Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 13P

Variance analysis

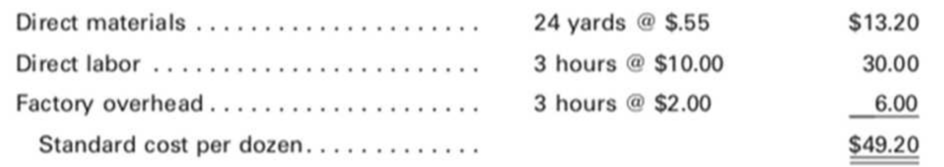

Cardiff Inc. manufactures men’s sport shirts for large stores. It produces a single quality shirt in lots of a dozen according to each customer’s order and attaches the store’s label. The standard costs for a dozen shirts include the following:

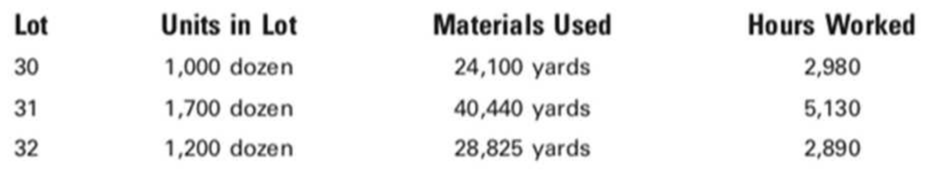

During October, Cardiff worked on three orders for shirts.

The following information is also available:

- a. Cardiff purchased 95,000 yards of materials during October at a cost of $53,200. The materials price variance is recorded when goods are purchased, and all inventories are carried at

standard cost . - b. Direct labor incurred amounted to $112,750 during October. According to payroll records, production employees were paid $10.25 per hour.

- c.

Overhead is applied on the basis of direct labor hours. Factory overhead totaling $22,800 was incurred during October. - d. A total of $288,000 was budgeted for overhead for the year, based on estimated production at the plant’s normal capacity of 48,000 dozen shirts per year. Overhead is 60% fixed and 40% variable at this level of production.

- e. There was no work in process at October 1. During October, Lots 30 and 31 were completed, and all materials were issued for Lot 32, which was 80% completed as to labor and overhead.

Required:

- 1. Prepare a schedule computing the October total standard cost of Lots 30, 31, and 32.

- 2. Prepare a schedule computing the materials price variance for October and indicate whether it is favorable or unfavorable.

- 3. For each lot produced during October, prepare schedules computing the following (indicate whether favorable or unfavorable):

- a. Materials quantity variance in yards.

- b. Labor efficiency variance in hours. (Hint: Don’t forget the percentage of completion.)

- c. Labor rate variance in dollars.

- 4. Prepare a schedule computing the total flexible-budget and production-volume overhead variances for October and indicate whether they are favorable or unfavorable.

- 5. Give some reasons as to why the production-volume variance may be unfavorable and why it is important to correct the situation.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

hello dear tutor If submitted blurr comment i will write values.

please dont Solve with incorrect values otherwise unhelpful.

What are the implications of the matching principle in accounting?

Expand upon this and add

Chapter 8 Solutions

Principles of Cost Accounting

Ch. 8 - How does a standard cost accounting system work,...Ch. 8 - What is the difference between the standard cost...Ch. 8 - Prob. 3QCh. 8 - What are the specific procedures on which a...Ch. 8 - How are standards for materials and labor costs...Ch. 8 - What is a variance?Ch. 8 - How do price and quantity variances relate to...Ch. 8 - How do rate and efficiency variances relate to...Ch. 8 - Prob. 9QCh. 8 - How does a materials purchase price variance...

Ch. 8 - Prob. 11QCh. 8 - Prob. 12QCh. 8 - When a company uses a standard cost system, are...Ch. 8 - What two factors must be considered when breaking...Ch. 8 - What might cause the following materials...Ch. 8 - What might cause the following labor variances?

An...Ch. 8 - Prob. 17QCh. 8 - Prob. 18QCh. 8 - Prob. 19QCh. 8 - Prob. 20QCh. 8 - When does a flexible-budget variance occur?

Ch. 8 - Why is it important to determine flexible-budget...Ch. 8 - Prob. 23QCh. 8 - What is the significance of a production-volume...Ch. 8 - If production is more or less than the standard...Ch. 8 - At the end of the current fiscal year, the trial...Ch. 8 - What variances from the four-variance method are...Ch. 8 - What is the primary difference between the...Ch. 8 - What are the four variances in the four-variance...Ch. 8 - In all of the exercises involving variances, use F...Ch. 8 - Prob. 2ECh. 8 - Prob. 3ECh. 8 - Prob. 4ECh. 8 - Prob. 5ECh. 8 - Computing materials variances D-List Calendar Co....Ch. 8 - Computing labor variances LIFT Inc. manufactures...Ch. 8 - Standard cost summary; materials and labor cost...Ch. 8 - Computing labor variances Fill in the missing...Ch. 8 - Standard unit cost and journal entries The normal...Ch. 8 - Making journal entries Assume that during the...Ch. 8 - Using variance analysis and interpretation Last...Ch. 8 - Using variance analysis and interpretation Last...Ch. 8 - Journalizing standard costs in two departments...Ch. 8 - Calculating factory overhead The standard capacity...Ch. 8 - Determining Budgeted Overhead The overhead...Ch. 8 - Calculating factory overhead: two variances Munoz...Ch. 8 - Calculating factory overhead: two variances...Ch. 8 - The normal capacity of a manufacturing plant is...Ch. 8 - Calculating amount of factory overhead applied to...Ch. 8 - Georgia Gasket Co. budgets 8,000 direct labor...Ch. 8 - (Appendix) Calculating factory overhead: four...Ch. 8 - (Appendix) Calculating factory overhead: three...Ch. 8 - Materials and labor variances Branca Inspections...Ch. 8 - Materials and labor variances Fausto Fabricators...Ch. 8 - Zippy Inc. manufactures a fuel additive, Surge,...Ch. 8 - Calculation of materials and labor variances

Fritz...Ch. 8 - High-End Products Inc. uses a standard cost system...Ch. 8 - RDI Products Co. manufactures a variety of...Ch. 8 - The standard cost summary for the most popular...Ch. 8 - Carlo Lee Corp. has established the following...Ch. 8 - USD Inc. has established the following standard...Ch. 8 - Allocation of variances

Costa Brava Manufacturing...Ch. 8 - On May 1, Athens Inc. began the manufacture of a...Ch. 8 - The standard specifications for an electric motor...Ch. 8 - Cardiff Inc. manufactures men’s sport shirts for...Ch. 8 - Fargo Co. manufactures products in batches of 100...Ch. 8 - Prob. 15PCh. 8 - (Appendix) Overhead variances—four variance

Mobile...Ch. 8 - Shinto Corp. uses a standard cost system and...Ch. 8 - Kamen Manufacturing Co. estimates the following...Ch. 8 - Prob. 19PCh. 8 - Jillian Manufacturing Inc. manufactures a single...Ch. 8 - Cost and production data for Binghamton Beverages...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY