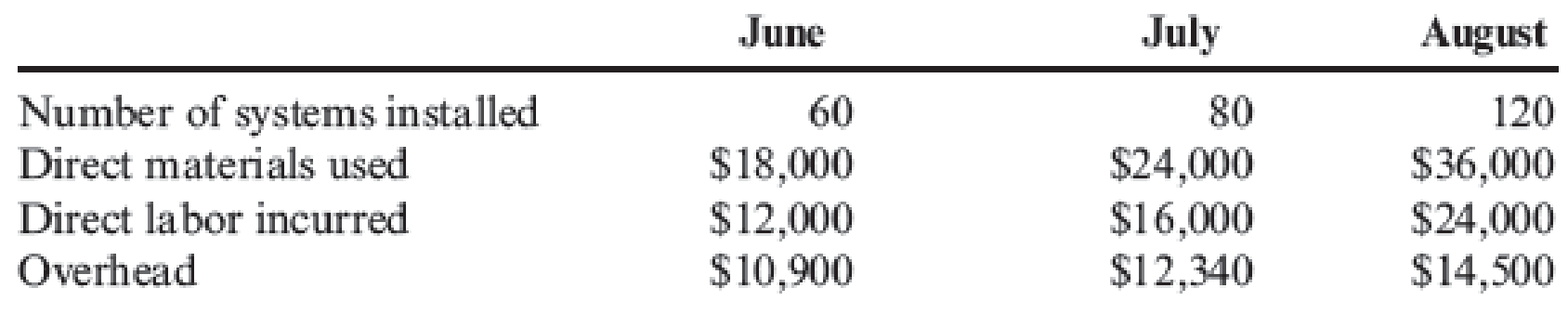

Refer to the data in Exercise 5.7. Vince Melders, owner of EcoScape, noticed that the watering systems for many houses in a local subdivision had the same layout and required virtually identical amounts of prime cost. Vince met with the subdivision builders and offered to install a basic watering system in each house. The idea was accepted enthusiastically, so Vince created a new company, Irrigation Specialties, to handle the subdivision business. In its first three months in business, Irrigation Specialties experienced the following:

Required:

- 1. Should Irrigation Specialties use

process costing or job-order costing? Explain. - 2. If Irrigation Specialties uses an actual costing system, what is the cost of a single system installed in June? In July? In August? Round your answers to the nearest dollar.

- 3. Now assume that Irrigation Specialties uses a normal costing system. Estimated

overhead for the year is $54,000, and estimated production is 600 watering systems. What is the predetermined overhead rate per system? What is the cost of a single system installed in June? In July? In August?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

PLEASE HELP. ALL RED CELLS ARE INCORRECT. NOTICE, REVENUE ACCOUNTS ARE IN THE DROPDOWN!

Journalize these transactions, also post the transcations to T-accounts and determine month-end balances. Finally prepare a trail balance.

Suppose during 2023, BlueStar Shipping reported the following financial information (in

millions):

Net Sales: $40,000

Net Income: $150

Total Assets at Beginning of Year: $26,000

•

Total Assets at End of Year: $24,800

Calculate the following:

(a) Asset Turnover

(b) Return on Assets (ROA) as a percentage

Chapter 5 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 5 - What is cost measurement? Cost accumulation? What...Ch. 5 - Why is actual costing rarely used for product...Ch. 5 - Explain the differences between job-order costing...Ch. 5 - What are some differences between a manual...Ch. 5 - Prob. 5DQCh. 5 - How do firms collect job-related information on...Ch. 5 - Explain the role of activity drivers in assigning...Ch. 5 - Define the following terms: expected actual...Ch. 5 - Why would some prefer normal activity to expected...Ch. 5 - When using normal costing, how are jobs charged...

Ch. 5 - Wilson Company has a predetermined overhead rate...Ch. 5 - Why are the accounting requirements for job-order...Ch. 5 - Explain the difference between normal cost of...Ch. 5 - Amber Company produces custom framing. For one...Ch. 5 - Amber Company produces custom framing. For one...Ch. 5 - Naranjo Company designs industrial prototypes for...Ch. 5 - Naranjo Company designs industrial prototypes for...Ch. 5 - Heitger Company is a job-order costing firm that...Ch. 5 - Frieling Company installs granite countertops in...Ch. 5 - Frieling Company installs granite countertops in...Ch. 5 - Prob. 6ECh. 5 - Vince Melders, of EcoScape Company, designs and...Ch. 5 - Refer to the data in Exercise 5.7. Vince Melders,...Ch. 5 - Reggie Wilmore has just started a new...Ch. 5 - Reggie Wilmore has just started a new...Ch. 5 - During March, Aragon Company worked on three jobs....Ch. 5 - Job Cost On April 1, Sangvikar Company had the...Ch. 5 - Job Cost On April 1, Sangvikar Company had the...Ch. 5 - On August 1, Cairle Companys work-in-process...Ch. 5 - On August 1, Cairle Companys work-in-process...Ch. 5 - Ehrling Brothers Company makes jobs to customer...Ch. 5 - During August, Skyler Company worked on three...Ch. 5 - Feldspar Company uses an ABC system to apply...Ch. 5 - Kapoor Company uses job-order costing. During...Ch. 5 - Salazar Company is a job-order costing firm that...Ch. 5 - Lorrimer Company has a job-order cost system. The...Ch. 5 - CleanCom Company specializes in cleaning...Ch. 5 - Prob. 23ECh. 5 - Geneva, Inc., makes two products, X and Y, that...Ch. 5 - Prob. 25ECh. 5 - During May, the following transactions were...Ch. 5 - Firenza Company manufactures specialty tools to...Ch. 5 - Prob. 28PCh. 5 - Cherise Ortega, marketing manager for Romer...Ch. 5 - Lieu Company is a specialty print shop. Usually,...Ch. 5 - Warrens Sporting Goods Store sells a variety of...Ch. 5 - Sutton Construction Inc. is a privately held,...Ch. 5 - Dr. Alyx Hemmings is employed by Mesa Dental. Mesa...Ch. 5 - Prob. 34P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please fill all cells! I need helparrow_forwardHilary owns a fruit smoothie shop at the local mall. Each smoothie requires 1/2 pound of mixed berries, which are expected to cost $5.50 per pound during the summer months. Shop employees are paid $7.00 per hour. Variable overhead consists of utilities and supplies, with a variable overhead rate of $0.12 per minute of direct labor time. Each smoothie should require 4 minutes of direct labor time. Determine the following standard costs per smoothie: Direct materials cost Direct labor cost Variable overhead costarrow_forwardgeneral accountingarrow_forward

- The following financial information is provided for Brightstar Corp.: Net Income (2023): $500 million Total Assets on January 1, 2023: $3,500 million Total Assets on December 31, 2023: $4,500 million What is Brightstar Corp. _ s return on assets (ROA) for 2023? A. 11.80% B. 12.50% C. 13.20% D. 14.00%arrow_forwardPLEASE FILL ALL CELLS. ALL RED CELLS ARE INCORRECT OR EMPTY.arrow_forwardAssume Bright Cleaning Service had a net income of $300 for the year. The company's beginning total assets were $4,500, and ending total assets were $4,100. Calculate Bright Cleaning Service's Return on Assets (ROA). A. 6.50% B. 7.25% C. 6.98% D. 5.80%arrow_forward

- what is the investment turnover?arrow_forwardA California-based company had a raw materials inventory of $135,000 on December 31, 2022, and $115,000 on December 31, 2023. During 2023, the company purchased $160,000 worth of raw materials, incurred direct labor costs of $230,000, and manufacturing overhead costs of $340,000. What is the total manufacturing cost incurred by the company? A. $720,000 B. $750,000 C. $705,000 D. $735,000arrow_forwardPLEASE HELP WITH THIS PROBLEM. ALL RED CELLS ARE EMPTY OR INCORRECT.arrow_forward

- Suppose during 2023, BlueStar Shipping reported the following financial information (in millions): Net Sales: $40,000 Net Income: $150 Total Assets at Beginning of Year: $26,000 • Total Assets at End of Year: $24,800 Calculate the following: (a) Asset Turnover (b) Return on Assets (ROA) as a percentagearrow_forwardprovide correct answer accounting questionarrow_forwardKubin Company’s relevant range of production is 11,000 to 14,000 units. When it produces and sells 12,500 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 7.20 Direct labor $ 4.20 Variable manufacturing overhead $ 1.70 Fixed manufacturing overhead $ 5.20 Fixed selling expense $ 3.70 Fixed administrative expense $ 2.70 Sales commissions $ 1.20 Variable administrative expense $ 0.70 Required: For financial accounting purposes, what is the total product cost incurred to make 12,500 units? For financial accounting purposes, what is the total period cost incurred to sell 12,500 units? For financial accounting purposes, what is the total product cost incurred to make 14,000 units? For financial accounting purposes, what is the total period cost incurred to sell 11,000 units?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY