Warren’s Sporting Goods Store sells a variety of sporting goods and clothing. In a back room, Warren’s has set up heat transfer equipment to personalize T-shirts for Little League teams. Typically, each team has the name of the individual player put on the back of the T-shirt. Last week, Shona Kohlmia, coach of the Terrors, brought in a list of names for her team. Her team consisted of 12 players with the following names: Mary Kate, Kayla, Katie, Tara, Heather, Emma, Kimberleigh, Jennifer, Dayna, Elizabeth, Kyle, and Wendy. Shona was quoted a price of $0.60 per letter.

Chip Russell, Warren’s newest employee, took Shona’s order and worked on the job. He selected the appropriate letters, arranged the letters in each name carefully on a shirt, and heat-pressed them on. When Shona returned, she was appalled to see that the names were on the front of the shirts. Jim Warren, owner of the sporting goods store, assured Shona that the letters could easily be removed by applying more heat and lifting them off. This process ruins the old letters, so new letters must then be placed correctly on the shirt backs. He promised to correct the job immediately and have it ready in an hour and a half.

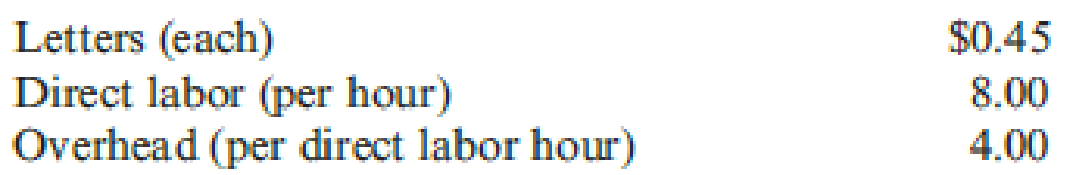

Costs for heat transferring are as follows:

Shona’s job originally took one hour and 12 minutes of direct labor time. The removal process goes more quickly and should take only 30 minutes.

Required:

- 1. What was the original cost of Shona’s job?

- 2. What is the cost of rework on Shona’s job? Assume that Chip failed to ask whether the names should be placed on the back or the front of the shirts. How should the rework cost be treated?

- 3. Now assume that Shona had mistakenly told Chip to put the names on the front of the shirts. In an effort to keep his customer happy, Jim suggested that Shona pay only for the new letters and the firm would pay for the labor cost. How much did Jim charge Shona in addition to the orginal price of the job?

Trending nowThis is a popular solution!

Chapter 5 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Hi experts please provide answer this financial accounting questionarrow_forwardNot Ai solutionarrow_forwardA firm is planning for its financing needs and uses the basic fixed-order-quantity inventory model (EOQ). What is the total cost (TC), including purchasing cost, of the inventory given an annual demand of 12,000 units, ordering cost of $40, a holding cost per unit per year of $5, an EOQ of 500 units, and a cost per unit of inventory of $120? Provide answerarrow_forward