Concept explainers

Binghamton Beverages Inc.

Variance analysis;

Required:

- 1. a. Calculate net variances for materials, labor, and factory

overhead .

b. Calculate specific materials and labor variances by department, using the diagram format in Figure 8-4.

c. Comment on the possible causes for each of the variances that you computed.

- 2. Make all journal entries to record production costs in Work in Process and Finished Goods.

- 3. Determine the balance of ending Work in Process in each department.

- 4. Assume that 4,000 units were sold at $40 each.

- a. Calculate the gross margin based on

standard cost. - b. Calculate the gross margin based on actual cost.

- c. Why does the gross margin at actual cost differ from the gross margin at standard cost.

- 5. As the plant controller, you present the variance report in Item 1 above to Paul Crooke, the plant manager. After reading it, Paul states: “If we present this performance report to corporate with that large unfavorable labor variance in Blending, nobody in the plant will receive a bonus. Those standard hours of 5,500 are way too tight for this production process. Fifty-eight hundred hours would be more reasonable, and that would result in a favorable labor efficiency variance that would more than offset the unfavorable labor rate variance. Please redo the variance calculations using 5,800 hours as the standard.” You object, but Paul ends the conversation with, “That is an order.”

- a. What standards of ethical professional practice would be violated if you adhered to Paul’s order?

- b. How would you attempt to resolve this ethical conflict?

- a. Calculate the gross margin based on

- 1 A)

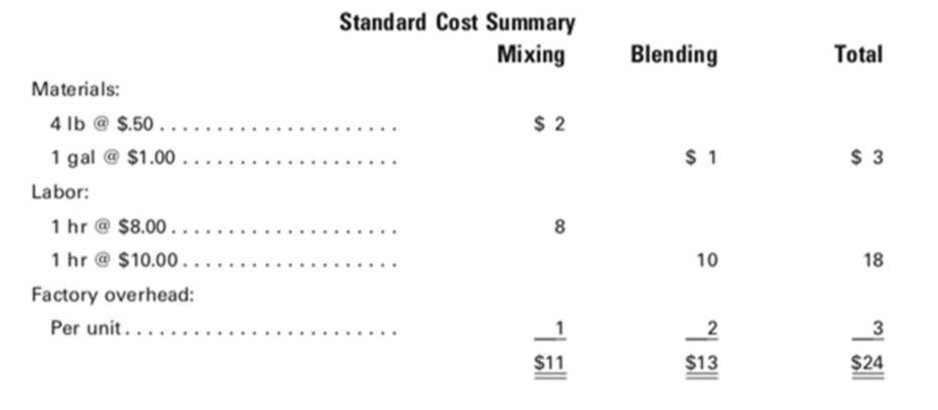

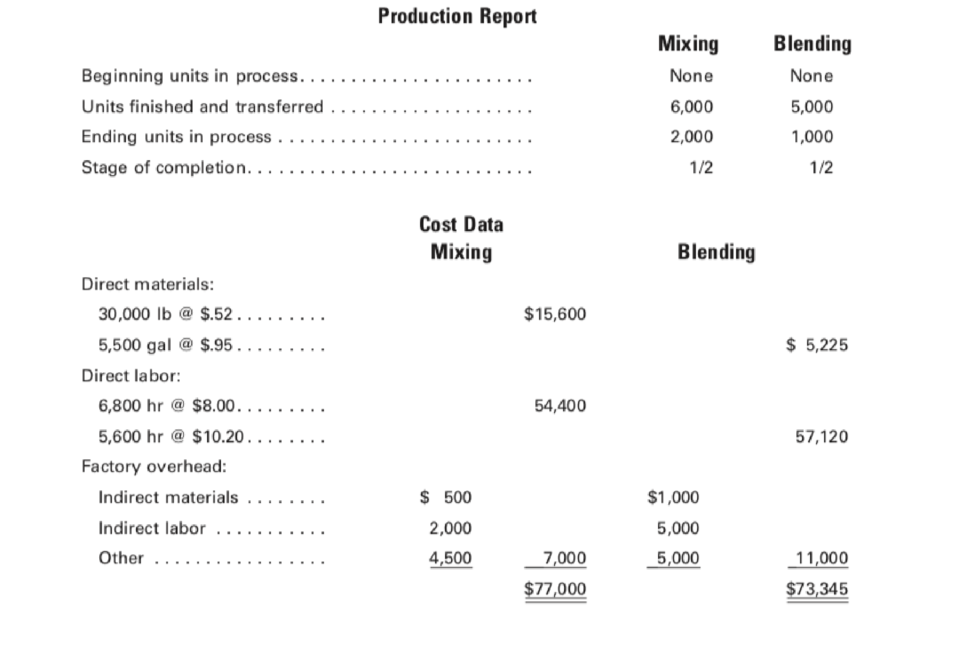

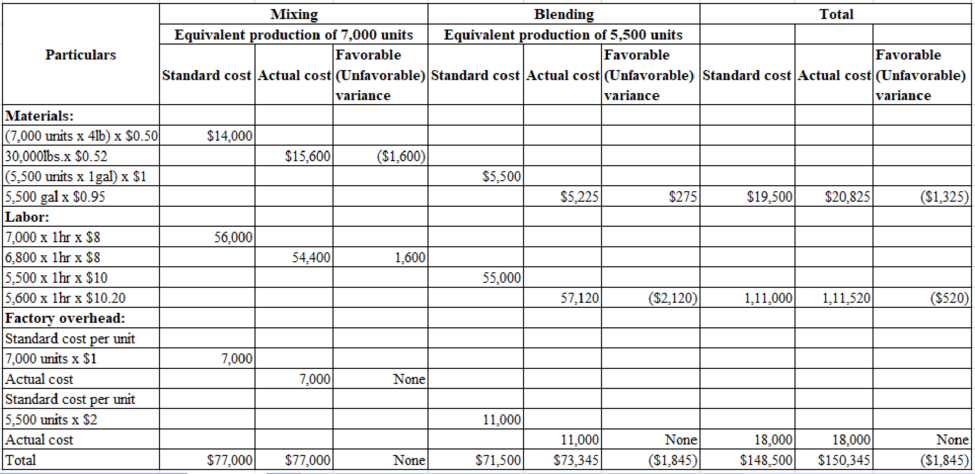

Compute the net variances for materials, labor, and factory overhead.

Explanation of Solution

Compute the net variances for materials, labor, and factory overhead.

Figure (1)

Working note:

Calculate the equivalent units in Mixing:

Calculate the equivalent units in Blending:

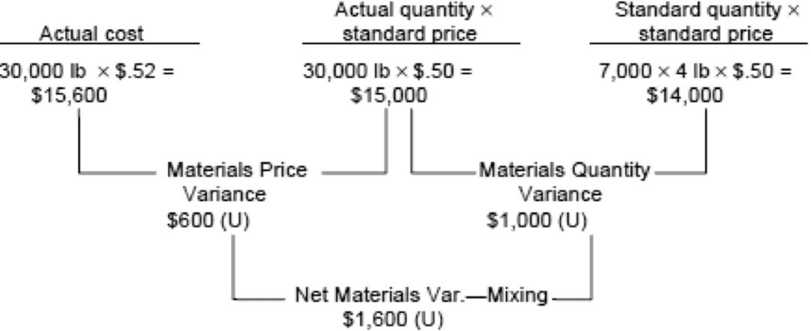

1 B)

Compute the specific materials and labor variances by department.

Explanation of Solution

Compute the specific materials and labor variances by department.

Materials:

Mixing:

Figure (2)

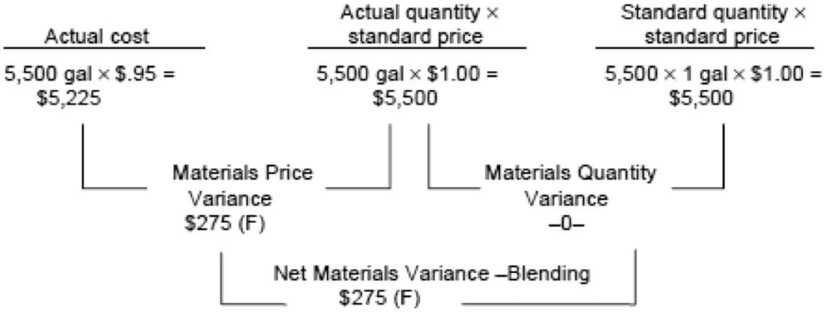

Blending:

Figure (3)

Labor:

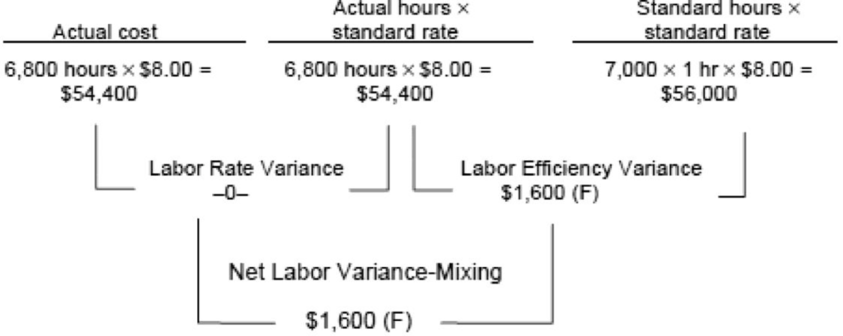

Mixing:

Figure (4)

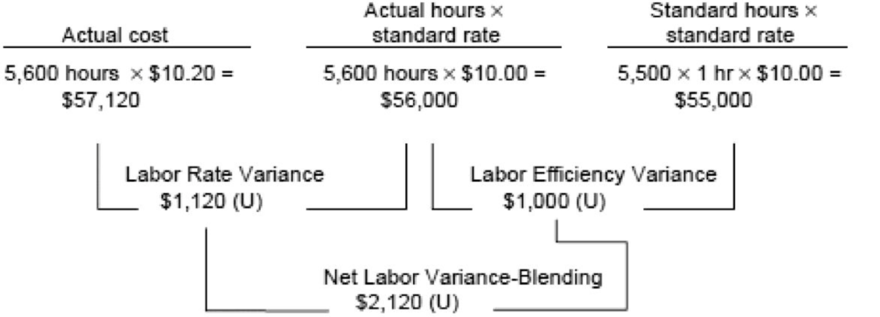

Blending:

Figure (5)

1 C)

Describe the possible causes for every variance from the computation.

Explanation of Solution

Possible causes for every variance from the computation.

In the mixing department, both the materials price variance and the materials quantity variance are unfavorable. If they willing to pay more amount for a superior quality material in anticipation to have a minimum amount of waste and spoilage, and that the strategy is unsuccessful and it is possible to increase the price for material that is not predict while the standards to determine. In the mixing department labor variances is more satisfied. There is no labor rate variance and the labor efficiency variance is favorable. So, this shows that the given ability of labor they budgeted for, the amount of labor time need to complete the production is less than the budgeted and there is a favorable variance due to a learning effect.

In the blending department, there is a favorable materials price variance and no materials quantity variance. This shows that they are capable to use minimum expensive materials than the budgeted for, while maintaining good control over materials usage. It is also probable that the price of materials of the quality that is planned to declined. A difficulty faced in the blending department is labor cost. So, the labor rate variance and the labor efficiency variance are unfavorable. If the strategy is to employ more expensive labor to complete the production of product by short time period is unsuccessful.

2.

Prepare the journal entry to record the production cost in work in process and finished goods.

Explanation of Solution

Prepare the journal entry to record the transaction.

| Particulars | Debit($) | Credit($) |

| Work in Process—Mixing | 14,000 | |

| Materials Quantity Variance— Mixing | 1,000 | |

| Materials Price Variance— Mixing | 600 | |

| Materials | 15,600 | |

| Work in Process-Blending | 5,500 | |

| Materials Price Variance— Blending | 275 | |

| Materials | 5,225 | |

| Factory overhead | 1,500 | |

| Materials | 1,500 | |

| Work in Process—Mixing | 56,000 | |

| Labor Efficiency Variance— Mixing | 1,600 | |

| Payroll | 54,400 | |

| Work in Process— Blending | 55,000 | |

| Labor Efficiency Variance— Blending | 1,000 | |

| Labor Rate Variance—Blending | 1,120 | |

| Payroll | 57,120 | |

| Factory overhead | 7,000 | |

| Payroll | 7,000 | |

| Factory overhead | 9,500 | |

| Various credits (Accounts payable, prepaid insurance, etc) | 9,500 | |

| Work in Process—Mixing | 7,000 | |

| Work in Process—Blending | 11,000 | |

| Applied Factory Overhead | 18,000 | |

| Work in Process—Blending | 66,000 | |

| Work in Process—Mixing | 66,000 | |

| Finished Goods | 1,20,000 | |

| Work in Process—Blending | 1,20,000 |

Table (1)

3.

Calculate the ending work-in process for every department.

Explanation of Solution

Calculate the ending work-in process for every department.

| Particulars | Mixing | Blending |

| Costs charged to departments: | ||

| Materials | $14,000 | $5,500 |

| Labor | 56,000 | 55,000 |

| Factory overhead | 7,000 | 11,000 |

| Prior department | 0 | 66,000 |

| $77,000 | $137,500 | |

| Less: Costs transferred out of departments | 66,000 | 120,000 |

| Balance of work in process | $11,000 | $17,500 |

Table (2)

4 A) & B)

Calculate the gross margin for standard cost and for actual cost.

Explanation of Solution

Calculate the gross margin for standard cost and for actual cost.

| S. no | Particulars | Amount |

| Sales | $160,000 | |

| Less: Cost of goods sold at standard | 96,000 | |

| a. | Gross margin at standard cost | $64,000 |

| Net unfavorable variance | 1,845 | |

| b. | Gross margin at actual cost | $62,155 |

Table (3)

4 C)

Explain the reason that the gross margin at actual cost differ from the standard cost,

Explanation of Solution

Reason for the difference:

Actual cost goes beyond the standard cost and results the unfavorable variance of $1,845, it is the reason for gross margin at actual cost is a lesser amount than the gross margin standard cost. In a standard cost system, the cost of production runs through the system at standard during the accounting period. During the ending period, standard cost is adjusted toward the actual while preparing the financial statements for external users.

5 a)

Explain the violation of ethical professional practice if hold on to P order.

Explanation of Solution

No, P told to act as unethical. The labor standards are used to for the earlier agreed to P and other superior. Specific IMA ethical standards will be violated by making the following changes,

Competence: Provide the support to make decision and suggestions are accurate, clear, concise, and timely.

Integrity: Withdraw from the engage in or underneath any activity that discredit the profession.

Credibility: 1) Information needs to communicate fairly and objectively. 2) Reveal all information that is expected by user’s to understand the reports, analyses, or recommendations.

5 b)

Describe the method to resolve this ethical conflict.

Explanation of Solution

Method to resolve this ethical conflict:

Follow the organization policy to resolve the conflict. If the organization policy does not resolve the conflict then other option is IMA’s suggested resolution of ethical conflict. In this case, present the information to the next level of management above P to the VP of manufacturing. This will be resolving this issue.

Want to see more full solutions like this?

Chapter 8 Solutions

Principles of Cost Accounting

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Financial Accounting, Student Value Edition (5th Edition)

Macroeconomics

- What is the annual depreciation expense?arrow_forwardSchnitzel Corp. reported 2009 sales ($ in millions) of $6,845 and a cost of goods sold of $5,120. The company uses the LIFO method for inventory valuation. It discloses that if the FIFO inventory valuation method had been used, inventories would have been $85.7 million and $69.3 million higher in 2009 and 2008, respectively. If Schnitzel used the FIFO method exclusively, it would have reported 2009 gross profit closest to? Solve thisarrow_forwardAnswerarrow_forward

- Please help me solve this financial accounting question using the right financial principles.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardA business has accounts receivable of $180,000, an allowance for doubtful accounts balance of $7,200, and estimates that 5% of outstanding receivables will be uncollectible. What is the required adjustment to the allowance for doubtful accounts?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning