Concept explainers

Analysis of materials and labor variances

RDI Products Co. manufactures a variety of products made of plastic and aluminum components. During the winter months, substantially all of the production capacity is devoted to the production of lawn sprinklers for the following spring and summer seasons. Other products are manufactured during the remainder of the year.

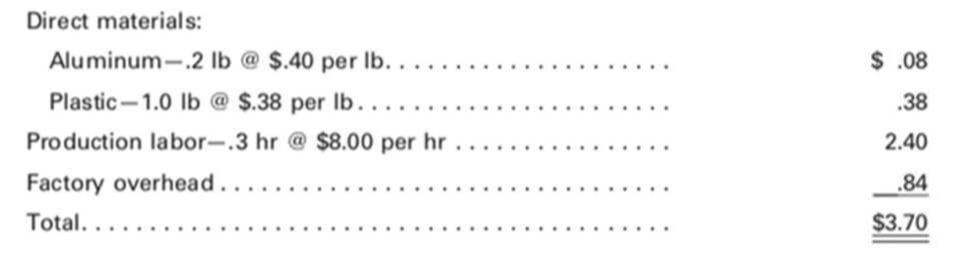

The company has developed standard costs for its several products. Standard costs for each year are set in the preceding October. The

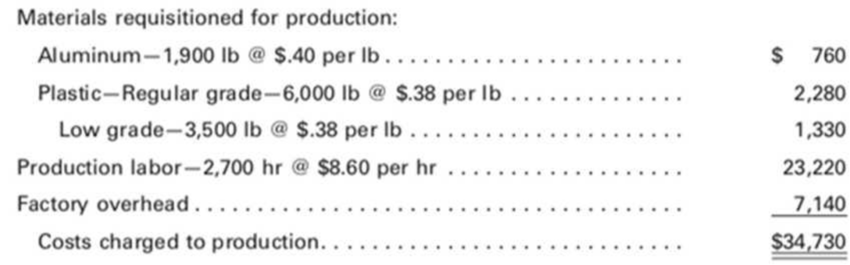

During February, RDI Products manufactured 8,500 good sprinklers. The company incurred the following costs, which it charged to production:

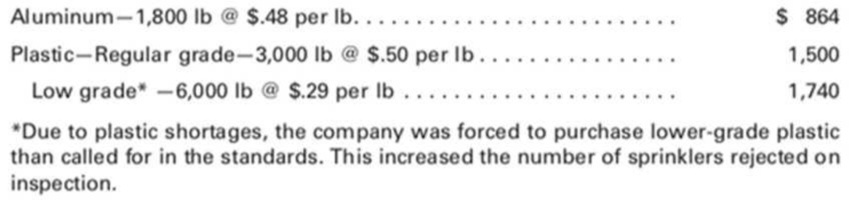

Materials price variations are not determined by usage but are charged to a materials price variation account at the time of purchase. All materials are carried in inventory at standard prices. Materials purchases for February were as follows:

Required:

Calculate price and usage variances for each type of material and for labor, using the formulas on pages 421–422 and 424.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Principles of Cost Accounting

- Please provide the solution to this financial accounting question using proper accounting principles.arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

- Can you help me solve this general accounting problem using the correct accounting process?arrow_forwardI need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning