Concept explainers

Dr. Alyx Hemmings is employed by Mesa Dental. Mesa Dental recently installed a computerized job-order costing system to help monitor the cost of its services. Each patient is assigned a job number when he or she checks in with the receptionist. The receptionist-bookkeeper notes the time the patient enters the treatment area and when the patient leaves the area. This difference between the entry and exit times is the number of patient hours used and the direct labor time assigned to the dental assistant. (A dental assistant is constantly with the patient.) The direct labor time assigned to the dentist is 50 percent of the patient hours. (The dentist typically splits her time between two patients.)

The chart filled out by the dental assistant provides additional data that is entered into the computer. For example, the chart contains service codes that identify the nature of the treatment, such as whether the patient received a crown, a filling, or a root canal. The chart not only identifies the type of service but its level as well. For example, if a patient receives a filling, the dental assistant indicates (by a service-level code) whether the filling was one, two, three, or four surfaces. The service and service-level codes are used to determine the rate to be charged to the patient. The costs of providing different services and their levels also vary.

Costs assignable to a patient consist of materials, labor, and

The overhead rate does not include a charge for any X-rays. The X-Ray Department is separate from dental services; X-rays are billed and costed separately. The cost of an X-ray is $12 per film; the patient is charged $15 per film. If cleaning services are required, cleaning labor costs $35 per patient hour.

Glen Johnson, a patient (Job 267), spent 30 minutes in the treatment area and had a two-surface filling. He received two Novocaine shots and used three ampules of amalgam. The cost of the shots was $14 ($7 each). The cost of the amalgam was $6 per ampule. Other direct materials used are insignificant in amount and are included in the overhead rate. The rate charged to the patient for a two-surface filling is $110. One X-ray was taken.

Required:

- 1. Prepare a

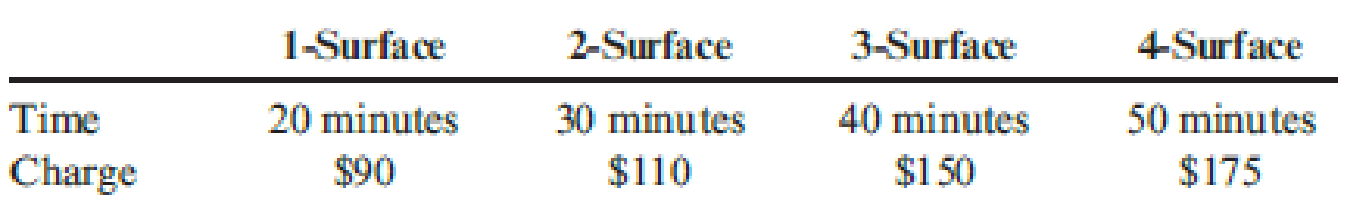

job-order cost sheet for Glen Johnson. What is the cost for providing a two-surface filling? What is the gross profit earned? Is the X-ray a direct cost of the service? Why are the X-rays costed separately from the overhead cost assignment? - 2. Suppose that the patient time and associated patient charges are given for the following fillings:

Compute the cost for each filling and the gross profit for each type of filling. Assume that the cost of Novocaine is $14 for all fillings. Ampules of amalgam start at two and increase by one for each additional surface. Assume also that only one X-ray film is needed for all four cases. Does the increase in billing rate appear to be fair to the patient? Is it fair to the dental corporation?

Trending nowThis is a popular solution!

Chapter 5 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- i wont to this question answer General accounting questionarrow_forwardJulie Finn is preparing the materials purchases budget for the first quarter. The production manager has provided the following production budget information: January 60,000 units February 55,000 units March 50,000 units Each unit requires 5 gallons of direct materials, and Julie wants to maintain an ending inventory equal to 15% of the next month's production needs. How many gallons will Julie budget purchase in February? a. 271,250 b. 275,000 c. 282,500 d. 312,500arrow_forwardnot use ai solution given answer General accounting questionarrow_forward

- Tucker Company makes chairs. Tucker has the following production budget for January-March. January February March Units Produced 8,959 10,313 12,637 Each chair produced uses 5 board feet of wood. Management wants ending inventory levels of raw materials to equal 20% of the production needs (in wood) for the next month. How many board feet of wood does Tucker need to purchase in February?arrow_forwardFinancial accountingarrow_forwardNeed Help General Accountingarrow_forward

- General accounting questionarrow_forwardThe Production Department of Connor Manufacturing has prepared the following schedule of units to be produced over the first quarter of the upcoming year: January February March Units to be produced 570 600 830 Each unit requires 5 hours of direct labor. Direct labor workers are paid an average of $15 per hour. How much direct labor will be budgeted in January, February, March, and for the quarter in total?arrow_forwardkindly help me with this General accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub