Long-term contract; revenue recognition over time vs. upon project completion

• LO5–9

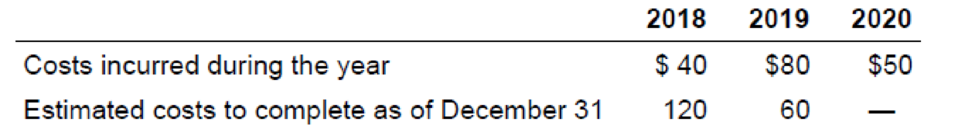

On June 15, 2018, Sanderson Construction entered into a long-term construction contract to build a baseball stadium in Washington, D.C., for $220 million. The expected completion date is April 1, 2020, just in time for the 2020 baseball season. Costs incurred and estimated costs to complete at year-end for the life of the contract are as follows ($ in millions):

Required:

1. How much revenue and gross profit will Sanderson report in its 2018, 2019, and 2020 income statements related to this contract assuming Sanderson recognizes revenue over time according to percentage of completion?

2. How much revenue and gross profit will Sanderson report in its 2018, 2019, and 2020 income statements related to this contract assuming this project does not qualify for revenue recognition over time?

3. Suppose the estimated costs to complete at the end of 2019 are $80 million instead of $60 million. Determine the amount of revenue and gross profit or loss to be recognized in 2019 assuming Sanderson recognizes revenue over time according to percentage of completion.

Requirement – 1

Contract

Contract is a written document that creates legal enforcement for buying and selling the property. It is committed by the parties to performing their obligation and enforcing their rights.

Revenue recognized point of long term contract

A long-term contract qualifies for revenue recognition over time. The seller can recognize the revenue as per percentage of the completion of the project, which is recognized by revenue mines cost of completion until date.

A contract does not meet the performance obligation norm. The seller cannot recognize the revenue till the project complete.

The revenue recognition principle

The revenue recognition principle refers to the revenue that should be recognized in the time period, when the performance obligation (sales or services) of the company is completed.

The amount of revenue and gross profit or loss will report in 2018, 2019, and 2020 income statement of S Contraction, and assume revenue recognize over time according to percentage of completion.

Explanation of Solution

Recognized revenue

In the year 2018:

Given,

The contract price is $220,000,000

Actual cost to date is $4,000,000

Calculated total estimated cost is $160,000,000

Now, calculate the revenue recognition:

Hence, the calculated revenue recognition is $55,000,000.

In the year 2019:

Given,

The contract price is $220,000,000

Actual cost to date is $120,000,000

Calculated total estimated cost is $180,000,000

Now, calculate the revenue recognition:

Hence, the calculated revenue recognition is $91,670,000.

In the year 2020:

Given,

Contract price is $220,000,000

Calculated revenue recognition in 2018 is $55,000,000

Calculated revenue recognition in 2019 is $91,670,000

Now, calculate the revenue recognition:

Hence, the calculated revenue recognition is $73,330,000.

Recognized gross profit

In the year 2018:

Given,

Estimated gross profit in 2018 is $60,000,000 (1)

Total estimated cost is $160,000,000

Actual cost to date is $40,000,000

Now, calculate the gross profit recognition:

Hence, the calculated gross profit recognition is $15,000,000.

In the year 2019:

Here,

Estimated gross profit in 2019 is $40,000,000 (1)

Total estimated cost is $180,000,000

Gross profit recognition in 2018 is $15,000,000

Actual cost to date is $120,000,000

Now, calculate the gross profit recognition:

Hence, the calculated gross profit recognition is $11,670,000.

In the year 2020:

Here,

Estimated gross profit in 2018 is $50,000,000 (1)

Gross profit recognition in 2016 is $15,000,000

Gross profit recognition in 2017 is $11,670,000

Now, calculate the gross profit recognition:

Hence, the calculated gross profit recognition is $11,670,000.

Working note:

Calculate the value of gross profit (in millions)

| Particulars | 2018 | 2019 | 2020 | |||

| Contract price | $220 | $220 | $220 | |||

| Actual costs to date | $40 | $120 | $170 | |||

| Estimated costs to complete | $120 | $60 | $0 | |||

| Less: Total estimated cost | $160 | $180 | $170 | |||

| Estimated gross profit | $60 | $40 | $50 | |||

Table (1)

(1)

Requirement – 2

To calculate: The amount of revenue and gross profit or loss to be recognized in 2018, 2019 and 2020 assuming the project does not qualify for revenue recognition over time.

Explanation of Solution

Revenue recognition:

In this case, there is no revenue recognition because the project does not qualify for revenue recognition overtime.

Recognized gross profit:

In the year 2018 and 2019:

In this case, there is no recognized profit, because the contract is not yet completed. Hence, the gross profit in the year 2018 and 2019 is $0.

In the year 2020:

Here,

The contract price is $220,000,000

Actual cost to date is $170,000,000

Now, calculate the gross profit recognition:

Hence, the calculated gross profit recognition is $50,000,000.

Requirement – 3

The amount of revenue and gross profit or loss to be recognized in 2019, and assume S Construction recognizes revenue over time according to percentage of completion.

Explanation of Solution

Revenue recognition in the year 2019:

Here,

Contract price is $220,000,000

Actual cost to date is $120,000,000

Total estimated cost is $200,000,000

Revenue recognition is $55,000,000

Profit recognizes is $15,000,000.

Now, calculate the revenue recognition:

Hence, the calculated revenue recognition is $77,000,000.

Recognized gross profit in the year 2019:

Here,

Revenue recognition in 2019 is $77,000,000

Actual cost to date is $80,000,000

Now, calculate the gross profit recognition:

Hence, the calculated gross loss recognition is $300,000.

Want to see more full solutions like this?

Chapter 5 Solutions

Intermediate Accounting

- How much is cash received from customer for the yeararrow_forwardNestle Resources acquired land on July 15, 2019, at a cost of $875,000. The company estimated that a total of 45,000 tons of mineral was available for mining. After extracting all the natural resources, the company will be required to restore the property to its original condition due to environmental regulations. It estimates the fair value of this restoration obligation at $95,000. The company expects to sell the property afterwards for $115,000. Before beginning mining operations, the company incurred developmental costs of $180,000. During 2019, the company extracted 20,000 tons of resources. It sold 15,000 tons. Compute the following information for 2019: a) Per unit mineral cost b) Total material cost of December 31, 2019, inventory c) Total material cost in cost of goods sold at December 31, 2019arrow_forwardWhat are nintendo's total vear-to-date actual costs over or under budget?arrow_forward

- I am trying to find the accurate solution to this financial accounting problem with appropriate explanations.arrow_forwardNovus Corp's contribution margin ratio is 58% and its fixed monthly expenses are $37,200. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company's net operating income in a month when sales are $145,000?arrow_forwardHow much overhead is applied to work in process ?arrow_forward

- I need assistance with this general accounting question using appropriate principles.arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardDuring 2021, Comfort Spa reported revenue of $36,000. Total expenses for the year were $27,500. Comfort Spa ended the year with total assets of $22,500, and it owed debts totaling $9,200. At year-end 2020, the business reported total assets of $19,000 and total liabilities of $9,200. A. Compute Comfort Spa's net income for 2021. B. Did Comfort Spa's stockholders' equity increase or decrease during 2021? By how much? Provide answerarrow_forward

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardA proposed project has estimated sale units of 3,200, give or take 3 percent. The expected variable cost per unit is $9.45 and the expected fixed costs are $21,800. Cost estimates are considered accurate within a plus or minus 4 percent range. The depreciation expense is $3,750. The sale price is estimated at $14.20 a unit, give or take 2 percent. The company bases its sensitivity analysis on the expected case scenario. If a sensitivity analysis is conducted using a variable cost estimate of $9.80, what will be the total annual variable costs?arrow_forwardI need Answerarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning