Income (loss) recognition; Long-term contract; revenue recognition over time vs. upon project completion

• LO5–9

Brady Construction Company contracted to build an apartment complex for a price of $5,000,000. Construction began in 2018 and was completed in 2020. The following is a series of independent situations, numbered 1 through 6, involving differing costs for the project. All costs are stated in thousands of dollars.

Required:

Copy and complete the following table:

The revenue recognition principle

The revenue recognition principle refers to the revenue that should be recognized in the time period, when the performance obligation (sales or services) of the company is completed.

Revenue recognized point of long term contract

A long-term contract qualifies for revenue recognition over time. The seller can recognize the revenue as per percentage of the completion of the project, which is recognized as revenue minus cost of completion until date.

If a contract does not meet the performance obligation norm, then the seller cannot recognize the revenue till the project is complete.

To determine: The amount of gross profit or loss to be recognized under various situations.

Answer to Problem 5.21E

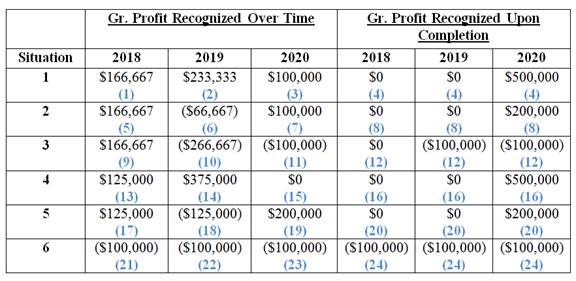

The amount of gross profit or loss to be recognized under various situations is as follows:

(Figure 1)

Explanation of Solution

Working note:

Situation – 1

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2018 | 2019 | 2020 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 1,500,000 | 3,600,000 | 4,500,000 |

| Estimated costs to complete | 3,000,000 | 900,000 | 0 |

| Total estimated costs (B) | 4,500,000 | 4,500,000 | 4,500,000 |

| Estimated gross profit(actual in 2020)

|

$500,000 | $500,000 | $500,000 |

Table (1)

In the year 2018:

In the year 2019:

In the year 2020:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2018 | 0 |

| 2019 | 0 |

| 2020 | $500,000 |

| Total gross profit | $500,000 |

Table (2)

(4)

Situation – 2

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2018 | 2019 | 2020 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 1,500,000 | 2,400,000 | 4,800,000 |

| Estimated costs to complete | 3,000,000 | 2,400,000 | 0 |

| Total estimated costs (B) | 4,500,000 | 4,800,000 | 4,800,000 |

| Estimated gross profit(actual in 2020)

|

$500,000 | $200,000 | $200,000 |

Table (3)

In the year 2018:

In the year 2019:

In the year 2020:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2018 | 0 |

| 2019 | 0 |

| 2020 | $200,000 |

| Total gross profit | $200,000 |

Table (4)

(8)

Situation – 3

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2018 | 2019 | 2020 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 1,500,000 | 3,600,000 | 5,200,000 |

| Estimated costs to complete | 3,000,000 | 1,500,000 | 0 |

| Total estimated costs (B) | 4,500,000 | 5,100,000 | 5,200,000 |

| Estimated gross profit(actual in 2020)

|

$500,000 | $(100,000) | $(200,000) |

Table (5)

In the year 2018:

In the year 2019:

In the year 2020:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2018 | 0 |

| 2019 | $(100,000) |

| 2020 | $(100,000) |

| Total gross profit | $(200,000) |

Table (6)

(12)

Situation – 4

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2018 | 2019 | 2020 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 500,000 | 3,500,000 | 4,500,000 |

| Estimated costs to complete | 3,500,000 | 875,000 | 0 |

| Total estimated costs (B) | 4,000,000 | 4,375,000 | 4,500,000 |

| Estimated gross profit(actual in 2020)

|

$1,000,000 | $625,000 | $500,000 |

Table (7)

In the year 2018:

In the year 2019:

In the year 2020:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2018 | 0 |

| 2019 | 0 |

| 2020 | $500,000 |

| Total gross profit | $500,000 |

Table (8)

(16)

Situation – 5

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2018 | 2019 | 2020 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 500,000 | 3,500,000 | 4,800,000 |

| Estimated costs to complete | 3,500,000 | 1,500,000 | 0 |

| Total estimated costs (B) | 4,000,000 | 5,000,000 | 4,800,000 |

| Estimated gross profit(actual in 2020)

|

$1,000,000 | $0 | $200,000 |

Table (9)

In the year 2018:

In the year 2019:

In the year 2020:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2018 | 0 |

| 2019 | 0 |

| 2020 | $200,000 |

| Total gross profit | $200,000 |

Table (10)

(20)

Situation – 6

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2018 | 2019 | 2020 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 500,000 | 3,500,000 | 5,300,000 |

| Estimated costs to complete | 4,600,000 | 1,700,000 | 0 |

| Total estimated costs (B) | 5,100,000 | 5,200,000 | 5,300,000 |

| Estimated gross profit(actual in 2020)

|

$(100,000) | $(200,000) | $(300,000) |

Table (11)

In the year 2018:

In the year 2019:

In the year 2020:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2018 | $(100,000) |

| 2019 | (100,000) |

| 2020 | (100,000) |

| Total gross profit | $(300,000) |

Table (12)

(24)

Want to see more full solutions like this?

Chapter 5 Solutions

Intermediate Accounting

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education